The BTC Horse Racing Thread

-

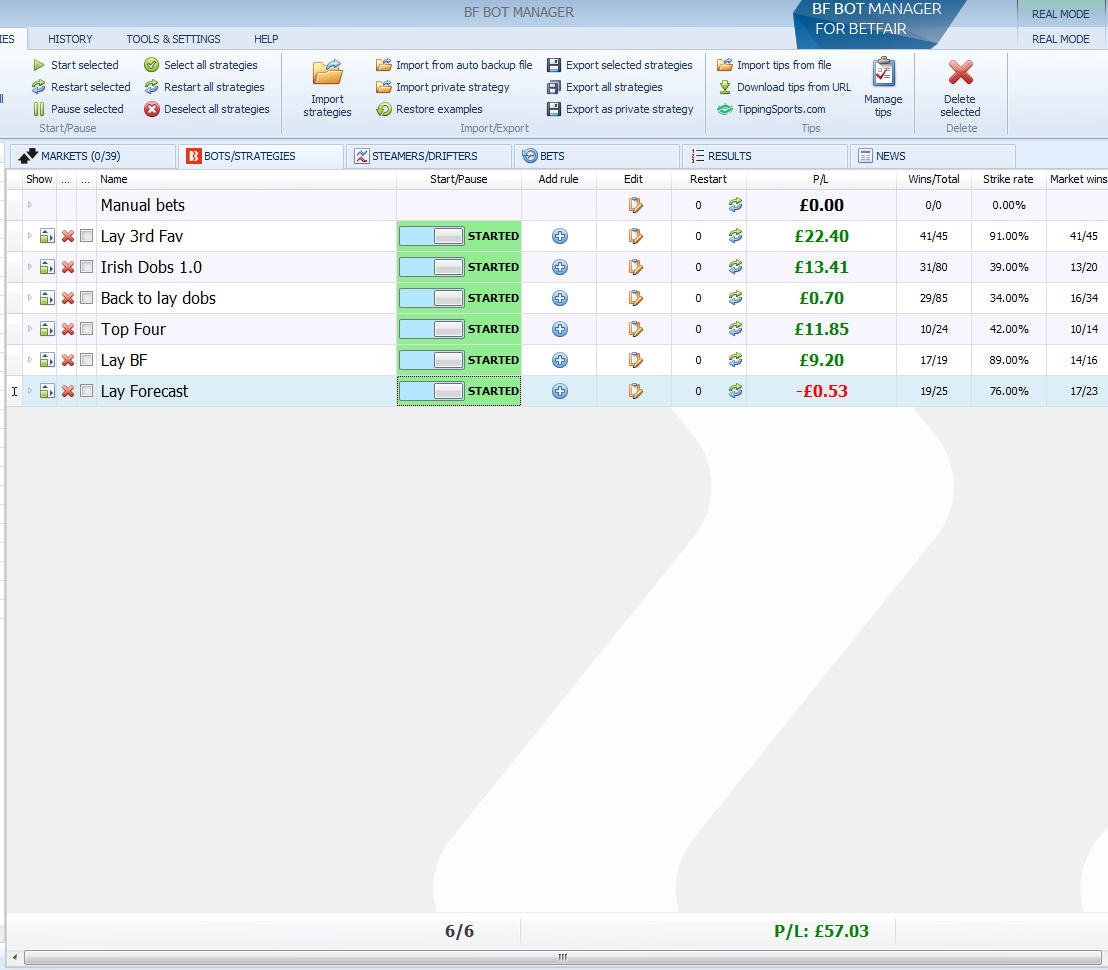

@Joseph-Henderson yeah should be close will have the real life bot results so either way we will see how good the strategy is

-

@Martin said in The BTC Horse Racing Thread:

@Joseph-Henderson I'm testing it £1 stakes on a bot anyway so you could just see how I get on with it if you don't want to risk any wonga

Wonga....word of the day

-

@Joseph-Henderson I'm testing it £1 stakes on a bot anyway so you could just see how I get on with it if you don't want to risk any wonga

-

@Joseph-Henderson all weather also avoided here

-

@Martin said in The BTC Horse Racing Thread:

rules_export (11).json

Can I just double check that the differences here are that the rule about not betting on 1&2 fav has been removed and so has NHF?

-

-

Thanks @Dan-MacKinnon !!

-

@Correa check against the backtesting. Mine shows 5 losses this week which matches the backtesting.

I've been trading LTBF for nearly a year and can confirm it's profitable. When it's good really good! But when it's bad it is tough to stick it out.

Like Martin said it's good for training your mindset. First off, start with a bank that if everything went wrong you have written it off. If you can automate, just don't look and let it go. Make sure the results match the backtesting and let time do the work for you.

If you need any tips or help with stuff let me know and I'm happy to share.

-

@Martin I might have done something wrong with this strategy since yours shows 17/19 wins while only yesterday I had 2 losses. I have been running it since 27/07 with 10 losses so far. Could you please share your json and .gz files again so that I can compare them? Thanks!

-

@Joe-Beeston said in The BTC Horse Racing Thread:

@Martin Hey,

Has the latest one (.json file) been updated on the OP of the horse racing megathread page?

Good point just updated it: https://forum.betfairtradingcommunity.com/topic/3531/horse-racing-strategies-megathread/2

-

@Martin Yeah, I need to double check what the bot is doing against the data from the horse software since mine isn't doing well. Since this is my first month, I'm still using £1 stakes, and I feel like it's hard to recover after one loss. As an example, if I lay at 9 and the horse wins, it takes two or three days to recover from this hit, assuming I have a streak of wins which is not always the case. While I can see that it's profitable using the backtesting, I still don’t feel very comfortable laying, hopefully I’ll get used to it with time.

.

.