The BTC Horse Racing Thread

-

@nick-allan said in The BTC Horse Racing Thread:

@karl-pick said in The BTC Horse Racing Thread:

@nick-allan said in The BTC Horse Racing Thread:

is that the one on the presets?

Yes,this month if you stake at £1 stake, I do not do races with 3 qualifiers and split bank on two qualifying runners in betting % to return roughly the same if winning.

bets 80 Winners 24 stakes £80 profit £20.88

These are my figures so will differ slightly with others as they probably do different splits etc.

Since January 1ST 2023....profit is £35.99 per £1 stake using same system

So I take it that the course and distance winner is set up for qualifiers as opposed to the race? and what I mean by this is if you look at back the favourite you're only backing the favourite in the race and of course that can be different from the daily selection because the favourite can change over the course of the day and especially in the last 5 mins before a race start, so I set up my bot to just fire on the favourite of that race say 14:00 at kempton. If you're talking about more than one qualifier then it's not the race that you trade, it's the qualifier selection like in lay the beaten favourite? of course I need to have a look at the rules on the strategy and I'll have a look at that tonight but of course if it's based on more than one qualifier and you have three qualifiers how do decide which of the two qualifiers out of the three too follow if that makes sense?

If there is 3 qualifiers I do not trade in the race.

If there is 2, I would split % liquidity if they both fall into the price range, for roughly same Winnings for example,

If two qualifiers where 3/1 +6 /1, I would have 66% of stake on 3/1 and 33% on 6/1shot, for roughly equal payout if either wins.

Hope that helps.......But Like I said I have my own way and do my own diligence, therefore I sometimes get different prices to standard. -

Hi Guys,

Just a quick one, I don’t know if it’s been highlighted previously.

On the C&D strategy it’s bringing up selections for Southwell later today.

Southwell has 2 courses and when you run the strategies for each, the AW historically comes back with a negative return (todays meeting) but the jumps course shows a positive return.

There a few courses that have this, Lingfield springs to mind so maybe running different strategies for Aw/Flat/Chase would benefit strategies such as this.

-

@karl-pick again im getting different results and they seem to lie up with the software results and this month BTF is down 13 points? jan was 20 points up so overall its 7 pts up which is good, i just have different results. I think out of the 3 strats i do now this is one that im goign to take forward and if i can figure out why short odds bots isnt firing the same as per software results i can take that forward too. But im dumping other lay strategies

-

@karl-pick said in The BTC Horse Racing Thread:

@nick-allan said in The BTC Horse Racing Thread:

is that the one on the presets?

Yes,this month if you stake at £1 stake, I do not do races with 3 qualifiers and split bank on two qualifying runners in betting % to return roughly the same if winning.

bets 80 Winners 24 stakes £80 profit £20.88

These are my figures so will differ slightly with others as they probably do different splits etc.

Since January 1ST 2023....profit is £35.99 per £1 stake using same system

So I take it that the course and distance winner is set up for qualifiers as opposed to the race? and what I mean by this is if you look at back the favourite you're only backing the favourite in the race and of course that can be different from the daily selection because the favourite can change over the course of the day and especially in the last 5 mins before a race start, so I set up my bot to just fire on the favourite of that race say 14:00 at kempton. If you're talking about more than one qualifier then it's not the race that you trade, it's the qualifier selection like in lay the beaten favourite? of course I need to have a look at the rules on the strategy and I'll have a look at that tonight but of course if it's based on more than one qualifier and you have three qualifiers how do decide which of the two qualifiers out of the three too follow if that makes sense?

-

@nick-allan ...the Back the Favourite is doing OK as well since January 1st 2023, that is £19.51 per £1 stake up.

But it is - £3 to a £1 stake in February.At least doing these you can monitor your losses easier as it is fixed loss on every bet and can be better in my opinion when bank building.

-

Something has changed. With LBF in particular i dont think thats just variance. I did a reoptimisation of the courses with a bias on more recent results but it didnt stop yesterdays poor show. I saved the results so will keep track going forward to see if its any better.

-

@nick-allan said in The BTC Horse Racing Thread:

is that the one on the presets?

Yes,this month if you stake at £1 stake, I do not do races with 3 qualifiers and split bank on two qualifying runners in betting % to return roughly the same if winning.

bets 80 Winners 24 stakes £80 profit £20.88

These are my figures so will differ slightly with others as they probably do different splits etc.

Since January 1ST 2023....profit is £35.99 per £1 stake using same system

-

@nick-allan that's the one!

-

@jonathan-jones said in The BTC Horse Racing Thread:

The big lays are causing serious damage this month.

Thing is i am wondering if there isnt something more long term going on. LBF for example has had steadily reducing returns for a while. If you look at the red graph (with the trades/strike rate) you will see its average strike rate has been subtly declining for several months. Pace lays is similar though the change is much more subtly (apart from this month so could be vairance). Both are seeing their worst performance ever. Over almost 2 years of data, steadily declining performance with the worst performance ever now. Think they might be done (at least in their current form).

Fundementally they seem like good strategies so i am wondering what has changed. Any of the more experienced members want to offer some ideas because those graphs show more than just variance and its a lot more than just 'winter'. I experimented with re-optimizing the courses giving a bias to more recent data (so september onwards or last March onwards). Both do sort the problem but had a bigger negative effect on 2021 data than i hoped. Is that too much curve fit or is a bias to recent data a valid idea? Wondering because i think out of all the variables one that could change over time is course layout.

yeah they are in metdown and i think i may have to stop using it as they 3 months live testing on small stakes has been so bad, i dont know if you can lay to a % of bank in betangel, i know you can on BFBM but again i dont know if that going to make it profitable? of course it will protect you from a 10-14 pt loss on the big odds horses that win, i dont know if you decrease the odds say 3-10 it makes it any better?

-

@karl-pick said in The BTC Horse Racing Thread:

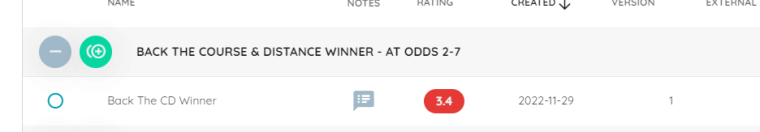

@david-milligan .....Course and Distance are doing very well at the minute, if your building.

is that the one on the presets?

-

I am on sim till the end of the month to make sure my automation is right so i wont change it yet as it would mess up my results but there is no way i would go live with those big lays at stakes, its just got to be liabilty based. Particularly since the max DD in the past 2 years is happening now and its breking its max DD record every few days.

-

@jonathan-jones Yes I've definitely been convinced that the 2% lay stakes was NOT a good idea and have changed everything in BFBM.

I know that @John-Folan mentioned he staked according to the maximum drawdown before, I'm not entirely sure the logistics of that but sounds like a sensible thing to do - build in a margin of safety and just let things play out.

-

@david-milligan

I think thats probably a good way forward. It 'sounds' good anyway.I have some data on this (but not the double liabilty bit). I downloaded all the individual results for all the strategies including versions of the lays at liablity. The results might interest you.

With Normal Lays:

Biggest Loss day: -27.51

Biggest Win day: 60.71

Average Points per day: 4.5

Max DD: 47.1%With All Liability Lays:

Biggest Loss day: -19.86

Biggest Win day: 55.46

Average Points per day: 2.98

Max DD: 38%With Liability Lays (but short odds lays as normal):

Biggest Loss day: -19.65

Biggest Win day: 55.56

Average Points per day: 3.05

Max DD: 37.44%This is at 1% compounding based on daily returns (not per race).

Shows 2 things you need to think about.

2% is bloody risky as hell. A flat 2% doesnt quite blow your account but the max drawdown is 76% (and, that occured a couple of days ago and after yesterdays results i think thats probably increased).

The short odds lays influence is marginal. -

@jonathan-jones this is what I've done - I'm backing at 2% bank and laying the short horses at the same. The longer odds lays I have programmed to lay with liability up to 4% bank

-

@karl-pick they certainly are, I'm running them with 2% stake. I only started running the presets about 2 1/2 weeks ago fully automated, at the moment C&D winner, back the fave and short lays are all in profit. Lay strategies are down but as I said above I have been laying to stake so some big losers have disproportionately affected the balance. Pace backs down v slightly but only had 4 bets

-

I was thinking something similar in terms of balancing lays and backs in a portfolio. Laying to liability wont 'smooth' things out. It just makes everything on that side smaller and gives a larger bias to the performance of the backs. Though, at the moment its an odd one because profit is scewed to the performance of the backs but drawdown is dependant on those big lays. Was wondering if lay to liabilty of twice the stake of the backs or something like that would give a better equity curve.

-

@david-milligan .....Course and Distance are doing very well at the minute, if your building.

-

@jonathan-jones I'm not too worried about the strategies themselves at the moment as they have good results over the long term and I haven't forward tested them anywhere near long enough to draw any conclusions.

The issue I have at the moment is balancing my greed and desire for my bank to grow exponentially, with realistic and conservative staking that will protect my bank and allow it to continue to grow over the long term. I need to find the sweet spot then trust the models and let them run for an extended period of time.

-

@john-folan said in The BTC Horse Racing Thread:

@sam-ratcliffe said in The BTC Horse Racing Thread:

Hello all. I was wondering if anyone has ever looked at laying a specific jockey?

Rachel Blackmore…. Oh wait, that’s not what you mean

Made me chuckle!!!

Never a truer word said in jest! -

The big lays are causing serious damage this month.

Thing is i am wondering if there isnt something more long term going on. LBF for example has had steadily reducing returns for a while. If you look at the red graph (with the trades/strike rate) you will see its average strike rate has been subtly declining for several months. Pace lays is similar though the change is much more subtly (apart from this month so could be vairance). Both are seeing their worst performance ever. Over almost 2 years of data, steadily declining performance with the worst performance ever now. Think they might be done (at least in their current form).

Fundementally they seem like good strategies so i am wondering what has changed. Any of the more experienced members want to offer some ideas because those graphs show more than just variance and its a lot more than just 'winter'. I experimented with re-optimizing the courses giving a bias to more recent data (so september onwards or last March onwards). Both do sort the problem but had a bigger negative effect on 2021 data than i hoped. Is that too much curve fit or is a bias to recent data a valid idea? Wondering because i think out of all the variables one that could change over time is course layout.