Trading Beliefs

-

Hey guys,

I am looking to create some podcasts and YouTube blog posts and most importantly members resources around what peoples trading beliefs are, I've put together a few things which I believe traders believe the thought process for me what do they believe and when? & Also when that belief is changed what's the next thought for them? I would really appreciate some help and feedback from you guys as to if I have missed anything??

(Heads up @Simon, @Charles-Cartwright, @Keith-Anderson, @Frode-Lia, @Luke-Ridger, @Chris-Watts, @Dave-Jessop, @Ben-Price, @james-everard - I had to tag you guys as you usually comment frequently on the forum and I think you might be able to help!)

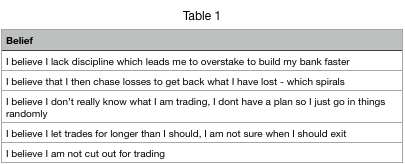

Mentality

Belief

Belief

I believe I lack discipline which leads me to overstake to build my bank faster

I believe that I then chase losses to get back what I have lost - which spirals

I believe I don’t really know what I am trading, I dont have a plan so I just go in things randomly

I believe I let trades for longer than I should, I am not sure when I should exit

I believe I am not cut out for tradingStrategy

Belief

Belief

I believe I dont know which strategy to use and why

I believe I should do the horses because thats what others do

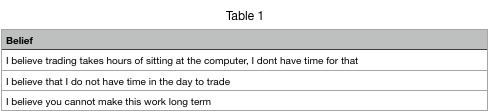

I see others using strategies which I follow and lose money onTime / Money

Belief

Belief

I believe trading takes hours of sitting at the computer, I dont have time for that

I believe that I do not have time in the day to trade

I believe you cannot make this work long term -

Cheers, la. Will do!

-

@simon Some corkers in there!!

-

@james-everard Thank you for the honesty matey.

You have in this post pretty much set your own set of rules to follow, now you just need to follow them? That's the hardest part though. It's like @Chris-Watts says above though trading isn't about being right or wrong, taking small loses are the biggest factor in being profitable long term.

-

@charles-cartwright Excellent, absolutely excellent!

-

@chris-watts Thank you for the excellent and honest answers here matey, they have been a big help!

-

@keith-anderson Thank you

-

@simon said in Trading Beliefs:

Like @Dave-Jessop has said below, a big one for me was and still is to a degree, is the “yips”. Being to hesitant to enter a trade. The negative effect it can have is that you hesitate, don’t enter, then you see the trade would have won which affects you negatively. You feel like you missed out even though your reading was spot on. This has then lead me to chase that loss. Even though it’s not actually a loss, I didn’t lose anything financially, mentally I lost out, so I enter a trade I’m not 100% sure on and sure enough it goes on to lose, leading to more frustration. I see and read a lot about people being to confident and overstating/overtrading, but I think being too cautious is just as crippling.

I’ve been doing this one quite a bit!

-

@Ryan-Carruthers on top of this, I have a few notes around mentality i keep and try to look at before i trade (although I don't always) but this keeps my mentality in check when required. I've acquired these from various resources (so not my own work by any means!) and these one's just struck home to me so worth sharing. So this is what I believe are an ideal set of beliefs, expectations and attitude for myself:

Attitude - Positive winning attitude. Winning in any endeavour is down to attitude.

Belief - no possible way to avoid a loss, it's a natural consequence of trading (expenses)

Expectations - Completely accepted the risk - considered and accounted for it financially and emotionally.

The market doesn't owe you anything, it won't do anything for you no matter what you project on it.

Accept full responsibility - you, not the market, is completely responsible for your success as a trader.

The market is the collective actions of other people who all want to take money out the market, they won't give it to you.

All my outcomes are self generated based on how I perceive the information I am seeing.

-

Hi Ryan

Great thread Ryan, the idea of videos could really help me out as I go through this cycle a lot still. My biggest problem which I know is a problem ,but still bloody keep doing it is entering a trade and the trade goes against me, I think chase my loss and then it goes from bad to worse. It really annoys me and that then has affects on other trades with my mindset by trading matches in leagues I shouldn't be trading in. Also afraid of getting into lay trades at odds above 2.5 and prefer under 2.0 , then I don't get into the trade and it would have won making me frustrated. Never seem to accept taking a loss is another problem I have. And keep on thinking of the long term ideal situation of doing trading full time making decent money.

-

Great thread and not much too add since everybody I think goes through the same issues.

I guess the key mantra for me in getting to being reasonably successful at this has been:

"Look at the process and not the results"

I think one of the hardest things for people to do is to put aside short-term downturns in results and to resist the temptation to discard a process that they have established and determined has validity. You should always examine your processes for trading in any market and correct if necessary but the overwhelming temptation to chuck everything away after a few bad days is something that is very difficult to overcome.

The converse is also true. Look at way too small a sample size and (if results are favourable) believe that the process is good because the results are so impressive and then be crushed when the downslide of the roller coaster happens. Testing systems through analysis of past results and through significant trials before committing significant amounts of your bankroll is a critical part of the discipline needed to succeed.

The other big one is to never, never look too far ahead and 'project' where you will be financially in x years or whatever based on ridiculously optimistic expectations of what you think your returns will be. If you fall short then the temptation to deviate from any kind of plan/process and go chasing things to make up the perceived 'shortfall' is overwhelming.

-

Good idea for a thread, we’re definitely a composite of our beliefs when trading so understanding them is important. Managing yourself is a part of the edge. The initial post doesn’t stipulate what level of experience you had in mind, my perspective has definitely evolved but earlier on these are some of the things I wrestled with:

•I must be trading something all the time or I won’t make enough profit.

Over time this became - If i'm trading all the time I wont be in the best place to make logical decisions and ill actually make less money.

•If I lose on a trade, I feel angry, frustrated and annoyed. If I win on a trade, I am a happy and all is well.

I now know that i'm not my trade, i accept that this is a probability game and that success is winning slightly more often than i lose. I now take more pleasure from following my process rather than the outcome of the trade.

•If I don't follow other people’s trades I will have missed out and that’s stupid.

I now only follow other peoples trades if they align with my own research and fit my own trading style. Following other peoples trades without knowing why or what to do when things change is stupid.

•The markets are out to get me, every time I enter it goes the other way. If I follow someone else on a trade i will somehow negatively impact the outcome of that event.

I now accept that this is scientifically impossible!

•I am unwilling to take the loss so I am letting this trade go longer until I’m proved right. Trading is about being right or wrong.

I know now that taking small loses is practically the biggest factor in being profitable and that trading isn't about being right or wrong. Its about putting yourself in a position where probabilities are in your favor and will play out over time.

•If I just keep studying and looking and reading, I will find the secrets to trading nirvana and retire happily on a beach somewhere.

If there is a secret.....I havent found it! best to give up the search and focus on doing things correctly instead!

•Everything has to be absolutely perfect for me to get into a trade.

Trading is dynamic and fluid, there will never be a 100% perfect setup or signal for a trade, take a good entry point and work from there. Your entry point doesnt have to be static, you can alter your position as things unfold.

•If I won, I was skillful. If I lost I was unlucky or it was something or someone else’s fault

Everything I achieve, good or bad is on me.

-

Like @Dave-Jessop has said below, a big one for me was and still is to a degree, is the “yips”. Being to hesitant to enter a trade. The negative effect it can have is that you hesitate, don’t enter, then you see the trade would have won which affects you negatively. You feel like you missed out even though your reading was spot on. This has then lead me to chase that loss. Even though it’s not actually a loss, I didn’t lose anything financially, mentally I lost out, so I enter a trade I’m not 100% sure on and sure enough it goes on to lose, leading to more frustration. I see and read a lot about people being to confident and overstating/overtrading, but I think being too cautious is just as crippling.

-

@Ryan-Carruthers Table 1 looks like a cycle chart of my trading when I first started.

1: I believe I am not cut out for trading

2: I believe I don’t really know what I am trading, I dont have a plan so I just go in things randomly

3: I believe I let trades for longer than I should, I am not sure when I should exit

4: I believe I lack discipline which leads me to overstake to build my bank faster

5: I believe that I then chase losses to get back what I have lost - which spirals

6: I believe I am not cut out for trading