*****New Football Thread*****

-

Anyone see that video by referee David Coote? And we try to say that Premier League refs are just s**t rather than biased!

-

Poor weekend this weekend from me. Think I'm down 6 or 7 points.

In the past I would have panicked. Thankfully those days are long gone

-

Second goal coming in the bodo v fredrikstad game.

-

@Craig-Greenway missed penalty + a disallowed goal so far

-

Straight into Stuttgart v Frankfurt FHG.

-

Next game I'm trading is a FHG in the Alkmaar v Willem game. Kicking off now

-

I'm jumping on Tottenham v Ipswich FHG. Odds start low so will be backing throughout half.

-

I know we’re not past this weekend but there is yet ANOTHER damn international break starting this week. I’m starting to think this (N.League) is deliberate, to disrupt club team continuity being established.

-

FHG in Karlsrusher v Munster is my next trade. Love home side for a FHG.

-

Next I'm on FHG in the Almere v Feyenoord game. 11.15 ko. FHG in last 21 for feyenoord. Will back as odds improve.

-

3 out of 3 yesterday. Going for over 1.5 FHG in Slavia Prague B v Sparta Prague B.

-

Cracovia v Katowice FHG is my next trade. Kicking off now.

-

Next I'm on darmstadt v Hertha FHG.

-

Morning guys. I'm currently on Chrudim v Vlasim FHG. FHG in last 26 for away side. 15 minute in.

-

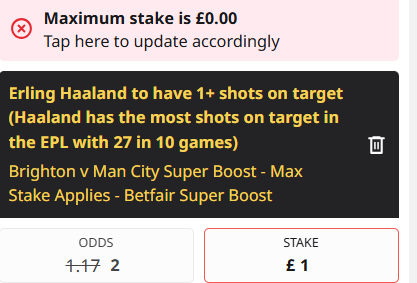

@Tony-Hastie haha i have been allowed another £10 on, being very generous (makes you wonder wahat they know about Haaland)...

-

I win

-

@Simon-Bates I usually am as well but looks like I am also allowed a tenner on so I'll take that...

-

@Shannon-Townsend doing this was what got me stake restricted

-

@Alex-Rule they let me have £10 for this, I'm usually limited to £2/£4