The BTC Horse Racing Thread

-

@karl-pick said in The BTC Horse Racing Thread:

@nick-allan said in The BTC Horse Racing Thread:

@jonathan-jones Tweak it in what way? Take the 1st, 2nd and 3rd fav out of the automation and just a straight odds selection (2-7) criteria based on the selections?

I use price only....2 to 6.8 as my guide not on whether its Favourite or Outsider.

thats probably why the backtest software isnt the same live would you not say? as you could have a selction that 3rd fav in the morning but 5th fav by the time the race starts and therefore the sortware wouldnt place the bet?

-

@karl-pick said in The BTC Horse Racing Thread:

@nick-allan said in The BTC Horse Racing Thread:

@david-milligan yeah the back the fav had a good finish, -3 for the month but it seems to be a good strat, not sure about the c and d winner ive just downloaded it for testing but i dont know the rules for the strategy? is it just backing the selection you get on on the daily selections? not like back the fav where you just back the fav

in say the 14:00 at kemptonSince January 1st ---- C+D £37.13...per £1 stake for me anyway.

How are you trading it karl? Are you only placing a bet if the horse selection is the 1st, 2nd or 3rd fav? Or just a straight odds selection (2-7) criteria? And are you trading all selections that the daily selections indicate as long as they between the specified odds range?

-

@nick-allan said in The BTC Horse Racing Thread:

@jonathan-jones Tweak it in what way? Take the 1st, 2nd and 3rd fav out of the automation and just a straight odds selection (2-7) criteria based on the selections?

I use price only....2 to 6.8 as my guide not on whether its Favourite or Outsider.

-

@karl-pick yep up about 25% for me since the start of Feb roughly

-

@jonathan-jones Tweak it in what way? Take the 1st, 2nd and 3rd fav out of the automation and just a straight odds selection (2-7) criteria based on the selections?

-

@nick-allan said in The BTC Horse Racing Thread:

@david-milligan yeah the back the fav had a good finish, -3 for the month but it seems to be a good strat, not sure about the c and d winner ive just downloaded it for testing but i dont know the rules for the strategy? is it just backing the selection you get on on the daily selections? not like back the fav where you just back the fav

in say the 14:00 at kemptonSince January 1st ---- C+D £37.13...per £1 stake for me anyway.

-

Today is the first day of going live with my experiment of using all the strats as a portfolio. Spent the last month (almost) in sim mode getting it to a point where the automation is working and the backtests match the previous days results (minor differences on back the fav but they are now very minor). So obviously had to tweak a few of the strategies. Going to give it 50 quid and a 1% compounding. Analysis suggests its moderatley risky but not terrifying (so the small bank) but should give a steady yet noticable growth.

So the strats taking forward>

Back C&D winner - I have removed the 1 selection and the fav conditions (needed so i can backtest and compare) but i have also dropped the AW and split the strategy. So i now have 2 strats with courses optimised for Turf and Chase. AW just has too much variance and adds too much risk to the portfolio.

Back Fav v3 - I have moved my bet time to 10 seconds after the official time to minimise inconsistency.

Back Pace - again removed AW and re-optimised the courses based on that.

Lay Beaten Fav - Removed the current fav condition and re-optimised courses based on ommiting the first few months. If you notice on the backtest for this its insanely profitable at the start of 2021. I beleive this skews the overal result so i adjusted the date for my optimisation. The final result is still very profitable on those out of sample months so i think its valid.

Low odds lays - removed the runners and classifications.

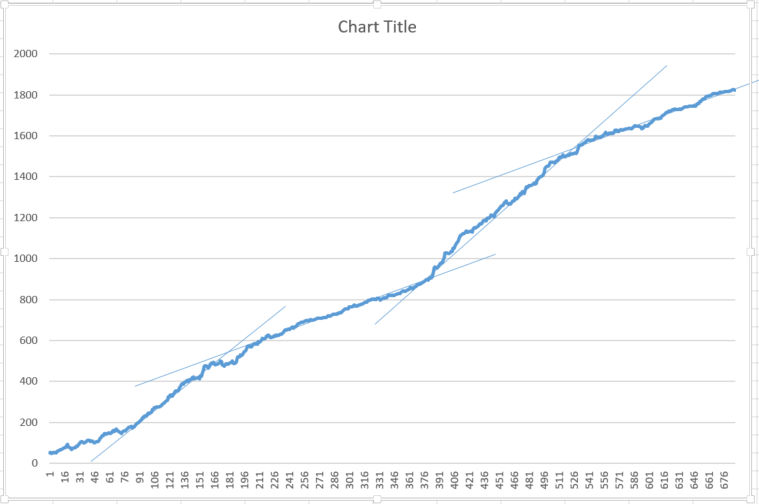

Lay 3-7s - My own based on laying horses that have not won on the course or distance at odds of 3-7.The backtest (fixed stakes) gives this chart:

An interesting thing about it (you can see from the trend lines i have added) is a distinct pattern of higher returns in the summer and lower (but still profitable) in the autumn/winter. This is expected since my strategies are more biased towards the flat.

It will be an interesting experiment. My results in live trading now match the backtests done the day after (in terms of trades taken, odds can be a tick or 2 off) with very few differneces using the amended strats so at least i can be confident had i started in March 21 and used these strategies that would be my result. Of course, things can change

-

Feb seems to of been a pretty rubbish month all round with only the low lays showing any real positivity. Expecting the pace backs to start pulling their weight this month so March shjould be better.

Be careful of Back C&D winner. Its not tradable in reality 'exactly' according to the rules so actual results will be very different from backtest results. 10 mins is miles and miles too long to even guess whats going to be top 3 at BSP and the backtest will only record a bet if there is only 1 horse that meets the selection and odds criteria (again, not something its possible to do in reality with a 10 min minimum timespan out from BSP).

Still shows profitable without those conditions though so fundementally its a good one i think, you just might need to tweak it a bit.

-

@matthew-sheehan sorry I meant the updated version, could you link it and I will post it to the OP of that thread, cheers

-

Not sure I'd done the same as others did, but the one I was using was the one I took from the main post on the bfbotmanager thread. https://forum.betfairtradingcommunity.com/topic/2915/bfbotmanager-automation-discussion

It's no problem, I just went in the strategy in bfbotmanager and added ireland and the courses - still learning with it but getting there

-

@david-milligan ah yes it would appear so

-

https://betfairtradingcommunity.com/en/trading-strategies/back-course-distance-winner

I think we back on the selection from the software as long as it's 1st/2nd/3rd favourite

-

@david-milligan yeah the back the fav had a good finish, -3 for the month but it seems to be a good strat, not sure about the c and d winner ive just downloaded it for testing but i dont know the rules for the strategy? is it just backing the selection you get on on the daily selections? not like back the fav where you just back the fav

in say the 14:00 at kempton -

Cracking day for the backing strategies today!

-

@david-milligan said in The BTC Horse Racing Thread:

@matthew-sheehan This was the problem for me too - @martin @John-Folan might be worth posting a FYI or an updated version of the short lays bot on the BFBM thread?

can you link me it?

-

@matthew-sheehan This was the problem for me too - @martin @John-Folan might be worth posting a FYI or an updated version of the short lays bot on the BFBM thread?

-

@matthew-sheehan must check that out!

-

@david-milligan it was only one for me too - think my bot is set to only do the short odds lays for British racing, not Ireland so it wouldn't have fired for Dundalk

-

Nice to see the strategies doing well. Laying is the way forward. It's what the bookies do.

Totally agree mate, ever since I read about favourites in general only winning about 30% of the time I became a LAY convert. As you say, clearly been working well for the bookies long enough!

-

@jonathan-jones said in The BTC Horse Racing Thread:

Stonking day yesterday. All the lays did well. No lost races.

Lay Beaten Fav - 2 points

Low Lays - 5 points

Pace Lays - 6 pointsAll have slight modifications from stock and though its very early days all appear to be better for it.

Nice to see the strategies doing well. Laying is the way forward. It's what the bookies do.