The BTC Horse Racing Thread

-

@Martin said in The BTC Horse Racing Thread:

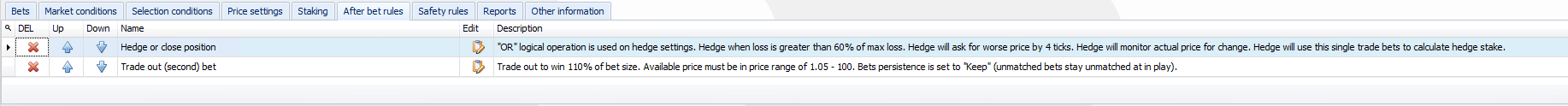

Back to lay dobs.gz

Just in case you (or anyone else) want the safety net on the dobs, this is how i've got mine running in BFBM.

I'm using the hedge position to trade out at 60% loss @ 4ticks below. Think the original software strat had a hedge at 70% loss. My reasoning is this should catch it better than setting it at 70% in BFBM, working so far.

-

@Martin said in The BTC Horse Racing Thread:

Big thanks to @John-Folan for helping me to set up BFBM and @Adam for creating the link between BTC and BFBM!

it's sick, isn't it. Saves so much time.

-

Big thanks to @John-Folan for helping me to set up BFBM and @Adam for creating the link between BTC and BFBM!

Here is an Irish Dobs strategy I have created. It will need some forward testing:

Download to the strategy into BTC software here: irish dobs.json

Download the strategy to BFBM to automate it here: 1690570294729-irish-dob-1

.0.gzBack to lay: rules_export (3).json

BFBM: Back to lay dobs.gz

-

Think so. Its just something i noticed when i was messing with it and thought that it was pretty interesting.

-

@Joseph-Henderson said in The BTC Horse Racing Thread:

@Jonathan-Jones said in The BTC Horse Racing Thread:

@Dan-MacKinnon

What i noticed with BFBM is you can share a bank between strategies so there is scope for a combined approach depending on your strategies. Perhaps combine a couple of stable strats to share a bank and grow faster but keep some of the more bouncy ones on their own.Does show though that there is a lot more to think about then just winning bets. Bank management is a powerful tool.

Is that the tick box next to the “set new” button? Then you can select which strategy banks to combine?

Yes. It’s a useful feature that. I’ve got strategies on different sized banks at varying degrees of percentage of banks (2%, 1% and 0.5). I’ve done a dependent strategy in the past when I was tracking steamers. It worked ok.

-

@Jonathan-Jones said in The BTC Horse Racing Thread:

@Dan-MacKinnon

What i noticed with BFBM is you can share a bank between strategies so there is scope for a combined approach depending on your strategies. Perhaps combine a couple of stable strats to share a bank and grow faster but keep some of the more bouncy ones on their own.Does show though that there is a lot more to think about then just winning bets. Bank management is a powerful tool.

Is that the tick box next to the “set new” button? Then you can select which strategy banks to combine?

-

-

@Dan-MacKinnon

What i noticed with BFBM is you can share a bank between strategies so there is scope for a combined approach depending on your strategies. Perhaps combine a couple of stable strats to share a bank and grow faster but keep some of the more bouncy ones on their own.Does show though that there is a lot more to think about then just winning bets. Bank management is a powerful tool.

-

@Caroline-Middlebrook said in The BTC Horse Racing Thread:

Hey guys, I am trying to use BFBM to automate a strategy that is based on BSP. It's fine for a strategy where I don't have any limits on the price, but I have a lay strategy where I want to implement a maximum odds.

The betfair interface allows you to do this by clicking 'Set SP odds limit' which then gives you a field to input the minimum odds for back bets or maximum odds for lay bets, but I cannot get this to work in BFFM!

I have gone through this thread in their forum but it is still not working:

https://www.bfbotmanager.com/phpbb3/viewtopic.php?t=3243

Any ideas?

CAROLINE-Ask this question on the Horse Racing Strategies Megathread, they should be able to help!

-

I messed about with excel and got it to compare a combined approach. It's definitely more risky but could be a decent bank builder. It appears to be simply compounding, but when it's combined it compounds at a greater rate due to the volume of trades.

I think there's good and bad to both. What you're potentially losing by not combining you should make up with longevity.

-

@Martin Currently doing Back The Fav, LTBF and Lay Third Fav on horses. Then Tom Lay U1.5 and a late goal strategy. Feels like first two weeks in July were on fire, then second half has been pretty muted. LTBF and Tom Lay U1.5 are each down around 10%.

-

@Joseph-Henderson great work, which strategies?

-

@Jonathan-Jones

Yeah, I guess the risk you take on with a shared bank may be worth it for the early stages to grow your bank faster, particularly if starting off small. Could always split the bank up once you get to a stage where having a big drawdown (say 50%+) seems too scary..

-

Interesting isnt it? No doubt a shared bank is a much bigger risk due to a wayward strategy (particularly if you are introducing an untested strategy) but i think it comes down to the bank size. If you are building a small bank then you get much more benefit for a smaller investment from a shared bank. If you have a good bank already and you are after an income or retirement type bank building then a split bank might be what you want.

-

@Jonathan-Jones

I just did some analysis of my trades this month. Running 5 strategies with split equal banks I am around 14% up (not been an amazing month to be honest, two strategies are down). If you export every bet and assume 1% stake of a rolling total bank the return is 65% with a max drawdown of 30.25%. Quite interesting..

-

I wrote a small app to help me reconcile my results every day. I download the individual results and import them. By default it runs the shared bank but strategies are selectable so i can just turn ones off to get what a single one does (that would match the backtesters output directly). So for this the shared one is obviously already done. I just ran the others individually then added the daily returns in excel and worked out the DD.

The massive difference was what made me look at it in detail because it really surprised me. But as a simple summary i guess you coud say you either:

Get approx 5 times the profit for a third of the investment but put up with a considerable DD on the shared bank.

or

Get approx a fifth of the profit for about a third of the DD with the split bank.So do you make the bigger investment and play it safe (and accept lower returns) or invest a smaller sum and take the ride? If i had a big bank then its a no brainer but for a very small bank to grow then its a bit less clear cut.

-

@Dan-MacKinnon said in The BTC Horse Racing Thread:

@Jonathan-Jones really interesting. Just out of curiosity, how did you manage to track all 3 together?

Wow, that is some food for thought. That’s the question I was going to ask!