The BTC Horse Racing Thread

-

@jonathan-jones said in The BTC Horse Racing Thread:

Got a question on how the backtest works in terms of trading type strategies. Would it re-enter if the criteria are met again and the trade on that horse it totally played out (Either hit its target or SL then price moves back into the highlighted range for example) or does it enforce one trade per race per selection. Dontmind what its doing i just need to know so i can replicate in the automation.

Currently it's one trade per selection

-

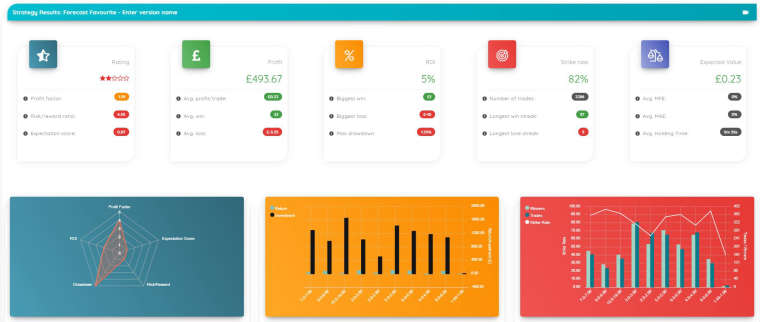

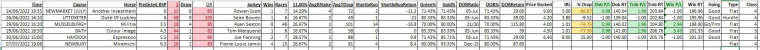

Interestingly the flat pace is a profitable scalping strategy if you want to do that. Using £100 stakes it would be worth £7666 a year on it's own. Also proves my point that getting in earlier is providing value.

-

@john-folan Wahooo! Here we go!

-

Today's

Classic Trobs: Dob, Trob or Win if odds are between 3.5-9

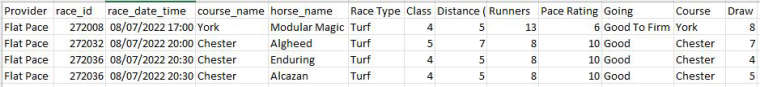

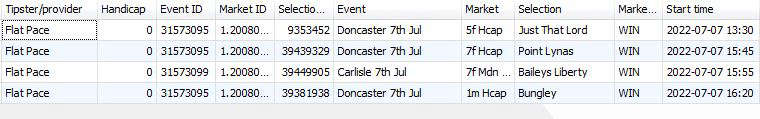

Flat Pace. Back to Win if between 2.0-25.0. 4-14 Runners only. Avoid Soft, Heavy and Firm Going

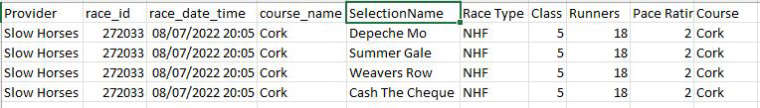

Slow Horses. Dob any over 6.0

-

@greg-mitchell great having you here, maybe one day you won't have too

-

Got a question on how the backtest works in terms of trading type strategies. Would it re-enter if the criteria are met again and the trade on that horse it totally played out (Either hit its target or SL then price moves back into the highlighted range for example) or does it enforce one trade per race per selection. Dontmind what its doing i just need to know so i can replicate in the automation.

-

@keith said in The BTC Horse Racing Thread:

@john-folan like buses

It is sometimes. Variance on backing strategies can be a lot higher than lay as the strike rate tends to be a lot lower. Just have to be ready for it.

Even the trobs I do only(he says) have a 43% strike rate. But the wins and losses tend to group. The trick is to not panic when you go on a long losing run. Sensible staking and a gentle compounding is the way forward. Never been a fan of doubling stakes when you double the bank. A nice one or two percent compound depending on the strategy gets you there. Then you can enjoy all those buses when they come along

-

@john-folan like buses

-

@keith said in The BTC Horse Racing Thread:

@john-folan nice one mate

Thanks. A nice Dob and Trob as well to finish the day

-

Loving being here, my kind of chat, if only I didn't have to work for a living... Anyway, first stab at my own Strategy, what's the thoughts on its return gang?

-

@john-folan nice one mate

-

Winner @8.8. Steamed in to 7.6 Nice extra value provided by the 11 minute entry point

-

@Keith I might very well have a look for an angle with the data in the horse racing stats

-

Today's

Classic Trobs: Dob, Trob or Win if odds are between 3.5-9

Flat Pace. Back to Win if between 2.0-25.0. 4-14 Runners only. Avoid Soft, Heavy and Firm Going

-

@ryan said in The BTC Horse Racing Thread:

@Keith @John-Folan

Yesterday I used the naps table any that were tipped in ATR or decent write up on Timeform were removed, only one left lay price 4.7 and it came 7th.

Very interesting @ryan are you going to make this a “thing”?

-

@john-folan Not a bad start!

PS I believe in pace as well, so close yesterday.

-

@Keith @John-Folan

Yesterday I used the naps table any that were tipped in ATR or decent write up on Timeform were removed, only one left lay price 4.7 and it came 7th.

-

No joy on the pace.

2nd and 3rd by a short head in the 15:00 at 21 and 19 oddsSo close. Holly has suggested looking at these Each Way. Might be an option. I’m sticking as I am now as I’m happy

-

@john-folan I like it mate!

Yes I was thinking either Racing post or Timeform? -

@keith God knows. Racing post I guess? @Adam ??

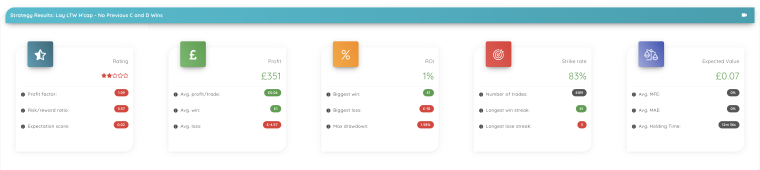

Anyway, here's a bit of refining. Mostly Race stuff. No horse metrics yet. Laying between 2-11 10 seconds out