The road to full time

-

@darri This update makes really interesting reading, how and what do you use for your data orientated approach.Becuae those results are really impressive.

Based on that it shows the OV 1.5 Goals market is slightly more successful than LTD

-

Another week over, only a few more and then we finish whats been a great year. A year of changing my entire portfolio away from inplays and match reading towards a more data orientated approach. It was likely to have mixed results but actually went fairly safely in the green. Hopefully 2022 will be a step up as we ever increase the tightening of my strats.

Here are this months results so far:

LTD: 10/13 won = +3.25 points/% of bank

Ov1.5: 9/10 won = +4.02 points/% of bank

SHG: 17/18 won = +10.2 points/% of bankTotal = +17.47 points/% of bank

As iv said many times in the past these results are with my own defensive way of staking. I could multiply these returns with far riskier staking but i see no need to. I get worried at some of the stakes i see people use and for me iv found a nice simple approach that manages to fit all 3 strats in fairly nicely. Its all about being able to compound, just be patient. The EOYR showed that compounding is faster than you think, dont need huge months.

Lets see how rest of month does. Ill most likely look to do a full portfolio review end of year to discuss the strats i plan to continue with in 2022. From then i will resume posting as usual. Hopefully these cement a data only approach can work for me. I know im missing out on bigger profit by not trading the inplays but being able to setup trades at start of day and forget about them while not as profitable is certainly more meaningful to my lifestyle i envisage having. Instead of waiting for games and looking at stats or watching games i can just ignore that and get placing trades and let them accumulate over time. So far looks like we can achieve that

plus it means almost all games i can post pre match so people can follow if they so wish.

plus it means almost all games i can post pre match so people can follow if they so wish. -

Now to watch the test match, still wide awake

-

Ever since i stayed up to watch the first ashes test my sleeping pattern has gone downhill. Wide awake. Perfect excuse to just come on here and write a post thatll put myself to sleep

One of the most common things i get asked about from people who are new or learning is what price should i be doing for x markets? They have perhaps done what i recommend and have tracked a strategy and are now looking to see if they can make money from it. This is when people can go wrong and destroy that hard slog of being patient with tracking for months. They take their s/r and convert that to odds and go right anything above this ill trade. I cant tell you how many times this happens or is asked.

So lets take an example. The good old fashioned coin flip. We know that it has a 50% chance of hitting either side. So odds of 2.0 are our break even (without commission from exchanges). Lets say using what most people think they should do so anything above 2.0 we trade, so exchange is offering 2.1 to back. So using a £100 bank, we use 1% stake and therefore each win is £1.1 and each loss £1. We flip 100 times and get the following results without variance:

Wins = 50 / Losses = 50

P/L = £55 (wins) - £50 (losses) = £5 profit

Thats around 5p per trade made.So here we made an assumption that whatever is above our break even we trade. But what if we waited and picked only the best prices we could get. What if instead of 2.1 (2.4% price gap) we could get 2.5 (10% gap):

Wins = 50 / Losses = 50

P/L = £75 (wins) - £50 (losses) = £25

Thats around 25p per trade.Think about that for a second. You are going to need to trade 5x the amount. So to make the same as the "value" trades we are going to need to trade 500 trades. Thats 5x the bank outlay and +400 trades more risk of variance. I see this a lot with people. They want loads of trades and loads of activity. Its called itchy fingers. We always want to be seeing greens and if we have a day of nothing we feel like we have missed out (fomo). Its that constant self reassurance we are good at something. People even moan when they have no trades. This then leads to them looking to find new strategies all the time, keeping them active, i myself have done this many times, trading is a mindset battle you always need to control.

So here is my reasoning for my own trading and what do i look for and why. I want an expected probability from my selections of at least +5% more than what the market thinks, but personally all 3 of my strategies i aim for over +10%. So in a simple way of putting this if my strike rate is 90% then i want at least a to back odds of 1.25 or more. Anything less i move on. Within your data you can know when you need that target price.

Why do i aim for such a large gap between s/r and price. VARIANCE. Simply put the closer your s/r is to the actual probability the more prone you will be to wild swings in variance. Im mainly talking about those who are typically using the main strats posted on this forum. So your SHGs/LTDs/Ov1.5s. The more volume you have to keep adding like our example of the coin flip the greater risk you are posing to your bank for swings.

Now yes there is also the misconception that tracked data without odds doesnt matter. It does. For example we can all be tracking city or liverpool to have a shg in a game they are 0-1 down in. But is it value? We see alot of people post lists or trades and never state what price or what % of bank they are using. People then get hyped at how long a run they get, but actually long term their gains are more modest than you think. Its been the case even with my stuff, im sure not everyone checks my sheets, but if i go on a long run sometimes ill then be hit by a few losses and the profit isnt as great as you thought long term. Swings both ways always happen to people. So always make sure your true s/r is what you eventually go off of. So if i trade with these odds this is how many times city and liverpool have scored., dont just go based off tracked data because your actual traded s/r will be different.

Now here is the disclaimer, this is my own opinion of how to trade. There will be many traders who prefer volume and constant trading. I prefer the value sniper approach. Ill likely trade a fraction to what others do. The term less is more has always been something iv looked for especially with money and scaling it. Each trade is a high conviction trade and i know i have a good edge on the price taken which will long term help me with variance. Ever wondered why i typically always get green months even on bad runs? I always have a s/r gap and long term it means my losses get eaten up by winning trades. I had 2 losing months this year and neither month affected the bank that much, whereas my winning months were consistent and made us able to compound far safer. Trading really is all about risk and your ability to manage it long term. Now this is why im posting so that people can maybe find their own approach. Do you like mine/others and take the best from both. Im not discrediting anyones trading at the end of day green long term is green. Im just hopefully giving a viewpoint from someone who prefers this way.

Long post but i was watching a video before hopping on this forum and then had a member ask me the question of what odds do i take for x strategy. I hope this helps flick a few lightbulbs and helps get people away from the volume grind and into the value hunting.

Any questions just ask

-

The amount of goals flying in right now is great to see, wonder if it continues. Perhaps because defences dont tend to be rotated as much thats allowing for more mistakes happening as they tire in this period. Regardless my strategies are almost unbeaten this whole month. Id guess almost everyone in the overs markets are getting good gains. On my data sheets its just seas of green. Wonder if there will be a small return to the norm in coming weeks if matches get played. Shall wait and see, but almost every trade right now seems to win, and looking across the forum seems its not only my data suggesting that. All good news given the current increase to amount of trades this month.

-

@darri said in The road to full time:

So just had a few mates get a positive covid test, i cant think of anything worse than getting self isolation especially with xmas in 10 days. Trading can often be a self isolating task already so please if you need a chat or are feeling down pop on here and drop me a message. Iv been a massive advocate for just spilling all my old problems on here and being a total open book. Doing that helped me, you are not whinging and you are not a loser for feeling down. If you ever feel like you need a chat with someone who isnt biased and would listen then hit me up for a message. Dont go through this time of year feeling down or alone, we arent! Doesnt always have to be about trading

That’s brilliant Darri that you are offering an ear. Hope your mates are ok.

-

@darri Hope your mates ok ive had covid its not nice hopefully they feel ok for christmas at least

-

So just had a few mates get a positive covid test, i cant think of anything worse than getting self isolation especially with xmas in 10 days. Trading can often be a self isolating task already so please if you need a chat or are feeling down pop on here and drop me a message. Iv been a massive advocate for just spilling all my old problems on here and being a total open book. Doing that helped me, you are not whinging and you are not a loser for feeling down. If you ever feel like you need a chat with someone who isnt biased and would listen then hit me up for a message. Dont go through this time of year feeling down or alone, we arent! Doesnt always have to be about trading

-

So been a week since my last update on my strats, thought id nip on and share the progress. Before that tho, while i do not wish to discuss covid its clearly going to affect games in this winter cycle. Another good reason why i stopped trading and helps me avoid the risks that could come from teams unable to field full strength teams. Please just be careful with trading in this crazy schedule now with extra variables that could affect your data.

Here are the results for December so far:

LTD: 6/7 won = +4.05 points/% of bank

Ov 1.5: 7/8 won = +2.79 points/% of bank

SHG: 10/10 won = +7.5 points/% of bankTotal = 14.34 points/% of bank

Only half way through month so would have been setup nicely had i been trading these. Like i said in last update while obviously id have liked to have banked this money im also doing this not for a short term gain but for long term progress. Neither of the set and forget strats had been through such a heavy period and therefore needed to be tested. Not having money in the markets doesnt make you a loser when you miss out. Compounding when you have full confidence in a strategy will more than make up for it. Its better to have something tested than trade them on the fly which isnt wise and extremely risky. Remember unlike other industries sports trading actually does have a ceiling for what you can and cannot make in terms of bank so dont worry about missing out on a few months while you track. Its only going to take you a few solid months of compounding to not care about 1 missed month. Especially if you plan to do this long term and not just a get rich quick scheme.

Ill give another update before xmas and then an end of month progress after. This will help build confidence for people who are currently trading/following my LTD. I promise we are hitting some great numbers now and all 3 strats look the best they have been since the tweaks, when you consider the amount we made this year, this next stage is gonna be fantastic. Cant wait till jan until we are back trading them.

Ill be back on maybe at weekend as i have a couple posts/topics id like to talk about in relation to a few comments iv seen people struggle with. Hopefully give my take on what id do etc to work on those issues. Hope everyone has a safe few weeks trading in run up to xmas

Any questions feel free to ask either on here or chat, still popping on to see whats being posted

Any questions feel free to ask either on here or chat, still popping on to see whats being posted -

Crazy amount of SHGs this weekend winning in all the top leagues. Had you just focussed on England, France, Italy and Spain there was 19/20 2nd half goals, pretty easy weekend, id even assume that the spanish game was easily avoided too so hopefully people should have got some good greens.

Many know that i only like to trade the most liquid leagues anyway. I see no point in tracking smaller leagues. I want to be an expert and have a narrow focus on the leagues i will always be trading.

Iv been looking into my data just for top divisions in France, England and Italy, its a crazy good return and no surprise they are my best performers too. Iv always felt good players produce consistent results more than weaker ones. Its kind of like trading a stock, a company with a solid background and in the elite s&p 500 level is often a safer play than a growth stock outside of it. Same can be said about anything we invest our money into. Finding an approach of picking safer trades with good leagues and good players tends to produce consistent results, for us traders thats less variance.

Dont just look at it from a small data set always look at it from a large one. I build all my strats around the best summer and winter leagues and i do believe that its a contributing factor to consistency in my results. Iv rarely ever had a terrible month, my red months (they do happen) are normally manageable compared to the winning ones.

Im also cautious to not over sell myself on how well my stuff is doing right now tracking wise. Believe me im actually looking at it now wishing id used some bank, but also know that wasnt why i paused for december. With such volume each week and trades almost everyday your always going to see inflated profits if you get this period spot on. Im still wanting to keep that long term vision and big data mindset rather than short and small data. Big data always wins.

-

@Darri Great post Darri and for me who is following what you do and are doing I enjoy reading what you have learned. Keep posting

-

I know people might get fed up of me harping on about my data tracking but hear me out, this blog is for my accountability also.

This weekend despite being a busy one is starting to get less games come up. This happening for me is a good sign. It means im honing in on tightening criteria and making sure im finding the quality trades. This will all help for when we come back to posting them in January.

Between now and then will be the most interesting time period. Im excited (total geek) about seeing how this all transpires. For me when we first started posting in a more data only approach i was confident enough to be posting and we made great gains, results shown were huge. These tweaks are going to take us to a new level of efficiency.

Some dislike having a tiny amount of games to trade, i dont. Im someone who likes to have a small selection thats high quality, rather than have a good amount of winners from a big batch. Either way can still work long term, its just my own preference. Similar to whats called high conviction stocks in stock market trading. Im a massive fan of how big investors work and think. Iv tried my best to bleed that into sports trading. Maybe some might think im overdoing it, perhaps, but im always looking to improve on the basics and let the fine details (individual games/variance) work themselves out. Like i said in previous post, being good at the simple things gives a very healthy base for which to improve, sometimes we try to outdo ourselves thus giving us a rather loose flooring in which to see this all come tumbling down.

So far the LTDs/1.5s are thriving with the new tweaks, both in past and current data. Iv also been heavily surprised in the way my shgs have been going. Iv provisionally added the strategy to the sheet for 2022. I dont think there is anything wrong with the approach of, if i have the time to trade then why wouldnt i trade this pick up and play strategy. This will only ever get a good chance during winter leagues. Something im tracking, even if i dont follow through with it. Just interesting if its even better with the new tweak iv come up with for it. Would help anytime i get the urge to trade, back to the old faithful so to speak.

Anyway a ramble but just keeps me ticking along. Keep up the messages as im still coming on here from time to time to check in on whats going on

-

@james-woodroffe exactly, the problem with online culture is its too easy to start comparing yourself to others. Ones idea of success might not be true for another. I understand some people might look at my results and go if im not at that level why bother. Some will perhaps even surpass my daily/monthly/yearly p/l, so what! Doesnt mean anyone is better at what i do or that theyd have traded my stuff any better, it really doesnt matter. Its about having confidence in your own abilities, know your strengths and weaknesses. Im happy being a sniper like trader, i get i could be trading 3/4 times my current volume and perhaps even having ridiculously good months but at same time im aware of the risks to that. My idea of success is someone who makes consistent green or enough green, to be compounding a good amount of months within the year. Slow and steady progress is not a bad thing. Its often new traders who feel like that, kind of like how people view actual investing. They see these mega rich people and fail to realise they all started somewhere and didnt care if people did better than them at some point they still reached their goal. I think actually some of the talks iv had from people on here has helped solidify that understanding for me.

There is something in how high performing people realise that the art is in simplicity and easily repeating something your good at, whilst avoiding the trends you dont know anything about (fomo) -

Great post again mate, and another example of how new traders should not get overly concerned about what others are doing and just make sure that they are doing the right things.

-

@Darri Nice post Darri and very useful especially for me, looking to emulate what you have done.

Happy Christmas and thanks for your help

-

Got a bit of time to hop on here and give a quick update as to how the strats are doing during the winter break iv imposed.

LTD: 4/5 won = 1.56 points/% of bank

Ov1.5: 6/7 won = 2.13 points/% of bank

TOTAL: 10/12 won = 3.69 points/% of bankThis is a very solid start to december. Please remember that iv taken the decision to not trade december and instead record data. Im worried about the amount of games and what that will do to my strategies performance and also the games id be trading (player rotation etc).

To also have a quick chat about the above results. There is a lot of times over the course of my use of this forum when traders like myself do this. We post a glitzy number of what our points or profit made was. We then measure that to what others have posted or what we think others are making, and determine if we are a success, this is flawed. Just always focus on yourself and what this would do for your own trading style. Some people are using rather large stakes to make huge gains, and finding themselves on backs on some pretty harsh drawbacks to bank. Just always remember to be cautious and have a balanced way of trading. Dont go being greedy with splashing the cash. Small but consistent is better than these volatile plays. If your strategy works it wont matter how big or small your stakes are youll still compound nicely. Always adjust your staking towards the risk of that strat. If i was staking 8/10 points for these it would be very flattering numbers but id not at any stage feel comfortable with that risk, all it would take is one bad weekend and boom there goes a large bank. Always treat smaller banks the same way youll treat a 10k/50k bank. Look at my results in the last post and see how compounding doesnt care about how small your stakes are. Safe and steady gains even with losing months still amasses a large increase.

The rest of this month ill keep people updated on. If this strat passes my winter break test then we are good to go for next years winter. Its all about thinking long term and how your going to prepare for the long haul. Im not just planning on trading for 1 year im here for years. Just be cautious about winning runs and how that might affect your mindset often when you start doing well you are too keen to up stakes, boy iv been there before

Let things develop, almost every strategy has bad spells. Even your fav traders on here from time to time myself included get hit by bad runs, dont get caught out in relying on them too much. Remember always trust your own data, track what your fav traders are doing, even get a spreadsheet up with their trades on it. See how its actually working and if there might even be any tweaks youd like. Not everyone can be transparent and show what every trade they ever do, how that affects the bank etc i get that, but if you want to follow something make sure you see it on paper as working, not just big runs. This builds your ability to track data and improve strats. I think thats key for how iv got to this stage of trading. Before id just base all my decisions on if i was making profit on betfairs site. Tracking is honestly something thats easily the first thing to work on. Trust me itll work, might even spot improvements for those followed strats

Let things develop, almost every strategy has bad spells. Even your fav traders on here from time to time myself included get hit by bad runs, dont get caught out in relying on them too much. Remember always trust your own data, track what your fav traders are doing, even get a spreadsheet up with their trades on it. See how its actually working and if there might even be any tweaks youd like. Not everyone can be transparent and show what every trade they ever do, how that affects the bank etc i get that, but if you want to follow something make sure you see it on paper as working, not just big runs. This builds your ability to track data and improve strats. I think thats key for how iv got to this stage of trading. Before id just base all my decisions on if i was making profit on betfairs site. Tracking is honestly something thats easily the first thing to work on. Trust me itll work, might even spot improvements for those followed strats

-

End Of Year Review: 2021

Just to get us in a situation whereby i can concentrate on planning for next year now, i thought id post up my EOYR.

At the start of this year before this "new bank" i had already grown a trading bank all the way up to £20k. When you understand the circumstances as to how much that meant to me given my situation previous youll fully appreciate that was a life changing moment for me. However, im not someone to just sit around and rest. Iv an over active mind and to ease that i wanted to invest in other ventures. Trading for me has a lifecycle and i felt i was too heavily focussed on just trading for my earnings. So as has been said i invested pretty much all that bank into crypto (ethereum) and my own video production company. This allowed me to start passion projects to keep me sane during boring trading days. So in march with this amassed knowledge of how to build a bank i wanted to start again this time however with a view to being way more efficient and clever. So in went £1k on march 21st and we started again.

The Bad:

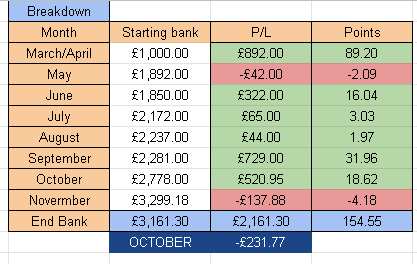

If i dont talk about the bad points in my trading then there really is no point in me boasting about transparency. Iv over traded and jumped on a few strategies this year. Having made the plan to be more efficient what actually happened was i felt i was sitting around waiting too long for action at times. This as you can tell is a mindset many newer traders fail with and for me someone who has been there, done those mistakes for it to creep back in was worse. However thankfully these errors were not too costly as shown in the image above.

I would say however that on looking at the above image, there are a few months that underperformed. Why? Simple, i mucked about with the portfolio. I added, removed and paused. I was not consistent.

Takeaway for 2022 will be to follow your own plan and stick to them, only ever add if it is better than what you already have. Small but consistent is better than money grabbing risky trades. Thankfully because im aware of taking value and how markets work my errors were not bank busting costly, but a lesson for others here, dont take the risks just for a better bank spike.The Good:

The image alone shows the good. GREEN. The bank has risen from £1k all the way to £3k. We have made a return of 210% whilst amassing +150 points profit. You dont get many chances in life to make such returns with as little risk. This is all with the single deposit of £1k zero top ups, now if you are someone looking for trading as their main source of income then imagine these gains with monthly deposits!

Think about it this way if we do those kind of returns for the next 5 years before premium charges we would amass a bank of : +£700k. This is all with me having outlined the mistakes. This bank increase could and should have been better.

Iv managed to find a solid way of trading with small amount of strats. These will be carried into 2022. Iv managed to change my mindset from a lets milk every penny out of trading into someone who is happy with just making consistent gains big/small. Compounding will take care of itself.

Iv a target in mind for when ill actually stop trading. Hopefully the industry allows us to keep going for a good while yet.2022:

Iv added a brand new sheet to my results link. Iv taken away the 2021 results and now fully focussed on the future. The 3 strategies are all ill be focussing on.

LTD

Goal sniper will be based on 1.5s and shgs (same games)

Champs league

This will allow for a passive income style. Ill only ever do shgs when im free to time wise with no pressure. Iv been guilty of adding too many new things this year, even tho most were profitable they did make me lose focus. So this year even with HR software incoming ill still only be trading these strats. Ill use the year to track any potential HR stuff. Cricket is also gone. It takes up too much time. Its my most profitable sport by a mile but its also my most time expensive. That for me is more important than making money here. Its all about the long term not short. The bank will still get there.So we start 2022 with a £3.1k bank. Iv not set a target but always looking to beat your best has always been something outside of trading i can get behind. I love that competitive way of thinking. I suppose during my time on this blog iv realised competitiveness is good in certain situations but not all the time. For me id say iv always been too competitive. Id see a trader and go i want to find something better. There just is no need. Im not competing with anyone else on here. We are all trying to reach same goals. A humbling moment has been had on here a fair few times when iv realised wait instead of competing, help. Being in competition in the right way, on the right situations does work for me tho but learning when to use it or not has been something iv been slower to realise.

This blog is all about showcasing what, why and how i trade. It shows transparency, builds trust, helps people think about their own trading and keeps me sane in this robotic world of trading alone. Without it i genuinely think id have just packed up trading as doing things alone is detrimental to your health and mind. Never let this thing take control and take hours and hours off you. Thats not what the beauty of this is about. I hope over 2022 we can all keep in touch and really build on a great year back after the disruptions of 2020/2021. Have a good xmas and new years you lot. Iv planned to do a LTD/Ov1.5 review in the coming weeks as i know a few people follow that strat. So ill not be in hiding, so feel free to post or message if needed.

Enjoy you lot, another essay type post

-

All the best for Christmas and New Year Darri thanks for your help overt the past year