BTC Book Club - Lessons Learnt & Trading Stories

-

JULY 2021

I haven’t done one of these in a while as I’ve been busy studying to become chartered. As much as I would love to tell you all about what I’ve been reading, I don’t think it’ll be that helpful (Unless of course you want construction advice about building a hypothetical home, in which case… best ask someone else!).STEVE JOBS by WALTER ISAACSON

I would recommend this book to anyone who is interested in Apple/ Steve Jobs. Although it’s not official, Walter did spend a lot of time with Jobs so there is a lot of direct communication. He’s also known for his biographies and I would also recommend the Leonardo Da Vinci one.- Steve Jobs’ father was a carpenter and taught him to take care in his work and finish everything to a high standard, even the details that people wouldn’t see.

- Apple’s motto is a Da Vinci quote “Simplicity is the ultimate sophistication”

- Tim Cook had an important role incorporating just-in-time manufacturing. This involved closing down some factories and moving the remaining ones closer together. The build time for a Mac dropped from 4 months to 2 allowing Apple to remain flexible and quick to react to any technological changes.

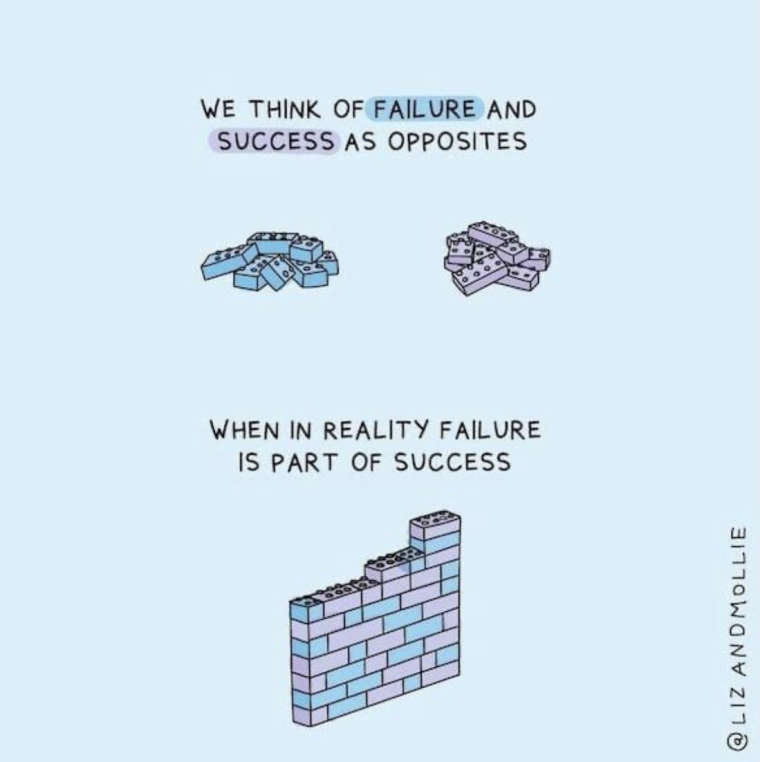

- Steve Jobs “Every success has come from hitting the rewind button. Too often companies ignore their faults and deal with it later.”

HOW TO FAIL by ELIZABETH DAY

This is an interesting memoir/ collection of stories from a British journalist and author who writes about how she has “failed” at different stages of her life and how those failures actually turned into successes.THE SUBTLE ART OF NOT GIVING A F by MARK MANSON

There’s so much from this one. But I’m going to pick one part for now:

“When a person has no problems, the mind automatically finds a way to invent some” - you will always give a f**k. You just need to focus on what’s most important to you.LESSONS LEARNT:

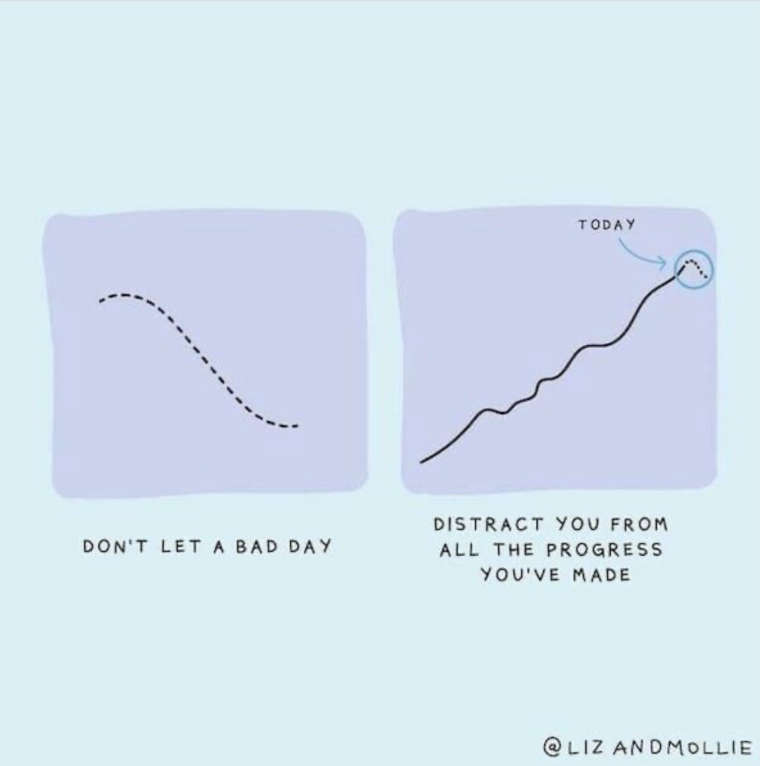

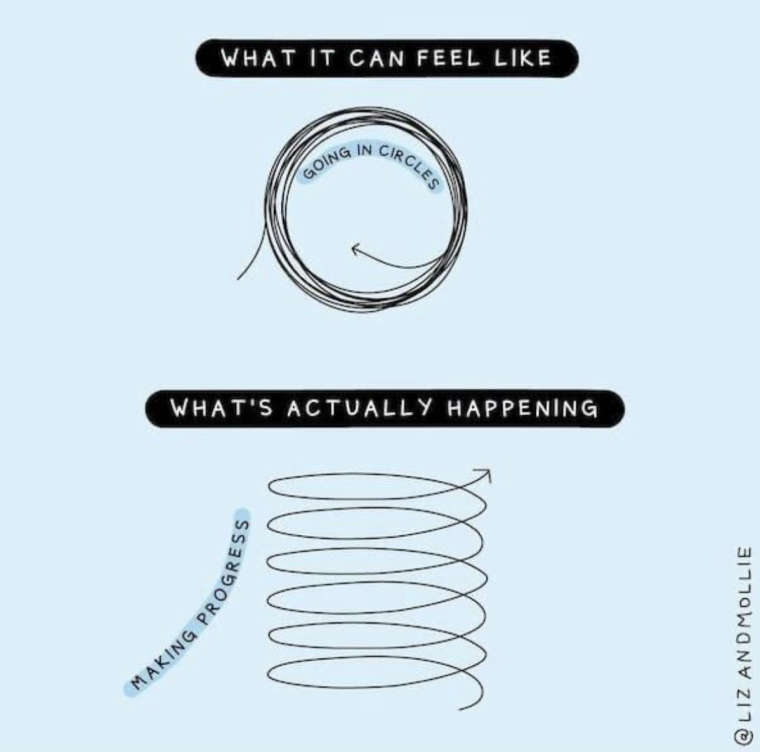

Another reason for posting this, after a couple of reckless weeks my bank dropped by 30pts. A few months of steady and patient trading I’m now back to where I started! 5 months to go back to where you started doesn’t sound great but I’ve learnt a lot. I’m sure most traders could have clawed that back quicker, but I prefer to go at my own pace “slow is smooth, smooth is fast”.

The lessons I’ve learnt were highlighted in the above. I think like most people on here, you want to prove to yourself and others so go flying off and try to reinvent the wheel. Instead, use the materials here and focus on eliminating mistakes. There will always be problems, so start with the personal ones you can fix easily.

I know it’s been said plenty of times before but mindset is everything. I was quite a cautious trader, but last month I upped my stakes from 2% to 3% of my bank. Nothing life-changing, but I noticed it actually calmed me down. I had the same SR but because I was seeing better returns I wasn’t as terrified when things went wrong. I’m not being reckless, but doing a small change showed me the long term potential.As always, hopefully someone has found this interesting and apologises for rambling

-

@dan-mackinnon Great post mate! Amazing how accurate that quote is especially with trading. Yet when you strip it back and forget your preconceived ideas of what it is and just find what your needing this really does change it all. Great quote: Don’t think of simple as going from complex down to simple, but instead from nothing to simple

-

I mean I am honoured, I am mentioned in the same post as the great Steve jobs.

I agree 100% I mean even on the BTC YouTube channel you can get most of the strategies I use free. It’s great having you here, looking forward to the next update! I’ve got a list of about 5 books to get through when I get a moment.

On another note I did find whispersync - it syncs from kindle and audible so you can read and listen together.

-

APRIL 2021

I haven’t done much reading of late as I’m currently studying to become chartered and work is hectic. The reading I have done has either been something easy, or very specific (I’ll leave you to come up with your own construction based metaphors for trading).I did hear an interesting story which I thought was worth sharing and something similar has been said on here by some of the pro traders. I heard an interview with Greg McKeown (Author of Essentialism) who’s team was tasked with coming up with a system to burn files to CDs for Apple computers. They had to give a presentation to Steve Jobs and knew this was their big moment. Hours were spent putting detail into this presentation, but they were also aware Steve Jobs is a minimalist and wants it sleek, clean and simple. When they gave the presentation it was not going well and at the end Steve Jobs walked up to the screen and said “I can you not just drag and drop these files and click 1 button?” and walked out the room. They realised that they were coming from opposite directions. Greg’s team was trying to streamline their product by cutting away parts, whereas Steve Jobs was trying to achieve his goal in the smallest number of steps. The lesson he learnt was:

Don’t think of simple as going from complex down to simple, but instead from nothing to simple

It’s easy to get wrapped up in loads of filters and different scenarios with side bets until your strategy looks like a noticeboard in a crime thriller. Sometimes we need to step back and just ask Ryan’s golden rule “What needs to happen to make this work?” and how can I get there in the fewest steps.

A final note, someone on here told me you can find all these strategies online without spending a penny if you wanted, the benefit you get from this site is being part of a community. I just wanted to say thank you to everyone on here, not just with trading but generally. It’s nice to interact with others and although I’ve never met any of you it’s good to feel part of a community.

-

Slightly off topic but stay with me, not a book but a couple of meme like pics.

After a shocking Saturday (again) I was very down on myself. A crappy nights sleep and some self reflection this morning and I'm ready to go again.

Looking through my unders data from the last 5 weeks trading, if I remove my mistakes (5 or 6, depending how I look at it) then it is actually profitable to the tune of 5.5pts. After yesterday I was ready to throw it out or totally redo it but I dont think there is any need, just avoid the mistakes.

This lead me to come across the following:

-

Love the discussion here around this, I think its going back to what actually is essential? Then questioning that..... I listened to the peak performance podcast with Jonny Wilkinson and its worth listening to for all of us here I feel but he talks about this state of flow - like when we were a child we played, if we were an astronaut everything around us was part of that we took it in - in todays interconnected world we lose some of that - I know sometimes I struggle to be present in the moment.

Focus is a great word too, a lot of times we dont focus on what we should be doing just filling the day with trivial tasks - where if we focused more we'd get more meaningful work done and less waste and have more free time.

-

@dan-mackinnon said in BTC Book Club - Lessons Learnt & Trading Stories:

I was listening to a podcast with Stewart Lee and he said something I found interesting and I wonder what your thoughts are. He said men of his generation (growing up in the 60s, 70s, 80s) have a collector mindset which younger generations don't have. He talked about showing his son his collection of Marvel comics or his huge record collection. But for the "digital generation" there is less interest because we have Netflix and Spotify, etc. I wonder if that's why minimalism and essentialism is becoming more popular with younger generations?

I second the suggestion that Ryan made of 'Essentialism'. You mention about minimalism and essentialism becoming more popular and i think its a reaction to people suddenly having far too much information available and realising its not a good thing unless it is kept in check. I was born in 83 so i just about remember having no internet and the introduction of the internet. Suddenly it took off and everybody could access every piece of information from past and present which is a phenomenal tool but it does start to create problems because its does detract from focus, and if there is one unique characteristic of success and successful people its focus. Then you add in social media and having access to every other persons waking moments and passing thoughts and its like an information overload - talk about ADHD central! I see it in my kids too, i compare how it was for me at 10 and my kids at 10 and they literally have information after information fed to them 24/7 which can be a good thing in some instances but judging the absolute nonsense they watch on tiktok/youtube im sure its not being utilised to its maximum

So i think people are starting to realise that its too much and there is no success to be had from looking partly at a million things, its better to be looking fully at a fewer number of things. Its almost like a reality check for the information age

Think of trading - how easy is it to come on here and see that someone is doing well on one strategy and it gets your interest, then someone else is doing well on something different, and yet someone else is doing a good job and a completely different strategy, then someone on FB shows a nice green screen, then a youtube video you watch makes a strategy look like a banker? So its a great tool to have the information to hand - but if not utilised correctly with some focus applied then it can be hard to nail anything. Ive done it myself and its something i have to proactively and consciously switch off from

-

@ryan-carruthers I'll add that to my ever growing book wishlist. I guess that goes with what someone mentioned on the football thread about not worrying if you miss a trade. Even if you're a pro trader there are more important things in life than trading football on a Saturday.

I was listening to a podcast with Stewart Lee and he said something I found interesting and I wonder what your thoughts are. He said men of his generation (growing up in the 60s, 70s, 80s) have a collector mindset which younger generations don't have. He talked about showing his son his collection of Marvel comics or his huge record collection. But for the "digital generation" there is less interest because we have Netflix and Spotify, etc. I wonder if that's why minimalism and essentialism is becoming more popular with younger generations?

The WTF one is good but they use some terminology I had to look up. I had to read it quite slowly just to picture what was going on because sometimes the author is so casual about what he's doing. Something he doesn't mention much but I had to remind myself is that he's 21 or 22 at the time. He's with another guy who I think is 20 but has never been in combat before.

-

Just ordered the Whiskey Tango One.

I am currently reading Essentialism by Greg Mckinnon

great book, all about focusing on what is actually essential and we fill our lives with filler a lot of the time - we need to look at what is actually essential. to get us where we want to go.

-

MARCH 2021

I’ve done a lot of reading recently thanks to having time off work. Apologises if this is a long one:LESSONS LEARNT: The more I read, the more I see how much of success in all areas of life is about mentality. Recently I’ve been working on an unders strategy which is looking promising, but for a while I doubted myself because I see lots of other traders try and discard it. That’s when it clicked that it’s a completely different mindset to overs. I tried to follow some LTD and o1.5 strategies and struggled in the same way I see people say about unders. I’m conscious of these posts being too long, but I’m happy to talk more about unders mentality separately.

I’ve seen Ryan mentioned it a few times but it’s good to be introspectively aware when trading. If you can identify when you’re “in the zone” then finding shortcuts to get you there quicker helps. I tried an experiment as mentioned in one of the books below that I found really helpful to jumpstart me into the zone. Before I did my first trade of the day I would listen to a song that made me feel prepared. I had another song which I know is 7 minutes and quite repetitive that I would listen to while doing my trades. I found myself more focused because I wasn’t counting down the time and it kept the part of my brain that does all the talking busy for a while. 7 minutes is a long time in the trading world and it’s good to find a way to focus a lot quicker. I also noticed that certain strategies go well with certain ways of thinking and realising that before you start is helpful. For example if you just can’t concentrate then a set and forget strategy might be better than trying to force yourself to analyse lots of in game data for a FHG.

THE ART OF LEARNING by JOSH WAITZKIN

This book is about a child world chess champion who went on to transfer those skills to martial arts. Funnily enough I spoke with Darri shortly after reading this book and he gave me some of the same advice:- There was a study of children between those who were “learning theorists” and those who believed they were gifted. They were all given easy maths questions which they all completed correctly. This was followed up with another set of questions which were impossible to answer. The learning theorists embraced the challenge whereas the others made excuses saying “it’s too hard for me”. Everyone got it wrong. Afterwards they followed up with another set of easy questions. The learning students passed easily, whereas the others had convinced themselves they were incapable and failed.

- When the author learnt how to play chess he started with the end (king and pawn vs king) which taught him how to use space and subtleties. Most children learn from the opening moves and therefore chess becomes about results. It doesn’t matter how you play, if you concentrated or if you were brave, as long as you won. This reminds me in trading - if your goal is to make profit then it doesn’t matter how you get there. There’s no real desire to learn a strategy and the subtleties that make it effective. Instead if you think about the end and what has to happen you can work backwards. Be willing to fail in an attempt to be right. It’s about the effort not the results.

- Look for depth not breadth. Delve into the micro to see what makes the macro tick. We are bombarded by distractions and information that it’s hard to concentrate

- When trading don’t dwell on results just make a note and move on. This allows you to remain “in the zone”. Use the following morning after to analyse your trades

- Have a personal routine so you can stay calm before a stressful or intense activity (eg listen to music). This will help you switch your mindset to be prepared.

- Be introspective and see how your emotions affect your decisions. Do you have a strategy for feeling cautious/ anxious vs overconfident

EDUCATION OF A VALUE INVESTOR by GUY SPIER

This book was very average and I wouldn’t recommend it. He talks a lot about Warren Buffett and all the insights I had were from Buffett.- When focusing on one area Buffett said “Put all your eggs in one basket and then watch that basket”

- Charlie Munger said “When you see a good move, ask yourself is there a better one?”

THE ART OF WAR by SUN TZU

I’ve heard this referenced so much, however I think it’s so broad it’s open to interpretation- He wins his battles by making no mistakes. Making no mistakes is what establishes the certainty of victory. Thus the victorious strategist only seeks battles after the victory has been won, whereas he who is destined to defeat first fights and afterwards looks for victory

- Move not unless you see an advantage. If you see an advantage, move forward. If not, stay where you are.

Other books that aren’t directly related to trading but I found some useful lessons

ALEXANDER HAMILTON by RON CHERNOW

When setting up the US Treasury Hamilton put in a 12 step recovery plan. Reminded me of the Steven Pressfield book when he said professionals look long term. I decided to make my own long term plans, and after the martial arts talk in the health chat I graded them yellow, orange, red, etc. up to black. It helped put my goals into perspective. The top level did seem ambitious and scary, but that’s what a black belt is. It also helped me focus and say these goals are 6 months, 1 year, 2 years away but this one is potentially 3 months away so focus on that.WHISKEY TANGO FOXTROT by LYNNE BLACK

I thought I would mention this if there are any history fans out there. It’s a memoir of an American Special Ops in Vietnam. It is unbelievable! If it was a film you would think they exaggerated. The lesson learnt was that your mind will quit a long time before your body and as long as you try your best luck will be on your side. -

For FOMO, also read: desperation to try to build a bank too quickly. I reckon this is where I was going wrong.

-

... Just because something is on my trading plan doesn't mean I have to trade it. Certainly for me in my early days of trading, the FOMO was probably my sole reason for over-trading

This is something I am starting to embrace, finally :astonished_face:

Although I will say its not so much a fear of missing out for me. Slightly different, but still FEAR, its a fear of wrong selection. So having 5 games on my plan and picking 2 of them to trade for various reasons. Lack of confidence in the reasons for those choices leads to FEAR of selecting the wrong games. Bit wordy but results in me 'having' to trade everything on my plan.

-

@dan-mackinnon said in BTC Book Club - Lessons Learnt & Trading Stories:

MARCH 2021 - TRADING IN THE ZONE by MARK DOUGLAS

Love these @Dan-MacKinnon Well done on the reviews.

Just one thing I want to mention about 'FEAR'. When we talk about 'FEAR' we tend to talk about a losing trade. But having a 'Fear of Missing Out' (FOMO) is just as important.

Just because something is on my trading plan doesn't mean I have to trade it. Certainly for me in my early days of trading, the FOMO was probably my sole reason for over-trading

-

@dan-mackinnon Excellent stuff. Will have to get this for myself to read.

Kickboxing analogy works very well too. When I used to do it and it was sparring time at the club, I always used to give my first partner a free hit. This got me over the initial 'shock' of getting hit and made me instantly relax and spar for the rest of the session much more effectively.

-

@dan-mackinnon Excellent, loved reading this.

The kickboxing analogy as well is perfect for trading. Thinking tactically, it's one of the reasons I tell people to watch the markets with no money on them to see how they move, otherwise you just focus on the red numbers and (I'm pinching from you now) tense up.

-

MARCH 2021 - TRADING IN THE ZONE by MARK DOUGLAS

As this is one of the most recommended books on here I wanted to give it a read. I was intending to summarise all the books I’ve read over the month but there are so many gems in here I wanted to share them. Hopefully it is of some use and apologises in advance if I ramble!- Anyone can learn how to trade in a market but very few make it consistent. It is the same as learning a golf swing but very few do it consistently.

- Traders can be self-declared risk takers as all trades have risk. But how many inherently understand and accept the risk? If fear is part of your trading you will try to avoid the risk. Trying to avoid what is unavoidable will have disastrous effects on your ability to trade successfully.

- THE BEST TRADERS ARE NOT AFRAID

- 99% of the errors you make as a trader will stem from fear. If you’re afraid of being wrong you will act in a way that will make you wrong

- Operate from the thinking that there is no possible way to avoid a loss, because losing is a natural consequence of trading - no different, let’s say, a restaurant owner incurring the expense of having to buy food.

- Why are casinos consistently profitable? Because they have an edge which they use over a large number. Micro level - the market is unpredictable and random. Macro level - consistent. You don’t need to know the outcome of every single trade as long as the trend is heading in the right direction.

- Edge = indication of a higher probability of one thing happening over another

I could easily write twice as much on this and I’m sure it’s a book I’ll revisit in the future. The biggest lessons for me are:

- An “Edge” is just an indication of probability. I would hear traders talk about “having an edge” or “not sharing their edge” and it sounds intimidating. That sort of talk encourages the idea that there’s some secret formula the rest of us don’t have access to. When you realise an “edge” is just a probability all that fear goes away. I would say “educated guess” is probably a better term (then again it’s less sexy to try and sell an online course or ebook based on “an educated guess!)

- FEAR - so many mistakes come down to fear. We all have different fears but once you recognise and accept it I’m sure you’ll notice that’s the source of your mistakes. For me, my fear was having a losing trade as a result I would get out too early. In the book the author says “you do not need to know what will happen next but accept that it will happen. If you know that based on your edge from 20 trades 12 will win and 8 will lose, but you don’t know in what sequence. All you know is the probability. If you truly believe in your edge then a loss is just bringing you one step closer to the next win”.

Fear of having a losing day might cause you to chase losses or overtrade. But if you trade every day for a year a losing day is a statistical inevitability. Fear of not progressing fast enough might cause you to overstake and be too ambitious because you can’t see evidence that you’re getting better. - MINDSET - 90% of trading seems to be about mindset. Maybe that’s why people with huge egos fail because they don’t want to accept their own weaknesses? I think people who are successful are not doing it for the money (although I’m sure it doesn’t hurt) but are doing it because it’s in their mindset to do it. On the Last Dance Netflix series Dennis Rodman says he would play basketball for free, they have to pay him to deal with all the other bullsh*t!. Stephen Fry said when he had his first success someone said to him “you’ve made enough money you don’t have to work now”. He said the idea of not working was the same as saying “you’ve walked enough now you don’t need to walk anymore, so we’re just going to cut your legs off”.

Reading this book reminded me of when I learnt to do kickboxing. First few weeks you learn how to throw a punch, build strength, etc. and work on the technical side. Then you would get invited to spar, but before you were allowed to throw a punch at someone you had to get punched yourself. The reason why is because they wanted you to not be afraid of getting punched. The reason most people get hurt is because they close their eyes or tense up in anticipation of getting hit. Getting hit doesn’t hurt anywhere near as much as you think it does (and I’ve been punched by some top kickboxers!). There is no way you’ll be able to go into a fight without getting hit in some way. There is no way you can be a successful trader without taking a loss from time to time. Once I got over my fear of getting hit I could start thinking tactically in fights and understand that I could actually ride a punch or kick to get into a better position. From there I continued to study and did kickboxing for 5 years at a decent level. The biggest turning point was overcoming fear.

Sorry for the ramble but hope that was of some help!

-

Thanks for sharing. I feel like there were metaphorical light bulbs flashing above my head as I was reading some of those quotes. And I really like hearing how you’ve applied those to your own experiences and lessons.

I know I will come back and read those quotes many times.

Once again thanks for sharing