Liqididty

-

With experience comes everything.

Ask many times and ask many different traders with no clear answer.You live as you learn, and I find my benchmark for liquidity.

Getting back and laying bets taken with no issues when using 2% of the current market's liquidity.Smooth and nothing erratic, just the way I like it.

So today I stake 1000 SEK trades and below using following values in SEK.5000/100

10 000/200

20 000/400

30 000/600

40 000/800

50 000/1000 -

I learn from my own wisdom LOL

I will use the 12-minute mark entering for trade as Each Day 10

But not Scalp/Trade 5/6 min mark for 10% return.I will test the whole 10 min or when reaching the goal of 20% return.

If possible, I will simulate this today with odds 3,5 to 4,8.

With back-dripping to reduce overall loss ratio, the excellent pendulum effect is achieved.What is the point - well, this is the point.

Most goals peak statistically at and after the 15-minute mark.

And also read that peaks of goals around the 30 to 45 min mark.

Hey, why 0-0 price drop dramatically - market behaviour.So instead of 10 to 20 min mark with odds 3 to 4 and back-dripping for 10% i will try do the exact same with the following difference where market and traders overall think differently.

To achieve 20% return with the same methodology.

What is the mechanism that triggers this higher return.

Markets' expectation at 12 min mark to 22 min mark - goal wise -

Markets odds - expectation wise - 3,5 to 4.8 to lay.That is the theoretical framework for stronger time-decay and drifting price movement against the market's expectation.

The in-play indicators are a key factor here to get a tendency towards matchreading for the present attack mode, tempomode or active/slow or low/high likelihood for goal attempts.With this saying also mention that one loss with original gave higher loss ration then 1 in 5 with one past trade with this parameters.

But that situation was from the original setup - so potential 20% return and back-dripping I might get around 1 in 4 or less.

That the simulation and real-life trading will tell.But with a higher liquidity game, I will stick to my original plan.

In lower liquidity games, I will test this out with 10£ trades.

So explore the possibility and see how well my educated guess or framework comes true with real-time stats from live trading.Cheers

-

Today I look at my old and current charts and can see that around 5 to 3 times during weekends, you have around 100,000 SEK liquidity.

So I will let the process go on for a couple of weeks, then if all goes as expected - I will use 2% of 100 000 SEK and set my limit to 2000 SEK.If I did not have a very high strike ratio and the diversification methodology where low as high stakes hedge up for each other overall.

I would not do this.So the first row is the liquidity.

The second row is the stake.

The third row is the drip-backing stake.The last one means that I buy back profits during the in-play trade.

In segments of 2 ticks.

Which gives a pendulum effect of reduced overall losses.Here is my chart I plan to use in the future - maybe within a month.

Then I just copy this winning concept to my other time decay strategies, and maybe within half a year from now i will have one full salary or make one full yearly income.SEK

5 000/100/20

10 000/200/40

20 000/400/80

30 000/600/120

40 000/800/160

50 000/1000/200

60 000/1200/240

70 000/1400/280

80 000/1600/320

90 000/1800/360

100 000/2000/400Should also mention that this methodology and winning concept works with smaller bankrolls.

For example ...

Sterling Pound

200/20/2

300/30/3 ... and so on ...I reckon with high stable strike methods with a 40% loss ratio or less.

And 10% return or higher.

Is the fingerprint for this set-up and mindset to work?Other ways tackling trading method I can not mention as I don't have real experience - when I say something is from that I live as I learn.

Cheers

-

@Patrik-Mellqvist phenomenal work as ever! well done

-

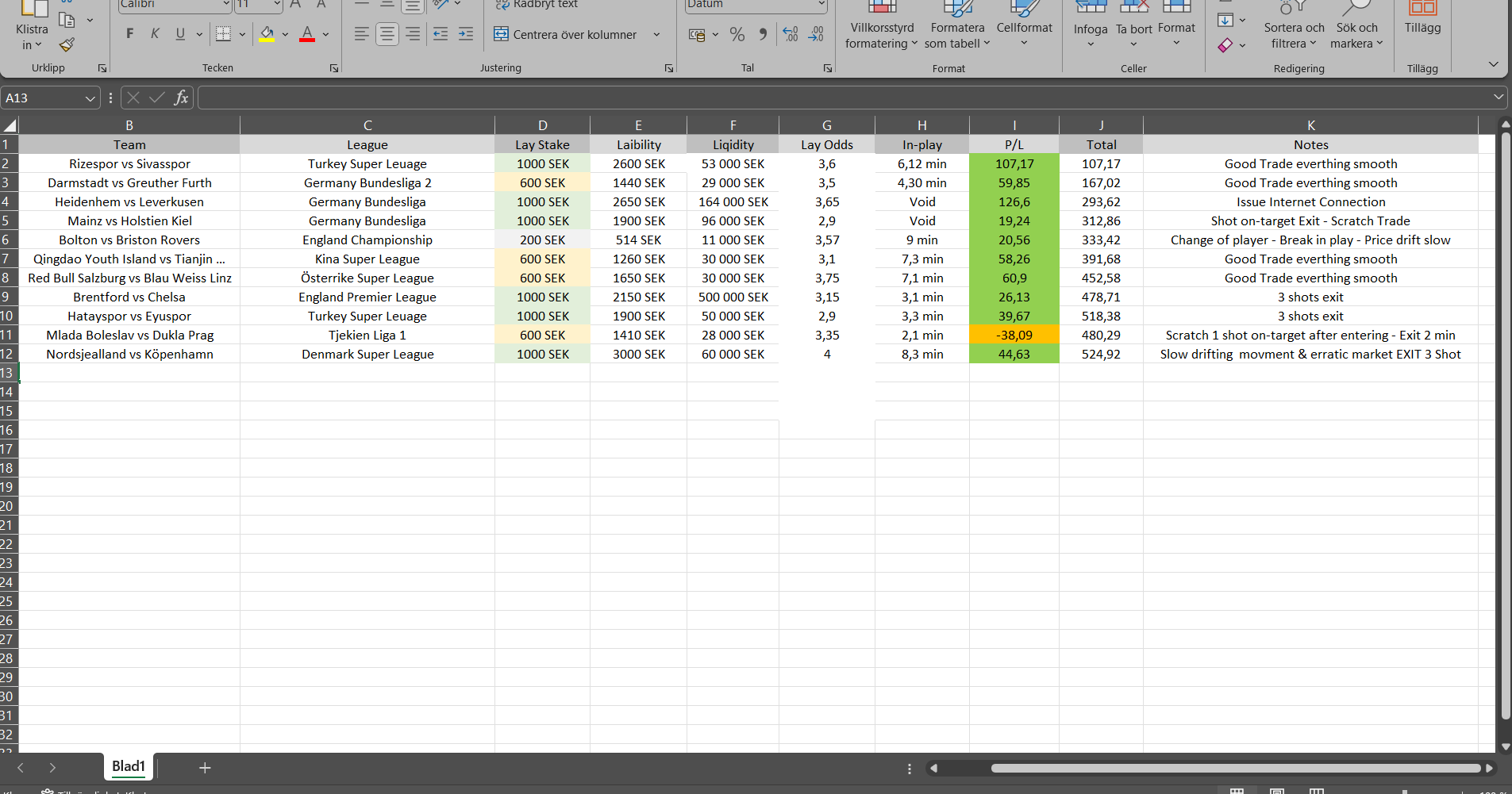

@Martin i have a - Try & Error - Spreadsheet that shows my overall expectation - then I start scaling up using this methodology mentioned above with great confidence.

I am in early learning curve, but suddenly I have an estimation including losses around 400£ plus profit each month.

Trading all weeks and weekends with time-slots for windows, I can use for trading and other times for living.All things with three are good.

Come up with going against traders and the market with this method - thanks to 10 Each Day method - that is similar to my method.In short, instead of 10% with 5 to 10 min in-play exposure.

I can adjust and to what others don't do and get 20% with the same risk-mitigation exposure.

Just changing the timeframe when entering the market.

Change the lay odds spread to speculate with.

And make the back-dripping with a 1-tick interval instead of a 2-tick interval.But I will execute that after three months under my belt with this set-up to get some real experience - because you see in the spreadsheet comment field that some leagues and some situation you can not be prepared for and need to experience in real life.

-

Here is one advanced tip for the ones who follow or like what I have to say -

Think about compounding and scalping with a different approach ...Forget about sticking to a market that has a fixed amount and a fixed stake to trade

Be flexible and use diversification when tackling your trading journeySo instead of using 5 different spreadsheets and 5 different bankrolls with 5 different stake amounts with 5 different liquidity situations

I use one big bankroll and use 2% of all liquidity markets with my trading method with an adapted stake

So the 10£ trades' winnings and loses will encounter themselves as a separate universe among the other amounts

So if I got a 30% loss with 100£ stake is don't matter because that is just one small loss among more overall winnings with my trading portfolio and the smaller winns will also in such situation HEDGE UP the overall bankroll - also the other way around if a couple of small loses at levels 10/30/60£ the 100£ with HEDGE UP overallYou see, is a give and take as long as you know you're winning more than you lose. Overall, this approach is working like clockwork

The next nice thing about it is to explore

Why take 50% of the winning each month and leave the other 50% to boost the bankroll

Then taking 50% daily should also give the same effect that by the end of the month, you have 50% to boost the bankrollSo I come to conclusion that routine and clear rules make all kinds of money management solution to work out just fine ...