Making myself accountable for my trades!

-

Ive done a lot of thinking about making things more efficient and on reflection i dont think it is all about that. I think that ive actually become more efficient and added a bit of extra trading in the same time-frame but my issue is i cant switch off from my trades once ive pulled the trigger, even the ones that dont require trading out. Ive started re-reading 'fooled by randomness' and he explains it as loosely as 1 plus 'pang' for a positive outcome and roughly 2.5 minus pangs for a negative outcome. Unfortunately im riding these 'pangs' of variance up and down more frequently now with each trade, even though on the other hand i know ive learnt to accept the loss as part of variance. Its definitely something i need to get a handle on!

-

I hate weekends. I only do automated stuff but I keep bloody checking it. Bad idea

-

@dave-jessop Glad its not just me. I have started automating more but i guess i need to get out of the habit of watching how things are going on the automated trades. Its probably just a case of moving the BOT out of view, dropping a strategy or 2 and then not worrying about recording results too much, i can always blitz it on a monday

-

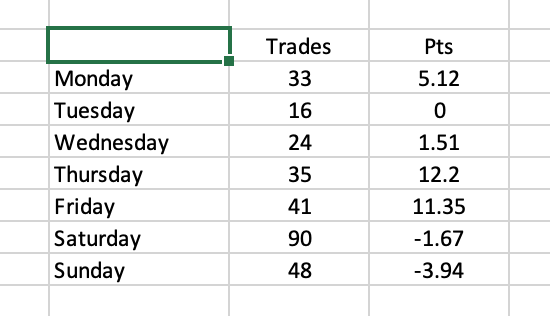

I need to figure out how best to strip back some of my football trading to reduce the workload at weekends. Another saturday which felt hectic at times and just juggling far too much....and the busy time hasnt begun yet! Its not just the placing of the trades which gets busy but also the recording of the data for analysis afterwards. It feels a waste to remove strategies which are ticking over a profit, but i guess i have to consider the 80/20 rule and concentrate on the absolute best. What cant be made more efficient will need to put on the back burner. I do want to have a balanced portfolio to even up the variance but obviously want to avoid being a busy fool. I can be overly keen to spot new angles or strategies at times. I did the following quick look of all football trades for the last 5 or 6 weeks showing number of trades with the resulting profit:

Quite a small sample but i noticed similar last season, albeit anecdotally. Weekends are harder for me to trade for personal reasons but they cant be avoided so i need to get to grips and find a better balance. Its less about changing selections, reviewing filters etc and more about improving efficiency further

-

Its been a few months since i posted so i thought id post an update.

Last season was a huge learning curve, lots of good lessons learnt and lots of hard lessons too! Its obviously quieter for the last month or so but ive enjoyed that to be honest, ive been more selective in my trades and if i dont have anything to trade then its fine. Im still quite active as im trading & recording quite a few things at the minute and ive started horses about a month ago. Ive paid a lot of attention to staking, bankroll management, data analysis & improving my processes recently so i feel like im becoming more knowledgable and well-rounded.....though i have long way to go!

Frode pointed out that a trader with the right staking & bank management could trade just a few of the strategies on here and be profitable and its true, theres so much gold in the way of good strategies. I follow a few of them and they are good so my bit is easy in perspective, pull the trigger without screwing it up! Martins Unders, Ryans split stakes, Keiths selections, little acorns, Charles' LS88, B2L & L2B, Johns horse selections.....theyre all really good strategies from great traders who are generous enough to share.....a portfolio purely of these would be balanced & very profitable with the right staking and bank protection

Ive started using a BOT recently aswell and its been a huge leap forward! Doing a range of horse strategies is very difficult without sitting there for 10 hours a day or constantly checking races so its allowed me to add strategies that otherwise wouldve been too much to manually process. It also removes any temptation to stray from the plan. Ive always been better at creating the plan than sticking to it so this really does help. Not to mention being able to place trades on overnight games if required

Ive still got loads to learn but im confident that i can continue to push on and keep improving all that i do. I probably need to cut down trading time, im a bugger for watching results when theres no need. It doesnt concern me if its a loss (so long as its a planned trade) so i dont know why i do it.....1 step at a time though!

-

@lee-woodman nice to see your back on track and building up confidence again Lee. Don't rush into though and take it easy with smaller odds and less trades to start with. This is what I tend to do after taking a few loses.

-

Been a strange week, one of the most frustrating for me. Two things have bitten me on my arse this week, overtrading (and ending up with no control) and not being quite selective enough.

I had a decent filter working for SH goals but didnt return many selections (probably a couple per day on average) so naively i loosened the criteria last weekend and it was a bit of nightmare. It wasnt actually a hugely obvious aspect of the filter but it seemed to make a difference. On the plus side, it re-affirmed the initial filter criteria itself so at least i have some positives to take! I definitely over-traded at weekend and at times was just 'chucking' my selections on without really taking care and ruling out the obvious ones to avoid. I was definitely annoyed with myself, not so much for taking a dent out of the months profits so far but the way i traded. I do want to ramp it up and i know i have some of the qualities required, i just need to develop more discipline in certain areas

Ive taken stock on monday though and have gone back to how i was trading before for the last few days so im happy with that

-

@gary-brown Personally I avoid trading for fun, I think I’d rather paper trade or check out some markets which I’ve been looking at or just take a night off from it. It’s a risk, in my opinion, to seek fun from it as it’d potentially creep in more but there’s no lesson from it

-

Hi Lee I am similar to yourself and nothing is showing up for me today. I don't want to use a system that doesn't work so I think its either no trades or a little trade for fun with low risk. Maybe a little inplay trade on one of the games I may watch which if it loses it wont bother me.

Its hard as I got up this morning all excited about jotting down todays trades and I woke up and nothing is showing up. I guess this is a test on our mentality and can be the difference between pro traders and non pro traders. Maybe even the difference between being successful and messing it up.

Got to try and resist temptation and not trade like a normal day. Its the long term goals what are important and I am trying to think of the weeks profit so far rather than making a profit today to help stop me from making any silly trades.

-

@martin-futter I know my game reading isn’t up-to-scratch yet so if I can sort my mentality, risk management etc then I know I can push on. It’s days like today where I’ve only got 2 or 3 games on my filters that are quite hard, as my instinct is ‘well I’m quiet today so I’ve obviously got time to take more on so let’s look at other filters’. I just need to accept it’s the nature of trading to be very ‘feast and famine’

-

@ryan-carruthers Cheers Ryan, thats decent advice and good to hear it from a pro!

My methods are working and i feel like they would do over time, obviously with tinkering & monitoring. Variance is relatively low really and the bank is growing nicely.

I think ill do what you said, concentrate on whats working, nudge the stakes up accordingly and paper trade on the side, as and when

-

@lee-woodman good work, I think a lot of people feel the same - they have that battle in their head can I rely on just a couple of methods or do I need a portfolio?

For me its does the current methods work? If they do can the stakes be increased slightly to increase profit consistently and slowly? Then you don't need anything else to trade because they are growing the bank. Then if you have some extra time you can look at paper trading bits or what can be automated/set and forget to maximise the time.

-

It’s been a great start to the month. I’ve been trading to plan and been organised and efficient with it. Im already 30% above my monthly target after 6 days so I’m very pleased with that

I’m finding I’m having to reign in my enthusiasm to increase my portfolio, my battle at the moment is to hold myself from adding too much too fast. The danger with adding more is not in increasing overall workload but in to spreading myself too thinly around peak trading times, but at the same time I’m conscious of relying on just a couple of systems. I guess I have a lack of patience at times and a constant need to improve and tweak whatever I’m doing.

My FH goal selections do have the potential to become ‘set-and-forgets’ so I guess that would relieve the need to trade them at busy times and free up some key time. They have been profitable for over 6 months running now and April is looking likely to be a 7th so I’m inclined to up the stakes a bit more aswell. My SH goal filter is doing well so it’d help me put a little more time into refining this and being more selective in pulling the trigger in order to improve the SR

-

Finished March as a really good month for me. Profit wise it was good but more importantly i learnt a huge amount about the mentality side of it. Whenever i traded to plan then things went well and whenever i didnt, it didnt.....things i heard at the beginning but guess i had to go through it to receive the proverbial slap in the face! Ive also found a nice balance of risk/reward in my trading plans and have a few decent strategies to work with, which i have simplified as thats how i like to work. Ive got quite efficient in the way i do things, such as recording/researching

Im really looking forward to pushing on in April. Ive adjusted my bank properly and set a suitable pts per trade aswell

-

I also included a simple yes/no column in my results sheet 'would i trade this again'. Once i filtered out the 'no' and filtered it down to the few trading strategies i was confident in trading then my results changed a lot, it shocked me enough to change things! Now i stick to those strategies and have a couple of others which im monitoring, ill add these or drop these if they pan out

-

@chris-watts Cheers Chris.

Yes i definitely need to constantly monitor that side of it, like most people do i guess. I think a big help for me, is that if i know im going to do x if this happens, y if this happens and z in this situation then i find i can stick to it easier.....so as long as i pre-plan my entry/exit/stakes then thats a huge part of the battle won before i even start. Its the uncertainty and making snap decisions 'on the fly' which is harder for me, but i can avoid this quite easily

I wasnt sure about posting a thread like this but im glad i did, it definitely made me accountable for what i was doing!

-

@lee-woodman great to hear Lee, your definitely on the right path. Be vigilant against lapsing back into previous mentalities. I suffer from this occasionally and it’s usually when things are going well!

Keep writing your thoughts, trades, progress on this thread. It really helps to keep on the straight and narrow when you post it publicly.

-

@ryan-carruthers I think i just started to pay more attention to the process rather than the outcome. I used to get annoyed if i lost a few points in a day, now i told myself im only allowed to get annoyed if i dont trade as i should. Likewise i dont get excited by a good day profit wise, but to appreciate what im doing if i trade right, figuring that the profits will follow naturally

I do a lot of reading aswell and a lot of the information from those books is starting to help, directly or indirectly. Ive also started to walk away from the computer if im not trading or monitoring a game.....which helps me to shut off and to stop 'following other traders into battle'