The BTC Football Trading Thread

-

Todays Goal Games...

My Split Stake;

Maccabi v Maccabi Tel Aviv - No Trade, goal too earlyCorrect Score Trade - Dutch Target Scores 3-1, 2-2 & 1-3;

Villarreal v Levante (also lay u2.5 goals to cover red in correct score dutch) - Scratch trade (lay u2.5 goals scratched correct score), target score not metNo go today... Goal blitz from Villarreal (not unexpected) & No trade in Israel (goal too early)

-

I have 2 selections for tomorrow, one from Portugal and one from Spain

Vilafranquense v Casa Pia

Alcoron v Malaga -

After paper trading LTD for a couple of months, I decided to begin my live trades. Today I had 3 selections, I did have more on the shortlist but I have been busy most of the day and went with the 3 that I could initiate the trade easily. These matches were all from Spain and are set and forget strategies.

Valladolid v Leganes

Mirandes v Zaragoza

Tenerife v Las PalmasI am pleased to say that all 3 won.

Trades 3

W 3

SR 100

P/L £9.42

Points 2.94

Average Stake £3.20 -

Lay Under 1.5 Goals (Expect a SHG): - Monday, 03rd January 2022

18:30 - Maccabi Haifa v Maccabi Tel Aviv

-

@keith-anderson said in The BTC Football Trading Thread:

Lay Under 1.5 Goals (Expect a SHG): Sunday, 02nd January 2022

15:15 - Elche v Granada

16:30 - Chelsea v LiverpoolLay under 1.5 Goals (Expect a SHG):

15:15 - Elche v Granada - HT: 0-0 / FT: 0-0

16:30 - Chelsea v Liverpool - HT: 2-2 / FT: 2-21/2 from the 1.5 goals

0/2 from the SHG

Poor day

-

@keith-anderson said in The BTC Football Trading Thread:

INPLAY:

LCS in the Brentford v Aston Villa match. Curretly 1-1 at HT

Goal! 2-1

-

INPLAY:

LCS in the Brentford v Aston Villa match. Curretly 1-1 at HT

-

@stuart-capstick Thanks for sharing this, I’m definitely going to have a read through and get my head round this type of analysis

-

@alan-steward said in The BTC Football Trading Thread:

@richard-latimer said in The BTC Football Trading Thread:

@stuart-capstick well I've got a p-value of 0 haha!

Of course data can be manipulated and backfit so ultimately it's a question of how.much integrity you put in your data.

I've had low p-values before but it's largest amount of trades probably the lowest value so that's something.

Drawdown is also good to know but is the very reason for reducing stakes after a 35% loss.

As with all things data, it is incredibly interesting.

Interesting point re reducing stakes after 35% loss... However after listening to a top pro trader discuss this I've never looked at reducing again.

Firstly it's all about Bank Size... Ensure it's big enough to cope with Strike Rate/Profit & Loss & Drawdown (obviously Stuarts point about P Value & Drawdown kicks in here)

Once all of the above are in place and you have a solid P Value system try doubling stakes every time you increase your bank by 50%

You should never need to give stake sizes back again!

Bank size should be all about P value & Drawdown... Vitally important to fully understand this... Hence my comment re excellent post from @Stuart-Capstick he introduced this to me a little while ago.

Agree with the idea of not needing to drop stakes if your system is significant (P value below 0.1%).

The only thing I would add is that varying stakes works best with low variance (low drawdown) strategies. With higher drawdowns (more "swingy"), better off using level stakes until the bank is doubled. -

@richard-latimer said in The BTC Football Trading Thread:

@stuart-capstick well I've got a p-value of 0 haha!

Of course data can be manipulated and backfit so ultimately it's a question of how.much integrity you put in your data.

I've had low p-values before but it's largest amount of trades probably the lowest value so that's something.

Drawdown is also good to know but is the very reason for reducing stakes after a 35% loss.

As with all things data, it is incredibly interesting.

Interesting point re reducing stakes after 35% loss... However after listening to a top pro trader discuss this I've never looked at reducing again.

Firstly it's all about Bank Size... Ensure it's big enough to cope with Strike Rate/Profit & Loss & Drawdown (obviously Stuarts point about P Value & Drawdown kicks in here)

Once all of the above are in place and you have a solid P Value system try doubling stakes every time you increase your bank by 50%

You should never need to give stake sizes back again!

Bank size should be all about P value & Drawdown... Vitally important to fully understand this... Hence my comment re excellent post from @Stuart-Capstick he introduced this to me a little while ago.

-

Nonsense. Nobody called Stuart, spelled correctly, can be cognitively challenged.

-

@stuart-wallace said in The BTC Football Trading Thread:

All a bit too much for someone as cognitively challenged as me !

me also. It might as well be in chinese.

-

All a bit too much for someone as cognitively challenged as me !

-

@stuart-capstick well I've got a p-value of 0 haha!

Of course data can be manipulated and backfit so ultimately it's a question of how.much integrity you put in your data.

I've had low p-values before but it's largest amount of trades probably the lowest value so that's something.

Drawdown is also good to know but is the very reason for reducing stakes after a 35% loss.

As with all things data, it is incredibly interesting.

-

@richard-latimer said in The BTC Football Trading Thread:

@stuart-capstick said in The BTC Football Trading Thread:

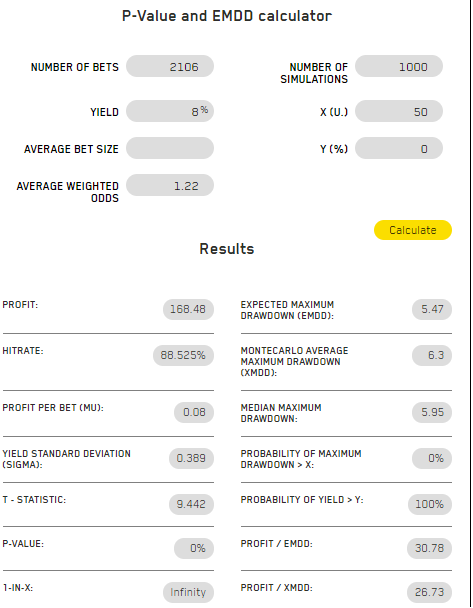

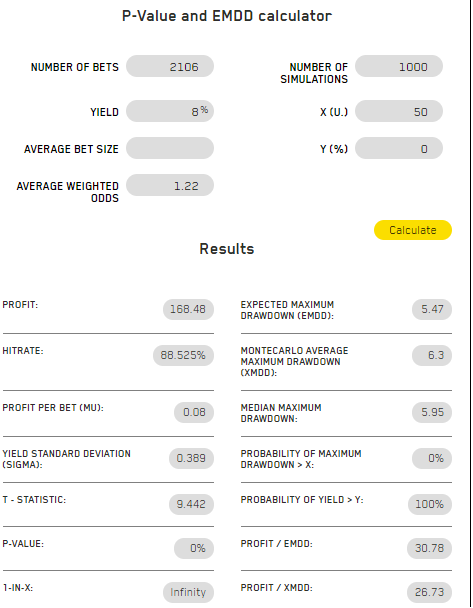

Lots of people collecting data on strategies and here is something that may help:

https://valuebettingblog.com/drawdown-monte-carlo-simulation-calculator-for-sports-betting/

Forget about strike rate; the most important metrics are profit, P value and drawdown.

P value- probability that your results are due to chance- you want this to be below 1% ideally. Lower the better.

Drawdown is a measure of how much your system "swings". It is the maximum distance between the highest peak and lowest trough in a given period.This uses Monte Carlo simulation (basically runs your system as many times as you like and works out the median drawdown, likelihood of making profit etc).

Here's one I made earlier:

You need to calculate your yield. This is profit/outlay.

This calculator is for backing. Most of us lay. But it's easy enough. Your outlay is simply sum of the odds you layed at minus number of trades. Then covert that into a percentage.You then need your average back odds. Again very easy: calculate your average lay odds, then use this formula-

1+(1/average lay odds)The profit figure will be lower because you are calculating as if you had backed with one point. In reality, you layed for more points. Simply put your average lay odds-1 into the average bet size box.

Whether you do this or not does not affect the P value. It will obviously affect the drawdown size , however.

It makes no difference whether you have a high volume or low volume system. The only things that matter are the profit (obvs) and the P Value (is your system a fluke? Will it be profitable long term?) The drawdown shows how "swingy" your system is. A system can be very profitable and still have a high drawdown. The question is whether you can handle that amount of "swing".

All the best for the New Year!

I've looked at p-values before. Good site. I'll definitely save this one.

P value should be the first thing you look at after profit.

-

@stuart-capstick Thanks for posting

Bookmarked to have a look at in a few days

-

@stuart-capstick said in The BTC Football Trading Thread:

Lots of people collecting data on strategies and here is something that may help:

https://valuebettingblog.com/drawdown-monte-carlo-simulation-calculator-for-sports-betting/

Forget about strike rate; the most important metrics are profit, P value and drawdown.

P value- probability that your results are due to chance- you want this to be below 1% ideally. Lower the better.

Drawdown is a measure of how much your system "swings". It is the maximum distance between the highest peak and lowest trough in a given period.This uses Monte Carlo simulation (basically runs your system as many times as you like and works out the median drawdown, likelihood of making profit etc).

Here's one I made earlier:

You need to calculate your yield. This is profit/outlay.

This calculator is for backing. Most of us lay. But it's easy enough. Your outlay is simply sum of the odds you layed at minus number of trades. Then covert that into a percentage.You then need your average back odds. Again very easy: calculate your average lay odds, then use this formula-

1+(1/average lay odds)The profit figure will be lower because you are calculating as if you had backed with one point. In reality, you layed for more points. Simply put your average lay odds-1 into the average bet size box.

Whether you do this or not does not affect the P value. It will obviously affect the drawdown size , however.

It makes no difference whether you have a high volume or low volume system. The only things that matter are the profit (obvs) and the P Value (is your system a fluke? Will it be profitable long term?) The drawdown shows how "swingy" your system is. A system can be very profitable and still have a high drawdown. The question is whether you can handle that amount of "swing".

All the best for the New Year!

I've looked at p-values before. Good site. I'll definitely save this one.

-

Do I recall seeing a post some time on how to group games on Flash Score... ie different trades in different groups?