The BTC Horse Racing Thread

-

I wish. Been plagued by exeution issues and swapping stuff around all the time. Thats why i have settled on the 3 i feel more confident with. Execution issues i hope are behind me and its now fully automated so i am in a good place i think.

-

@Jonathan-Jones Yeah I've tried to develop quite nice mix, with all 8 having been tested. 2 out of the 8 I've been running since last July live and are quite reliabe, 2 are completely my own which I've tested for a while and was happy enough to run live. 2 are slight variations of the presets (LTBF and Back the fav), which I've adjusted for my own preferences, and the last 2 are a bit more speculative and are other members strats with have looked quite good over the backtest/forward test.

Hoping the variation and the mix of speculative vs. reliable will work well in the longer-term. Just got to hold my nerve in the negative swings.

-

I did run several but only run 3 now (and might add that fourth if the favourites update doesnt kill it). All the ones i run have had at least 3 months forward testing as profitable and since the start of the year out of sample tested or one of the live lays (and the back i am hoping to re-add) have been forward tested in the software for about a year.

I used to tweak stuff, think it looks awsome then run it live. Really, really bad idea. Like picking up other members strategies and running them live either straight away or after a couple of months forward testing. Not a great idea. I found a lot of them either bombed or just pootled around doing nothing.

The 3 i run only give an average of 2.5 points a day for this year or 3.1 over the full backtest but at least i know they have genuine long term credentials so i can run them with some faith.

-

@Jonathan-Jones

I am interested to see how this all works out. I am desperately having to fight the temptation to look at all of this in such a zoomed in way. It doesn't help that in the second month I have run them, the 8 strategies I'm running have collectively had their worst month (the only losing one, in fact) in the last 2.5 years.. It causes me to second guess myself - but with 43000 pieces of data in that time, I just have to trust in the numbers.I was worried that perhaps I had got the staking all wrong, but looking at it again today does seem to make logical sense, so I just have to stick with it!

-

That looks similar to the formula i use. I keep wondering what the software is doing different because its always a lot less than what i work out.

At the moment i am just using a fixed 1% shared bank after my little investigation into splitting the bank, though i am growing a very small account. Based on what i see after this upcoming release i may add another strategy to the mix but that will be on its own bank (at least initially).

If i ever get to the point where i am actually making a nice, usable bit of money i will almost certainly look into split banks again.

-

@Jonathan-Jones

Yeah that's exactly why I came up with my own way of doing it- because a DD percentage meant nothing as the bank grew. What I really needed to know, is how much money I could potentially lose if the strategy tanked from day 1, without any growth.To combat that I calculate the drawdown percentage using the formula:

=MIN((A1-MAX(A$1:$A2))/MAX(A$1:$A2),0), with A being the running p/l of the strategy (+ the initial bank).

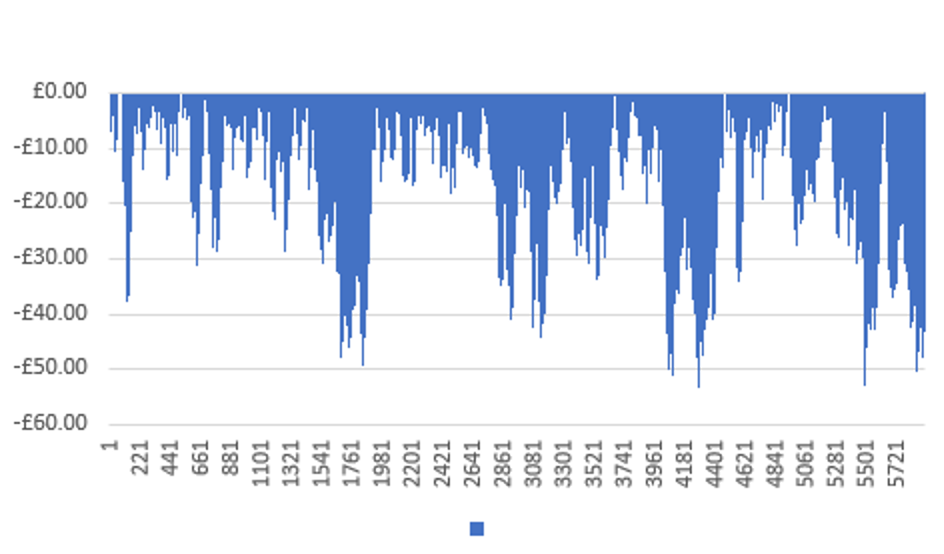

Once I know the DD %, I then use this to find the monetary DD by multiplying the DD % by the highest bank total reached up until that point. I use this formula to help do that - =B2*MAX(A$1:$A2)I can then visualise the highest monetary drawdown using a graph - like this:

I work all of this out just using flat stakes as a starting point. That way I know what that % that strategy should always be of the overall bank total. I can then compound, keeping this figure consistent, meaning that my strategy should always be able to double is highest ever DD, without blowing it's individual bank.

If you're not using flat stakes to get a starting point, how do you do it?

-

If you are basing your DD on flat stakes its not telling you anything, also how are you calculating your DD? The DD figure the software gives doesnt seem to make and sense to me and its always a lot lower than calculating it myself using a standard formula. The standard formula i use (and i have also seen it on this forum somewhere though i got it from a stats site) gives numbers that actually look correct, this one doesnt (i am aware there are a few definitions of drawdown so not being critical).

Example of why flat stakes isnt useful.

If i start with £100 then grow my account to £1000 and get a dd in that last week of 100 points at flat stakes of £1 any DD caluculation will give you a max DD of 10%. Thats not correct becasue its specific to the point in the cycle that the DD occurs. You want to lose that 100 points in the first week (which is just as possible)? thats a 100% dd and a dead account.

-

@Martin said in The BTC Horse Racing Thread:

Big thanks to @John-Folan for helping me to set up BFBM and @Adam for creating the link between BTC and BFBM!

Here is an Irish Dobs strategy I have created. It will need some forward testing:

Download to the strategy into BTC software here: irish dobs.json

Download the strategy to BFBM to automate it here: 1690570294729-irish-dob-1

.0.gzBack to lay: rules_export (3).json

BFBM: Back to lay dobs.gz

I like these. Between the two that's over 500 points across the 2.5 years

-

Can we chat stake size for a moment?

I currently run 8 strategies, with a total bankroll that was divided evenly into 8 sections.

In order to work out the individual stake size for each strategy, I used the same formula for each, resulting in each strategy having a different size stake.

The process I used to derive each stake size was to first work out the maximum drawdown percentage, taken from the whole data set over the last 2.5 years. I would then take this percentage and use it to calculate the highest monetary drawdown (based on £1.00 stakes). Taking this figure, I would then multiply it by 2 (essentially allowing the strategy to reach double the maximum recorded monetary drawdown before blowing the bank). I would then take the allocated section of the total bank (so in my case 1/8th of the overall total), and then divide it by the doubled figure, giving me my stake size.

In practice it would look like this (based on a hypothetical bank roll section of £200.00):

Lay the Beaten fav (with slight personal adjustments)

Bankroll: £200.00

Highest percentage drawdown (£200.00 bank, £1.00 stakes): -15.59%

Highest Monetary drawdown: -£53.40

Double the largest monetary drawdown: 53.40*2 = £106.80

Stake Size: 200/106.80 = £1.87My question is, given that I essentially just made this up, does it make logical sense? And secondly, what is everyone else doing to determine their stake sizes? I'm trying to manage all 8 strategies in a way that reduces the overall potential drawdown of the entire bank, so I'm interested in hearing how other people manage this.

-

@Jonathan-Jones said in The BTC Horse Racing Thread:

Gives you more time to come up with more strategies.

Or play the PS5

-

Gives you more time to come up with more strategies.

-

@Martin said in The BTC Horse Racing Thread:

As much as I'm enjoying automation for most of these member strategies they can be traded manually pretty easily, just a case of being on the pc at the time you want to trade.

You wait. You will be automating all of it.

.

.Automation is making me incredibly lazy.

-

@Martin said in The BTC Horse Racing Thread:

Back to lay dobs.gz

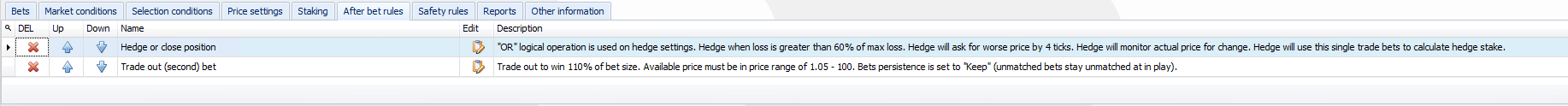

Just in case you (or anyone else) want the safety net on the dobs, this is how i've got mine running in BFBM.

I'm using the hedge position to trade out at 60% loss @ 4ticks below. Think the original software strat had a hedge at 70% loss. My reasoning is this should catch it better than setting it at 70% in BFBM, working so far.

-

@Martin said in The BTC Horse Racing Thread:

Big thanks to @John-Folan for helping me to set up BFBM and @Adam for creating the link between BTC and BFBM!

it's sick, isn't it. Saves so much time.

-

Big thanks to @John-Folan for helping me to set up BFBM and @Adam for creating the link between BTC and BFBM!

Here is an Irish Dobs strategy I have created. It will need some forward testing:

Download to the strategy into BTC software here: irish dobs.json

Download the strategy to BFBM to automate it here: 1690570294729-irish-dob-1

.0.gzBack to lay: rules_export (3).json

BFBM: Back to lay dobs.gz

-

Think so. Its just something i noticed when i was messing with it and thought that it was pretty interesting.