CPC's Horse Racing Systems Performance and Ideas

-

Have really enjoyed interacting with the members of BTC over the past few months and as we are nearing the end of Q1 of 2019 I thought it was time to start my own trading performance topic.

As some of you will know, I basically exclusively trade on horse racing, although am intrigued by other opportunities and have been doing this for about the last 5-6 years. I have made every mistake in the book (many of them several times!) and as a consequence burned through several substantial bankrolls in the first 3-4 years of trading. Over the past couple of years I have refined my approach and strategies and greatly improved my trading discipline to the point where now I consider myself a pretty decent trader on the racing markets.

Both because of where I live and the fact that I travel frequently for work, I have to tailor my approaches to be workable with minimal 'live' interaction (another reason I have been reticent to depart from racing). I would estimate that I spend no more than 30-45 mins a day researching and setting up trades for the next day of racing, and all of them run through an automated bot on a VPS. I do use commercial software to assist with this and factor that into my P and L statement.

Once March closes I will post my results for the first quarter of this year along with some explanation of how I forecast, adjust my bank, and approach staking for my primary systems. I think this will be mostly just me thinking out loud but of course any questions or comments are very welcome.

I will also continue to post my individual selections for my B2L66 system (I have what I think is a decent L2B approach too but want to trial that for another quarter before making public recommendations).

-

@charles-cartwright thanks that’s what I thought. I tend to throw stuff away if it’s below 10%

-

@john-folan said in CPC's Horse Racing Systems Performance and Ideas:

@charles-cartwright maybe I’m trying to overshoot with some of my yields/ROI. 5% is reasonable isn’t it?

John:

I would say that a long term 5% yield is more than acceptable (I think I read somewhere that Tony Bloom's number crunchers view anything above 3% as worth considering). If you can find a couple of approaches that regularly perform that well then you will be doing really well.

As far as ROI goes....I view anything above a 10pt increase in bank to be a successful month. I typically do better than this but that is a 10% ROI.

This year I have decided to only increase my stake quarterly and to only do it up to an increase of 30% no matter what my quarterly return is.

Determined to try to view this as an investment for the long term and not as a short term source of disposable income (which is in my mind a gamblers mentality).

C

-

@charles-cartwright maybe I’m trying to overshoot with some of my yields/ROI. 5% is reasonable isn’t it?

-

@charles-cartwright Nice work, on a tough month matey and still a profit well played!

-

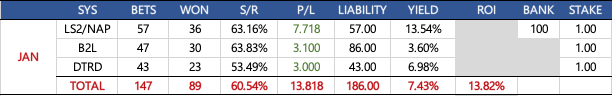

January Results

Here are my trading results for January. Overall a pretty decent return given the atrocious conditions for racing most of the month. My aim is always to turn a minimum return of 15pts a month and just fell shy of that.

B2L I post every day and they were tough to select this month.

LS2/NAP is a mixture of lays that I select using ProForm and a slightly modified method of picking the bad tipsters from the naps table. All are laid in the place market hence the low strike rate but decent return.

DTRD are picks from ProForm's double top rated selections trimmed based on a couple of other criteria and then set up as DOBs rather than win bets.

-

@charles-cartwright said in CPC's Horse Racing Systems Performance and Ideas:

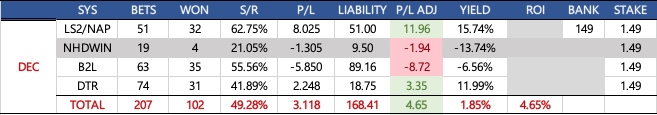

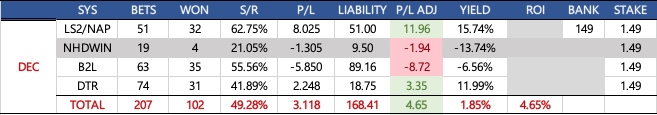

December Results and 2019 Analysis

December was a pretty disappointing month overall.

I ended up dropping the NHDWIN option due to some poor performance and replaced it with a modified DTR from ProForm that limits selections to a manageable number (aiming for a 5-6 pt monthly profit). B2L, as those of you following these picks on the Horse Trading thread will know, recorded its second worst month of the year with only April being a bigger loser. Ground was certainly a factor for the NH selections even though try to take all of those factors into account and will be wary of picking much when going is beyond soft going forward.

Month-to-month results for 2019 were generally very solid and overall I am pleased with how the changing blend of systems has done. Ups and downs as always with having to shred my bank back down to 1K being the definite low-point.

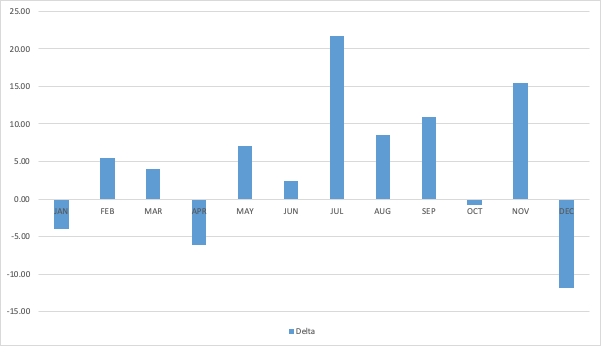

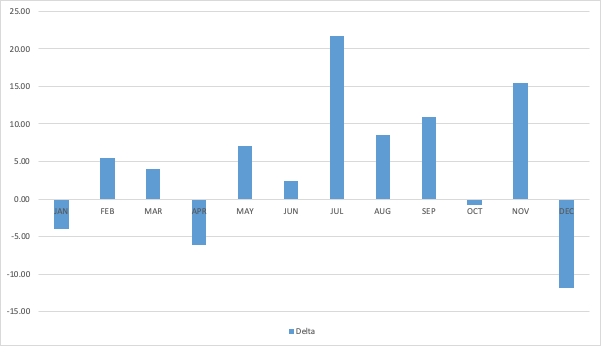

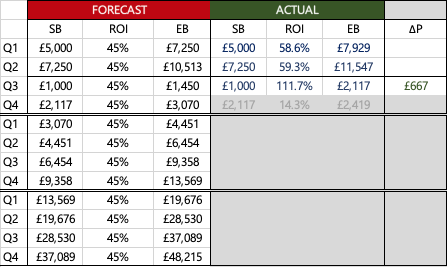

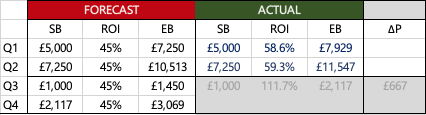

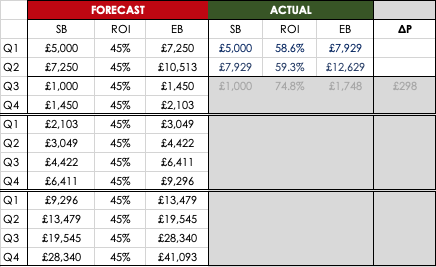

I forecast a 15pt gain in base points each month (so a 45% ROI per quarter) and the chart below shows how the actual results compared with the expected gain.

Only 3 months ended up below forecast (Jan, Apr and Dec) with some very solid months in between. I was compounding stakes every month this year and in hindsight I think that is too aggressive and compounding quarterly is a better way to go. Will implement that starting in 2020.

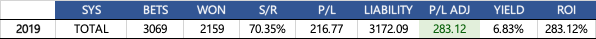

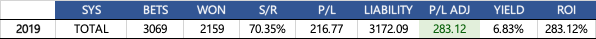

Bottom line is this is what 2019 looked like overall:

Turned a 1K bank at the start of Q3 into a bank of 3,252 to start 2020.

As always, questions and comments welcome.

Happy New Year.

C

-

December Results and 2019 Analysis

December was a pretty disappointing month overall.

I ended up dropping the NHDWIN option due to some poor performance and replaced it with a modified DTR from ProForm that limits selections to a manageable number (aiming for a 5-6 pt monthly profit). B2L, as those of you following these picks on the Horse Trading thread will know, recorded its second worst month of the year with only April being a bigger loser. Ground was certainly a factor for the NH selections even though try to take all of those factors into account and will be wary of picking much when going is beyond soft going forward.

Month-to-month results for 2019 were generally very solid and overall I am pleased with how the changing blend of systems has done. Ups and downs as always with having to shred my bank back down to 1K being the definite low-point.

I forecast a 15pt gain in base points each month (so a 45% ROI per quarter) and the chart below shows how the actual results compared with the expected gain.

Only 3 months ended up below forecast (Jan, Apr and Dec) with some very solid months in between. I was compounding stakes every month this year and in hindsight I think that is too aggressive and compounding quarterly is a better way to go. Will implement that starting in 2020.

Bottom line is this is what 2019 looked like overall:

Turned a 1K bank at the start of Q3 into a bank of 3,252 to start 2020.

As always, questions and comments welcome.

Happy New Year.

C

-

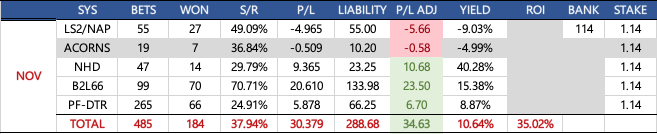

November Results

Made a few changes this month just to try to level things out a little bit by diversifying a couple of approaches.

LS2 I switched over completely to laying-the-place which of course clobbers the S/R but hopefully also levels the variance a bit. Was not hugely successful this month taking a small loss but hopeful that is just a blip. Essentially the lay the naps took a month off over they reset the table and that is just coming back now in December although will probably still be slow for a while.

I canned Little Acorns early in the month. Can't for the life of me see how this could suit anyone but a mad gambler. You have to use a progressive staking plan to make any return at all and it can very quickly get very scary indeed with 7,8, and 9 race losing streaks not all that uncommon. Not for me. So to replace that I have simply put in ProForm DTR. This is really the simplest of all selection systems using PF with each horse being both top rated by pace (based on last time out) and by ProForm's formula for ranking horses in each race. Not exciting but a steady earner and has a high rate of turnover which helps with the commission rate.

Only other change was to increase the liability on B2L to 1.66 so that each conversion returns a full pt.

Results shown below:

Good month overall with only LS2/NAP lays being in the red, everything else solidly in green. No changes anticipated for December and with the combined ROI of October and November standing at 49% (Oct 15% + Nov 35%) am already above my quarterly forecast and so everything else this year is gravy.

Cheers.

-

amazing how you pulled a great profit from a horrible month!

-

@charles-cartwright I really look forward to these buddy, thank you for sharing with us.

-

End of month update

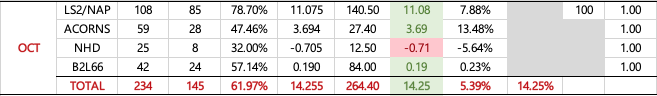

October was a bit of a mixed bag. Largely a struggle on the backing systems (B2L and the newish National Hunt Double Top Rated (NHD)) but decent on the laying front. Overall ended up just shy of my 15% ROI per month target:

Only making one minor change going into November and that is to lower the liability on the B2L66 system from 2pts down to 1 and scrap the stop-loss that I have had in place. Other than that steady as she goes.

Here is where I stand going into November. Still on track to have 3K going into 2020 and the 5 year plan is in place!

-

@charles-cartwright

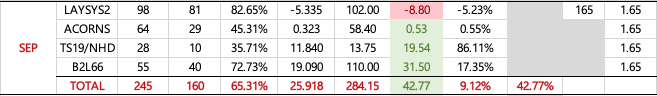

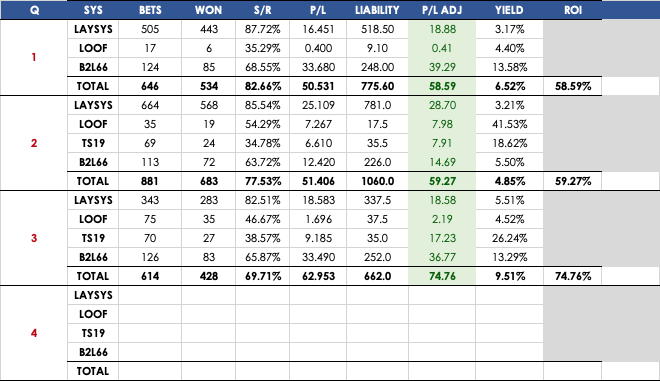

Below are the results for September, YTD by quarter, and then financial returns for my horse racing trading approaches for 2019.

September:

For reference, the 1.65 represents the adjusted stake because I compound the staking each month of a quarter and since this was the last month the base stake is X1.65 pts of the value at the beginning of July. Hope that makes sense. You can see that my bread and butter LAYSYS2 which is a combination of overpriced horses based on ProForm parameters and poor NAP tipsters had a poor month but everything else was in the green. Only marginally ahead on Little Acorns and had some scary losing streaks but my straight backing ProForm picks had a good return (end of the turf sprint season and beginning of national hunt double top rated) and B2L was very successful. All in all a good month.

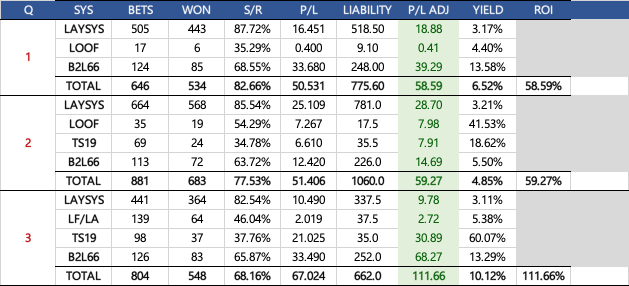

YTD

As you can Q3 was a fantastic 3 months, with an overall yield of over 10% and a 112% ROI. That is over double what I forecast as an acceptable quarterly return and has helped to nicely move my shredded bankroll in the right direction.

Financial Statement

So here is where I stand as we go into Q4. You can see that I managed to scrape enough into a bankroll to start at an effective 1K on July 1st. That bank now stands at 2,117 and that will provide the basis for staking into October. I don't expect to continue to have 110% ROI quarters but even if I go back to the 60% that I was seeing earlier in the year I will have well over 3K going into 2020.

Any questions please free to IM me or post here. Will be back with an update at the end of October.

Cheers

-

End of month update

August

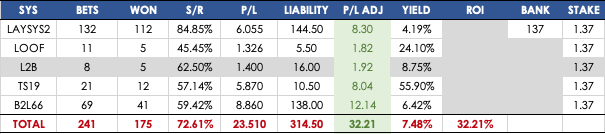

Interesting month to say the least. Had to destroy the bank in the middle of it, abandoned any attempt to do L2B using an automated approach, and had a crazy rollercoaster ride on B2Ls. Anyway, at the end of it all this is what the state of play looked like:

Since this is the second month of the quarter the bank and stake are compounded from July which was a terrific month (37% ROI). The P/L column shows the 'straight' P/L in terms of points based on the staking scheme for each system and the green shows the adjusted number based on the compounded stake.

Just looking at the raw numbers then a decent month with a 7.48% overall yield on 241 trades. Helped by a nice return on my Turf Sprinters system (ProForm). I have to start researching something similar for NH racing for when this one ends at the end of September (October is way too volatile). Was really up and down though from day-to-day which again reinforces that although we can't help looking at that we can't base our trading on a few days results. Canned L2B during the month, at least doing it this way. I have been trading a few of Rob L's selections (@tradingrob on Twitter) to help rebuild the bank but it really isn't my style at all.

So year to date this is where we are:

Here are my actual financial returns for this year. Again I had to shred the bank in August but managed to scrat enough together and make some off-system bets so that I could "simulate" starting July with a 1000 quid bank. Now up to 1750 going into Sept.

Heading for a fantastic 3rd quarter as my forecasted ROI for each quarter is 45%. Am going to officially add Little Acorns to the mix starting in Sept and following the progressive staking model (will start at 0.25 pts as the base trade liability).

As always, questions and comments are welcome.

-

Ah mate that’s a nightmare. I suppose at least you had the money to do what was needed. My trading fund gets raided regularly which annoys me but life happens. (And kids, my dad always said if you want to have money don’t have kids. Wise words)

I’m looking forward to watching you rebuild. Which I am sure you will. Probably a lot quicker than you think.

-

So those of you who follow the Horse Trading Thread will have seen my post earlier this week that catalogued the financial meltdown that followed by 2017 BMW M3 colliding with a large piece of rubber stripped off a truck tyre. I won't go into all the gory details again but I have been 'forced' by my nearest and dearest to stripmine my betfair account to cover the damage and avoid an insurance claim with the inevitable consequences.

So from a position where I was, provided that my current strategies didn't suddenly tank or lack of liquidity blew some of them up, less than 2 years away from having 100K in my account to having basically bugger all.

My current account balance is a miserable 708 quid!

What I have decided to do is catalogue how I grow that from here using exactly the same approach as before. What I hope to able to show is that in about 2 years (without making a single deposit) I can turn that back into 15K and be on track for my original goal.

Will be back on this blog at month's end with an update.....

-

@jarratt-perkins

Thanks Jarratt. Hopefully the next part of the series will be helpful for those who are starting on a small bankroll!

-

@charles-cartwright Thank you for sharing all this and being very open and honest. I love reading these updates and its a glimpse of where I would like to be and the business approach you have around it!

-

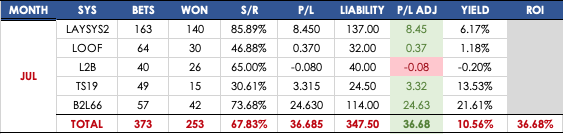

July Results

Posting my results and some analysis for the month of July. Best month of the year so far for me, with an over 35% ROI (10.5% yield) on my portfolio for the month. As a reminder I set a target of 45% ROI a quarter and consider anything over that forecast to be a really successful 3 months.

Here is the breakdown of how the various systems performed:

Obviously this was a great month for the B2L selections with a 74% S/R and a return of almost 25 pts for a pretty amazing yield of 21.6%. Would love to be able to sustain that but that is almost double a typical month and so can't expect that to continue. Still, got to love that positive variance when it kicks in.

TS19 is my little ProFrom based system for picking winners in Turf sprints (7f or less). Was a little bit down on S/R this month (usually runs around 35%) but a couple of nice priced winners kept it in the green.

L2B was basically flat and this is the second somewhat disappointing month. Not really sure why and hopefully it will turn around since a 65% S/R is pretty dismal when you are only trying to get the odds to move up 25% in your favour before the selection DOBs.

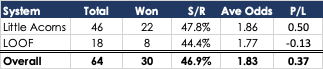

LOOF (Lay Odds On Fav) is now a combination of my own ProForm driven system for picking possible OOF that are worth opposing and Little Acorns. Not a great month for either of these approaches to be honest (details below):

The S/R was actually not too bad but the average odds on the selections was too high for that to translate into a winning month. These are just flat bets at 0.5pt stakes. I would never ever do progressive staking of any kind on systems with a less than 50% S/R since you for sure will regularly hit runs of 4 or 5 losses in a row and occasionally 7 or 8. Will see what next month brings but I am dropping these down to 0.25pts for now to get a much better handle on what the true ave price is for acorns.

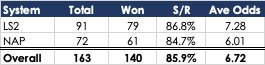

The best news though is on LAYSYS2. This used to be a system that I based entirely off ProForm stats, was a straight-laying system, handicaps only and a couple of other criteria thrown in. Don't think I ever explained it in full here because it's ProForm which not many people have and it throws up a lot of selections which then get filtered out. Anyway, after all the flurry of interest in Martin's concept of laying selection put forward as naps by 'out of form' tipsters I started adding those into the system. What I have done to make it simple is just do the following:

-

Sort the naps table in the RP by P/L and then note the bottom 10 in the list.

-

Re-sort by race time and weed out any that were also picked by a 'winning' tipster.

-

Put the rest into BF Bot Manager as possible LAYSYS2 picks.

Below are the results of that for July:

In simple terms NAP has an average trade price about 1.3 pts lower than LS2 whilst only lowering the S/R by about 2%. If that can be sustained then this is the best straight laying system I have ever seen...it's a big if because its only based on less than 100 trades right now and this could just be a pos variance swing that I happened to hit.

As a point of reference, at an ave price of 6 you ONLY need an S/R of 80% to breakeven if flat betting. At a price of 7.3 you need a S/R of 84.5%. So the NAP picks in July had an edge over the expected result of almost 5%! Again, if sustained, that is the best I have ever seen. Anything around 2-2.5% is decent and is typically what the big time traders consider worth keeping.

Too much to hope August will be as good but hopefully can at least sustain July's momentum to some extent.

Any questions or comments please feel free to post or send me an IM

Charles

-