The BTC Horse Racing Thread

-

I've been away for the past week and took a break from trading. Has LTBF righted itself or is it continuing to be a pain? The backtesting shows it's still struggling

-

@Joseph-Henderson It depends entirely on the criteria in your strategy.

If there's anything in there that could change between 07:00 and 13:30 then yes, that could change your qualifiers.

-

@Adam Does this mean if you download the Daily Qualifiers at say 7am and upload them to BFBot, then not all selections that would appear at say 1.30pm will necessarily have pulled through by that time. I’m using a stripped filter so didn’t think the time I downloaded Daily Qualifiers mattered, but maybe I’m wrong. This might explain why my results from the Bot vary a bit to the results in the software, which is bugging me!

-

@Toyin-Butler said in The BTC Horse Racing Thread:

@Adam Just a thought, would it be possible to have an

updated atreference on qualifiers?Yes possibly, it's on the roadmap

-

@Greg-Mitchell said in The BTC Horse Racing Thread:

@Adam Quick Question on the software, if I use the "Traded Rank" filter, and say chose just Rank 1 and then add whatever other filters I feel like. Then set it to place the bet at 10 seconds before the start time. Does it pick the horse that is traded Rank 1 at that time or the one that finished the race as rank 1?

Currently the final ranking, which I appreciate isn't useful. We are working on linking various similar stats to the entry time window instead of final values.

-

@Adam Quick Question on the software, if I use the "Traded Rank" filter, and say chose just Rank 1 and then add whatever other filters I feel like. Then set it to place the bet at 10 seconds before the start time. Does it pick the horse that is traded Rank 1 at that time or the one that finished the race as rank 1?

-

@Jonathan-Jones The times above were the finishing times of the entire qualifiers run (for everyone's active strategies) in BST.

The last couple of times the qualifiers for that specific strategy of yours were updated were (in BST):

08:32

10:04

12:02

14:05 -

The ones are showing are definately old ones. I may of found the cause of my issues with that BestBacks strategy. The strategy is ok, the filter is not. It still had the Favourite conditions. It obviously shouldnt. So, i must of misclicked save at some point or something. Anyway, i removed it this morning. Thought it was about 11 - 11:30 ish, was definitely well before 1. The favourite is still showing in the conditions on my qualifiers (favourite 1-4) so they are definitely wrong.

And:

They have now (in the last couple of mins) corrected.

Too late for the day though.Those times BST or UTC?

-

What is going on with the qualifiers tab these days? past few days i have been thinking its been slow updating but today i know its not changed in about 2 1/2 hours. I updated a strategy filter some point between 11 and 11:30. Its not updated the qualifiers. They are still the old ones.

Thats me out for the day then.

-

@John-Folan think I need you to create some bots for the new strategies I just released!

-

@Jonathan-Jones Fairbot is limited. It’s slightly faster than BFBM but the sheer scale of what is possible as filters on BFBM is brilliant. Ive fully automated my short odds lays so I don’t even need to import selections. (Still got a couple of courses to add to the course filters but that’s it. As they come up they will be added).

The other stuff is auto imported from the software and the filtering gets me a 99% accuracy with the software. Occasional differences but that’s life. I have thrown strategies away if I can’t get them close but that might be more down to being lazy rather than software. For inrunning I use bet Angel for speed. Its filtering however is terrible. Peter Webb has made it too complicated for most.(me included or I would use it for everything. It’s bloody brilliant for manual scalping tho).

BFBM will have the added advantage of automating football as well if you do it once the new revised software is out. Something to bear in mind. They are also pretty good at adding stuff to new releases if they think it’s useful. There’s a few of my suggestions that they have added over the last couple of years. A couple they haven’t. But I want the moon on a stick!

-

@John-Folan

if you look at the 5th condition thats the favourite one. Fairbot does it by allowing you to set an order then do a compare. So its order by back odds then Back Price (named horse) <= BackPrice 4th horse. I think i have pushed fairbot a lot further than its meant to go and its well past its limits now. If BFBM can sort my issues with late non runners and allow me to run multiple rules against the same horse/ multiple horses in a race then i may just have to stump up the extra cash because there is no doubt my problems with executing according to the strategies are costing me a considerable sum at the moment.Yes. Number of selections is number of runners

-

@Jonathan-Jones thanks. I’ll have a play and see if I can get bfbm to play ball. I’m not a fan of fairbot as I just feel bfbm is better suited to what we do. Each to their own though. Some people swear by it.

There is no favourite condition though. That’s the only thing I could see throwing it out. But that doesn’t explain why the software is missing those you have said are in the top four that haven’t been taken.

I’m guessing selections is fairbots way of saying number of runners?

-

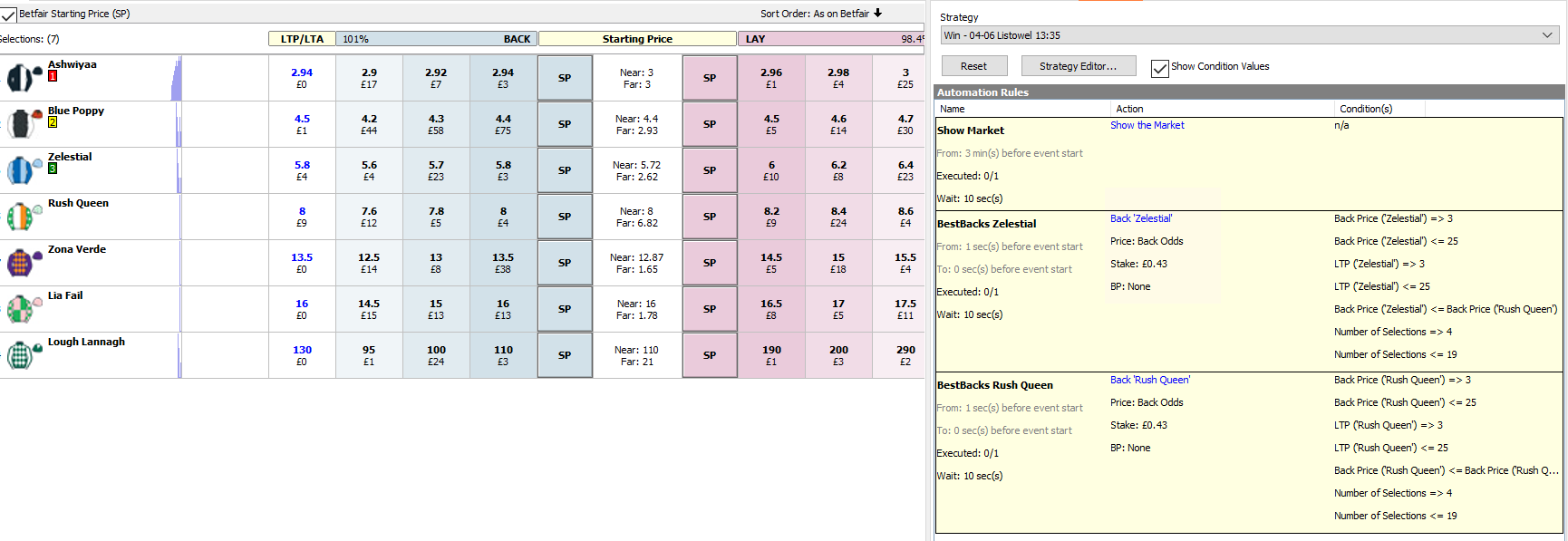

This is one of todays.

2 horses in the selections, a rule set for each.

You may wonder why the apparent duplication of the rules (back price and LTP). Its more of a thing on the lays, probably not needed on the backs but i found a lot of instances on the bigger lays where LTP and best avaible lay price were miles apart. So, it was a case of either go for entry at LTP (and not get matched) or go for entry at best lay and take a possible much bigger loss than intended. So, i added the check to make sure the softwares trigger was taken but i could also get a good price. Its not made any difference on the backs. -

@Jonathan-Jones can you show the conditions for your bot as screenshots?

-

That might explain ones that i dont have but the software does (not on my original selections in the morning but non-runners mean other horses move up a ranking then become selection) but cant see how it would explain ones i took but the software didnt.

@Adam

These are some from yesterday:Doncaster 14:16 Taken Wannabe Brave Taken in reality, Not in the software

Listowel 15:00 Taken Karaoke @ 5.9 (but was triggered @6.1 so was valid) Taken in reality, Not in the software

Musselburgh 15:05 Taken Espressoo @ 10.5 Taken in reality, Not in the software

Musselburgh 15:40 Taken Gareeb @7.8 Taken in reality, Not in the softwareAll the above were taken but dont show on the backtest. All meet the odds critera, all are in the selections spreadsheet. All are in the top 4 at BSP. There were loads more differences but i can explain most of them by horses swapping places after official start but before actual start or not in the original selections (so probably moved due to non-runners).

I did have A fair few fairbot execution issues yesterday (some races dont look to of updated at all) so think i have had enough of that now (not the first time thats happened with Fairbot in streaming API mode). All in all a total points difference of 12 yesterday (not in my favour either - never is) which is becoming frustratingly common. Hopefully there is a very simple explaination for the ones above that i have missed. Then i can work to reduce/remove the issues. Think BFBM is probably an essential now as Fairbots limitations are becoming costly.