The road to full time

-

@lee-woodman the funny thing is tho if we just accept that as tho its our first point of call, when its not. Accepting that we will figure this ourselves actually means its gonna take longer. I dont agree with we have to figure this out ourselves. Its easy to find a strategy i mean this forum is endless good strategies, you can make any market work. Its the bigger picture of trading we struggle with at first, is that ego/individual reward/reputation seeking etc seeping through. Thats why the forum is here, thats why i post on this blog and other blogs. All it takes is one lightbulb moment at times to transform someone's trading. If that spark comes from btc lads, me, keith anderson, john folan, richard futter etc then its worth it offering the advice. We arent saying our way or no way, its not you have to do my lates or nothing else works. People will come up with their own signatures/style in trading, but there is a group of core fundamentals to trading i feel we all ignore very early that hopefully one of my posts or someone else's resonates early. Some people try and fail very quickly, the members on here we see them post frequently and then slowly we see them vanish without even trying the advice. Dont just try this alone, your paying a membership to be part of the community and learn from like minded people. So its not always smart to just say learn ourselves, i think thats just a individual thing/issue. It was for me. The doctor/lawyer situation is an extreme. Good example in practice but thats because of laws and health. But for example i could open a florist tomorrow or a lemonade stand, there is no barrier to entry, if i dont surround myself with people who know that industry better than me then ill struggle at first and be battling a lot longer for me to see any sort of ROI from it. If i just ignore the advice and say nah ill figure this out myself its wasted time and so inefficient. Its not to say the above names mentioned are gods of trading(i most certainly am not) we specialise in our own areas and dont know everything but like we say the universal trading rules are consistent with absolutely everything. Individual strategies and your own version are but mere small parts to all this. If your not utilising the forum and asking the questions from the pro traders or those with experience then your missing the main value, its not the inplay tips, the strategies, its the advice and experience we can learn from the better more experienced traders.

Martins fav quote i have read was that one:

“If you give a man a fish, you feed him for a day. If you teach a man to fish, you feed him for a lifetime.”

That for me is absolutely what this post and forum is about, there is a difference between a will to learn and stubbornness, and i feel like the original post reflects this. So yeah i agree with what you said about freedom, but other than that i feel that is a mindset change that can be avoided. We dont need to do it all ourselves and surely missing a trick on the value of this forum if you dont try learn from others. -

@darri I think one of the things that attracts us to trading is what makes it difficult to crack - freedom. We have the freedom to trade what we want, when, in what way, literally endless choices but the downside being that we have to figure it out ourselves. I know there is a lot of great advice out there (unfortunately a lot of crap too) and so many of the ‘rules’ are almost universal, like you’ve said. When you learn something like say being a doctor then there is a curriculum to follow, a path on which you are several years into before you even begin to think about making choices whereas with trading you make choices on day 1. If you imagined trying to be in a different profession with the same curriculum as trading - ‘just go for it, some information is here and some is over there (watch for the endless crap though) but feel free to trial and error as you go along’ - it obviously wouldn’t happen in many industries. If every trader had to spend 2 years learning before being allowed a betfair account then obviously things would be a whole lot different (not suggesting this should, could or would happen by the way)

-

Iv come to realise that iv been helping or posting rather a lot recently and its always the same message. I find it fascinating how a trading journey is developed in the same way every time. Every one of us has experienced the same type of journey. One of the interesting things with that is we all sign up for this having watched or read info about trading and the dos and donts. Yet when it comes to actually starting to trade we become hungry for everything, kid in a candy shop. This goes against all the advice we listened to before we sign up for trading and its what all the current pros who do this for a living of have done for years advise us. I wonder if this is a mental thing/ego that we have to try it our own way first, just to test. It reminds me of when my dad tried to teach me keepie ups, i wasnt interested because i was so determined to impress him by learning it myself. I remember not long ago actually saying this to him, if only id just listened. Battling against something i knew little about and didnt ask or accept the help someone who does know and was actually good at. I feel like because results in trading is solely on the individual we start to think like that, and thats its us against the world.

Now dont get me wrong, every strategy i do is based on my own version. I am no saint. I literally did the above with trading. I battled and battled and eventually figured it out. But every youtube video, blog on these subjects are all absolutely what iv found out for myself. Wasting so much time and money. So its quite ironic i often get caught up in trying to help and offering advice, that id not have really listened to myself. For me tho its that whole keepie ups situation again, i want in 2-3 months time for people reading what i post to go wait iv just found that out. Im sure the btc lads get this all the time. Its a great feeling.

I think my mindset changed on this when i stopped doing it on the side and really tried to turn it into a business. We listen to people with better experience at work, people can have better skills and knowledge, so why wouldnt we in trading. That doesnt mean in time we will be better than them or find something new out. Its one of those things. The individual aspect and reward based on you and your trades can have strange effects on people. Especially when its bets/trading/sport/competition/money involved. Just speaking to someone and thought that was an interesting take. Sorry for the ramble might be meaningless but just thought since im posting advice and help on loads of blogs and places right now that id at least explain why id hope people listen but fully understand and wont take offence if you dont. Just in 2-3 months time if you do spot that thing or if i was right or wrong send us a message, it does mean a lot to know at some stage iv helped and not just been a pain in the arse or opinionated

-

So i mentioned last month that I was gonna wait for 100 points before I then upped my staking. In the past that has done me well. However basing my decisions on the past isn't strictly smart here. I'm now trading not just one strategy but also have cricket and I'm on the verge of adding another. This will mean my bank swings wont be so volatile based purely on how the SHG/Lates go. So waiting till 100points/% is actually just being slow for sake of it.

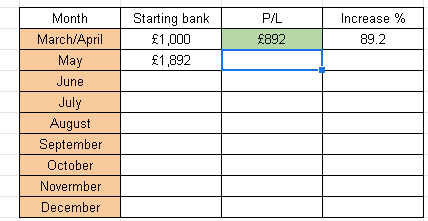

Iv added a small add on (image above) which just makes this a bit clearer on the sheets. I know I update the bank ticker at top of this blog anyway but just for ease to look back on iv added this. Will help with planning seasonality wise. Last month with ipl was fantastic and id be more likely to be looking at say a 20-30 point/% increase normally. But now that im adding in an a couple fantastic/tested strategies these benchmarks will increase. Cricket being one, really has scaled all of this since around the last ipl.

So moving forward the compounding will be a bit more scheduled rather than dependant on reaching targets. Just due to the fact variance wont be such an issue anymore. My plan is to have SHG/Lates, My new LTD strategy, Cricket and Other which is for opportunity trades I spot along the way (FHGs/Outrights) from there I don't think ill even test anything else and it would just be a case of managing those. My plan is to be making around 20-30 points/% every month, looking to try hit £80 - £100k by end of next year. Ill not be withdrawing anything until I hit £10k so the build up stage should be fast. Then once hit £10k ill look to withdraw 10 points/10% of profits every month (after betfair charges) and then keep the rest for the bank. I have certain milestones I am aiming for and at those ill make changes.

I hope the transparency and me posting my football trades live on the football thread is helping show this is possible for everyone and that it becomes a decent read to see the journey. Last time I did this I was a bit stop start with keeping the blog updated on my bank, not this time I run my video production from home most days (editor) and trade around that. I could have just done trading but I feel it a healthy balance to have something outside of it mentally. But all this means, I have plenty time during day to get things updated. Will look to do end of month reviews and I might start to post my LTD list either on here or on the football thread. Football thread isn't as active as it used to be so maybe could post there instead of just keeping it on here, ill find over time what I and others prefer.

-

First day of the new month hopefully wont be too much longer before the 100 points target is hit. Ill be posting my games up on the football thread this weekend as its raining and freezing as per up here in :scotland: so no cricket for me

try get as close to 100 points target as i can over next week. Youll see the sheets have been altered, nothing removed just made easier to view. The SHG and lates are both now on one sheet as they are same market and sometimes same games. Will still be a while before any of the testing strats are added, anything added from here would be set and forget as dont want to keep adding time to trading. But as with most set and forgets because they arent influenced by inplay they need to be tested a bit longer before getting a good base to work from. The image i posted yesterday shows that even tho they are profitable i still want it to be full proof.

try get as close to 100 points target as i can over next week. Youll see the sheets have been altered, nothing removed just made easier to view. The SHG and lates are both now on one sheet as they are same market and sometimes same games. Will still be a while before any of the testing strats are added, anything added from here would be set and forget as dont want to keep adding time to trading. But as with most set and forgets because they arent influenced by inplay they need to be tested a bit longer before getting a good base to work from. The image i posted yesterday shows that even tho they are profitable i still want it to be full proof.Got a really good balance right now between how im using time efficiently with trading. Remember tho if you have a 9-5 job, have a family etc dont spend everyday trying to crack this. Be sensible. Im a full time trader so just because you see me trading dont think im on here all the time. I place my trade and move on, if i have nothing else to do ill watch the game. Dont let this swallow you up. For me and the other pro traders/full time traders this is our jobs so be aware when comparing hours spent trading etc. For me tho i spent 6hrs trading all last week. Probably about 2-3 hrs adding in results and looking over results. So all in about 10hrs all of last week at max. Yes iv watched the cricket midweek but not all have been trading angles and iv been watching them anyway regardless of trades.

-

END of month review:

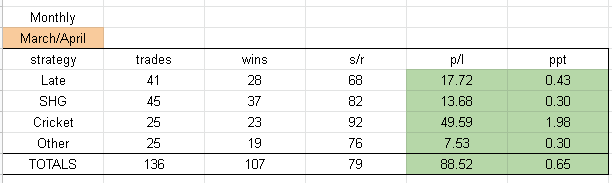

Ok so when you look at this please understand this isnt 2 full months of trading. This is just the int break in march up until today.

Cricket: +49.59 points/% of bank

Been a fantastic ipl so far for me. Iv now not had a loser since the opening game where i showed exactly what i did wrong in the update. Iv recently started to mix this up between set and forget trading and positional trading that iv explained before. Iv been really focussed on when to use each. Youll notice that on a few of the set and forgets iv not used my full stake. This is something im tracking along the way. I normally stake half stake on the set and forget and then leave half to use for a good position come 10-15 overs in the chase. Iv just not had the chance yet to do both in the match. Cracking ipl so far, im sure the loses will come rolling in soon especially when the pressure for playoffs arrive but ill be ready as much as possible. Hope people have found the runs guide on my sheets a good guide for games and where teams should be at set stages for chasing targets.Football: +40.66 points/% of bank

The core to all my trading is still football. Iv hardly even thought about it this month with ipl yet its still almost on par with it returns wise. Since the int break i really feel like iv massively overtraded the late goals strategy. Iv said this along the way in some updates. Over confidence can sometimes seep in when things are going very well. Id say this totla should be around 8pts/8% more than what it is. I know it sounds silly but remember this is my job and this is a mistake that has made me miss out on 8% growth. I do know that it is probably due to the cricket and me not fully focussing. Like i said in my last post its marked in the journal and ill make sure next month those mistakes are ironed out. So expect me to be on less trades.Upcoming:

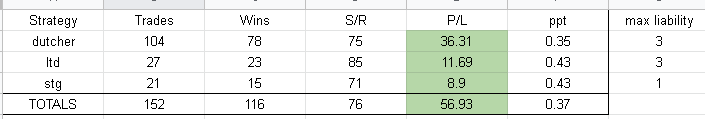

Iv got a new strategy that iv been testing and i have posted about it before. Just made a tweak on it so now need to wait a bit more for confirmation. Im always looking to add to my trading. Iv 3 things being tested.

So as you can see early stages, however the dutcher strategy is now on its final phase of testing having been tweaked many times. Once these are absolutely solid and i plan to use them myself ill post them for everyone to see. Which ones will make the cut i dont know yet only time will tell. Im in no rush to add anything. But if any of these become part of my own setup ill share.

Conclusion: +88.52 points/% of bank

Nice and steady month here. Have to obviously factor the cricket into this total but for me cricket is a bonus. I never really had too much cricket in my previous bank builder so to me these are extras. Im always looking to add or improve what iv already got. Seeing the seasonality of cricket comps and how i could long term do this makes me very happy. When busy times come with cricket i know i can rely on set and forget football trades too. Its becoming a very sustainable model of trading iv got here. Next month will be quieter anyway as the wait for summer leagues to really take shape. Then the euros

Starting bank on 23 march: £1,000

Starting bank on 1st may: £1,892

(wont be trading until the weekend now) -

@james-rome heres the thing mate once you have a solid strategy start to ease off on the restrictions. The issue with doing 1pt a day and go type thing iv rarely seen work. The reason for that is we all have winning and losing days. Say we lose on the first day and we lose 2pts. The next day we win 1pt. Then the next we lose 2pts again. Thats then -3pts and meaning we then need 4 winning days to get back into profit. However within those losing days we might have just discarded 2-3 games we didnt fancy because our opinions ruled it out. That 2-3 wins might be the difference to you being profitable or not. Having a tier list each day means we bring our opinions into trading. I think later down the line with trading knowledge opinions arent that bad cause youll spot weaknesses easily. If your doing a journal anyway just add and extra column for what iv just suggested i think this will work better than your restrictions of 1pt day. Yes they sound safer but the limit is also a hinderance. Once you have an edge you utilise it.

-

@darri Hi Mate

I am doing something simliar i have a note book so my target atm is to make 1 percent of bank a day if i can. I decided to do this as FOMO is my biggest problem so i thought this is a mangeable target a day. So i look at the filters indentifiy which games are the best and would have confidence trading not just picking them as on the filter ( been guilty of this myself in the past). So I rank the games in the filter like my top choice downwards and i try and get on my top choices first. Once i made my 1 percent i stop now.Unless during my research I think i found a gem. I found this to better for myself as i then i am only looking at making 2 good trades a day instead of as many as possiable. ATM need 2 to make 1 point. If i lose one of my top ones i lose 1 point ill trade my top choices and then thats it. If i not wrote a trade down in the note book now its not getting traded. Just woundered if people do simliar or just use a blog. I found this has helped me stop over trading as can flick through look at over notes from when trades went bad. At the front got some rules i want to stick by so if it doesnt hit them i dont get involded. This way at least i feel like i am being discplines as well. Curious if anyone got any thought on this

-

So i was speaking to someone last week about this and thought id put up a post about it. One of the tips iv found extremely helpful was this idea of writing a journal/blog not about your winners, not about your p/l, but only about your losses. This applies to most things in trading: testing, actual trades etc. For the next month after every single losing trade write down somewhere either on the comp, notepad, spreadsheet, whatever you want, write why you believe that trade lost. Typically these are, fomo, overtrading, overstaking/chasing, not looking up stats, relying too much on stats, not reading inplay, trading iffy leagues, lack of motivation, bad day at work, being actually unlucky etc. Basically looking at anything to do with your trade that you feel was the reason for that loss.

At the end of the month, if one of those things happened more than once obviously at the start this will be almost all of them. Write that down somewhere so you can see it at every time you go to make a trade. The way i did this was i focussed on improving one of these every month. When you focus on that one thing you become accustomed and normalised with that way of thinking. Then next month start on another issue and so on until eventually the last thing that happens the most is being unlucky. Now dont be big headed with this be honest with yourself if you feel unlucky. Did the striker miss a 4 yard tap in, was the game having 24 shots on target and no goal (atalanta) these things do happen. If you can get it to that stage thats when your trading game changes.

I see this alot with traders, we typically tend to focus on trying to find strategies based on its strike rate and how often we will be right. Instead we should work on how we can reduce the risk first. I feel that optimising and maximising wins is the easy part, you can find that info all too easy. The hard part is reducing the risks. Thats why this blog typically shows me explaining why i reduced risk rather than rushing profits. This blog is my way of doing what iv just explained above. Im doing it daily with cricket. I dont need to do it anymore with football but i will if i try new strats, read the start of this blog it was all about me explaining my reasoning for reducing risk. The key players, inplay stats etc are all risk reducers not profit maximisers. Kane scoring or winks scoring wont make me more from that trade. But no kane might reduce the risk factor for me in entering.

These little tips and tricks of the mind help. I was sceptical at first too and really even after first week didnt get it being quite stubborn, but like with going away and testing something thoroughly you learn a great deal from a broad data set about yourself. So go ahead and try it and give me a message after 1 month telling me your reason for losses and we can work on something to improve that next month.

-

IPL update:

CSK vs SRH: +1.78 points/% of bank

This ipl run im on is insane. It honestly feels like a bit like im cheating the system. Im now so fluid with everything involved that im making extremely good decisions. Today was a perfect example. The exact same score as yesterday so should i not have just done the same trade? NO! First game at delhi we have no idea how that pitch will play. SRH the team who got 171 this time are not a team in form. They possess only one good bowler as they are failing to balance the side. Last year this team managed to rally at the end with the balancing of bringing in holder to sort out both the bowling and the middle order batting. Right now they have 3/4 overseas players in the top 3 batting order. 2 good wickets and straight away into the domestic players with no real spine to the team. Look at almost every other team. Its well balanced. Typically 2 batsmen and 2 bowlers. With the better teams having at least one of those pros being an all rounder filling two positions. SRH do not. However they do typically reach the playoffs but they have changed their lineup from last years final push.

So with them only getting 171 you could assume an in form csk with all overseas players in form and a deep batting order and an imbalanced bowling unit from SRH that actually that score could be chased. Big difference to yesterday when they have a in form bowling unit with many variations to defend with. With all this in mind i backed CSK here at 1.73 with half my stake. They got off flying and never came back and i never saw a good position for me to enter other half. So again a set and forget style trade being the only trade.

Just trying to show you must think of everything and add that all up, this can be for football/cricket any market your trading. There were a lot more risks today than yesterday so red flags come out and you must reassess and not carpet trade every game the same way. Ill bore people with this but you really have to start thinking about all the variables before entering trades if you want to maximise things. Yes set and forgets are great but if your wanting to get that spike to the bank get involved with knowing when and where to put them. Iv worked hard at t20 its paying off. Iv not just done some simple trade here if it were that simple loads of people would be doing it. At the same time i dont want to scare people into going wow thats a lot to take in. Slowly doing this in stages by mastering one thing at a time makes this alot easier. Has the message been repeated enough yet? Probably but ill keep saying it because i still think people try too much too soon.

-

I’m 40 and no pension either.

-

@keith-anderson said in The road to full time:

@matt-wood said in The road to full time:

@lee-woodman @Darri

Thanks gents. I am intending to spread my 'eggs' around so they are not all in one basket. I have a Vanguard pension, as does the mrs, plus some other funds in there which I just intend to leave alone until im old and need a wheelchair

The trading212 account i am intending as a bit more of a flexible, almost 'money I can afford to lose' account. Obviously Im looking to make some money out of it but it will form part of my trading bank.

Appreciate all advice though as Im new to all of this stuff.

@Lee-woodman just nearing the end of that book now, picked it up on my Kindle for 99p, loads of good info in there!

@Darri Have joined the waiting list for Trading212 so will be waiting for the email from them now.

I'm 40 and actually have no pension plan!! F*****g hell! Probably too late now!!

Naaaahhhh Im 41 now, only started mine last year!

-

@matt-wood said in The road to full time:

@lee-woodman @Darri

Thanks gents. I am intending to spread my 'eggs' around so they are not all in one basket. I have a Vanguard pension, as does the mrs, plus some other funds in there which I just intend to leave alone until im old and need a wheelchair

The trading212 account i am intending as a bit more of a flexible, almost 'money I can afford to lose' account. Obviously Im looking to make some money out of it but it will form part of my trading bank.

Appreciate all advice though as Im new to all of this stuff.

@Lee-woodman just nearing the end of that book now, picked it up on my Kindle for 99p, loads of good info in there!

@Darri Have joined the waiting list for Trading212 so will be waiting for the email from them now.

I'm 40 and actually have no pension plan!! F*****g hell! Probably too late now!!

-

@lee-woodman @Darri

Thanks gents. I am intending to spread my 'eggs' around so they are not all in one basket. I have a Vanguard pension, as does the mrs, plus some other funds in there which I just intend to leave alone until im old and need a wheelchair

The trading212 account i am intending as a bit more of a flexible, almost 'money I can afford to lose' account. Obviously Im looking to make some money out of it but it will form part of my trading bank.

Appreciate all advice though as Im new to all of this stuff.

@Lee-woodman just nearing the end of that book now, picked it up on my Kindle for 99p, loads of good info in there!

@Darri Have joined the waiting list for Trading212 so will be waiting for the email from them now.

-

@darri similar here mate, RCB set 172 for Delhi to chase. DC get off to a flyer but the data says 172 will be a hell of a chase in Ahmedabad. The wickets fall and suddenly DC are under the pump chasing nearly 10 an over. They get close but RCB being 2.30 then suddenly 1.25 half way thru.

-

@darri I accidentally posted on this blog page mate wasn’t really with it this afternoon thought I was on the football thread mate. Not that that really makes much difference.

-

@matt-wood like with all things trading and investing personal choice/preference is key to finding the ideal platform/strategy. Find out what your looking to invest in, how often, your strategy etc, these can all add up in the charges on certain platforms. Trading 212 for me does everything i need, individual stocks, grouping stocks (your own s&p 500) which you can decide to scale, buying fractions of stocks if your budget doesnt allow to buy a whole amazon/apple stock etc. Like lee says tho its complicated at times and like with betfair trading keeping it simple is often best and safer. But based on your original question id go for trading 212 as thats also the one i use and is well worth the waiting list, its different to almost all the others.

-

@matt-wood If you are looking invest widely for the longer term rather than quite specifically then vanguard is a great company to use. There’s a great book on it, how the own the world by Andrew Craig, which basically says most active investors don’t beat the market long term and 99% would do as well to just spread out the investments widely across a simple portfolio covering many markets. The fees are one of the biggest things to look at, a small amount can make a massive difference over the course of 20 years of compounding

-

IPL update:

RCB vs DC: +1.96 points/% of bank

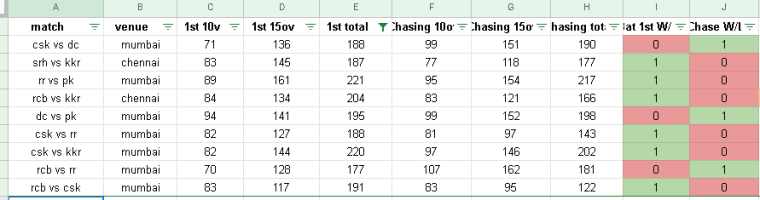

With the early stages of this ipl over and each team playing 5 games we can start to piece together how totals and chases will go more accurately.

The above is a filtered view showing games this ipl when +170 was scored by the team batting first. So far teams batting first have won 6/9 meaning a 66% which converted to odds = 1.52

RCB the team who posted that +170 total, their odds were 2.32 to back which means the market believed this to be a 43% chance of winning.

So we have them as 66% market 43% huge price difference.

I backed with half my stake and waited inplay to use the rest of it. DC ended up losing wickets at key times but i never wanted to oppose 2 batsmen that could chase anything so i exited my position, going into the death overs by removing the liability. Really happy that probably for the first game this ipl iv relied fully on the data iv been tracking. It may well be small but it also was consistent with last years too and that was on different pitches so maybe it is a good gauge of current t20 conditions. As more games start to fit this ill likely not trade out and just have them as set and forgets but because its still just the early middle stages of the comp i wanted to build confidence that the approach worked

-

@james-woodroffe whats it about this week? is it anything related to this blog? kind of want this blog to be about trading, investing and football/cricket, there is an off topic thread which is where to post videos/podcasts/book recommendations etc