The road to full time

-

I like it and have learnt a lot from you

-

@darri said in The road to full time:

Do people still like this blog as a read or is it too predictable now? What would people like to see? If not then ill just keep continuing but dont want this just to be me waffling on to myself

its hard not getting to know who reads these there is no analytic for me to judge etc, im not gonna be a youtuber and ask for a like and subscribe but it would be good to know who is reading still

its hard not getting to know who reads these there is no analytic for me to judge etc, im not gonna be a youtuber and ask for a like and subscribe but it would be good to know who is reading stillIm certainly still reading, some of your posts take me all my lunchtime mind

By reading these I feel its helping my mindset trying to see how you are getting on and by the comments you make.. -

I am bro, I get a lot out of it.

-

Do people still like this blog as a read or is it too predictable now? What would people like to see? If not then ill just keep continuing but dont want this just to be me waffling on to myself

its hard not getting to know who reads these there is no analytic for me to judge etc, im not gonna be a youtuber and ask for a like and subscribe but it would be good to know who is reading still

its hard not getting to know who reads these there is no analytic for me to judge etc, im not gonna be a youtuber and ask for a like and subscribe but it would be good to know who is reading still -

End of month review (only 2 weeks):

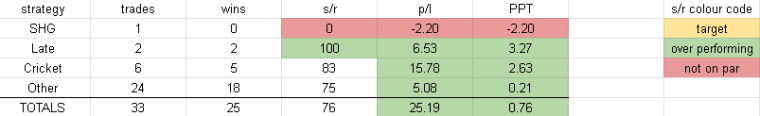

SHG (data only):

Not much to go on here, been the international break so only games in the aus a-league and la liga 2. Testing is still going on with the scorelines with these, iv a separate spreadsheet tracking the data on them. Ideally i want to have enough of a data set to be in a position come start of next season that ill have this SHG strategy fully done in terms of what qualifies and then from then on its just improving it gradually with minor tweaks. These next two months will hopefully show its potential and give confidence going into summer leagues. Currently only 0-1/1-1 are fully tested to be profitable others not quite enough data.Late:

As ever solid and steady. The new approach im taking with managing myself and my strategies is helping here. With this being my only real inplay focus for football i can literally set and forget the other trades and check results later. With these i need to be there for a 5-10min window which really isnt that much. Iv been ultra selective with these. That wont change going into late season. Motivation of teams is a huge aspect now so my judgement on individual games will be my advantage/edge here.Cricket:

This is my overperforming sport this month (only 2 weeks) as iv been tending to not trade the longer formats in favour of just t20 cricket. That changed a bit because since it was a quiet period i was able to actually focus on it more. I feel im honing in on my own strategies within each format now. With test cricket its day 3 onwards and assessing how i feel the match will go at that time given the past 2 days. This is often when iv seen the biggest swings occur. Managed to catch a few in the west indies test recently and currently inplay i have a nice green on the current test too. Odis im finding easier to read than before. I think when i tried at first i still had t20 ingrained type trading with these. Now tho i can fully see the whole picture. How teams are likely to accelerate and what realistic amount of runs can come at certain milestones in matches. All this info goes into the trade. I typically only look for one or two moves in a match. I know i could be doing plenty small scalps here and there but for me less screen time and getting on the big swings is plenty.Other:

These are just made up from the int breaks. Not adding to the main sheets because they arent around any data set. For me these are just a bonus. Filler trades so to speak. Value is value end of day and was keen to get on some of these. There will be some trades that i feel are too valuable not to get on at times. Typically this will be ints, europeans games or cups. Other sports will reside in here. In busy times ill cut down on these.Conclusion:

starting bank on the 21st march was: £1,000

new bank 1st april: £1,251

25% in 2 weeks without normal football ill take that. IPL is around the corner too and this will hopefully keep cricket profits ticking along. Big month for me here as i get to fully see my new more efficient approach and how it does in very busy times.

-

Also interesting to see the repercussions this int break has on the players. Some players are gonna have played 5 games (club and country in 2 weeks and clocking a hefty amount of miles/travel) not every nation has big squads, scotlands a good example, very little rotation from us and i expect strong side on wed also to avoid an upset. This extra game also means they will have thursday and friday at best to train with their club. Might not trade that strongly this weekend if im honest despite normal games again.

-

Currently testing a few too many strategies and need to cut back a bit. The over reacts were demanding a lot of time as you had to wait for a goal to appear from the list of games. So not ideal when im trying for less screen time. Currently testing a few set and forgets as that can be tracked from the morning so i dont need to look inplay. Ill do some updates on them as posts along the way just to show what im thinking etc, plus it helps me to look at it in a deeper level as get to write about it and understand it more.

-

End of week update:

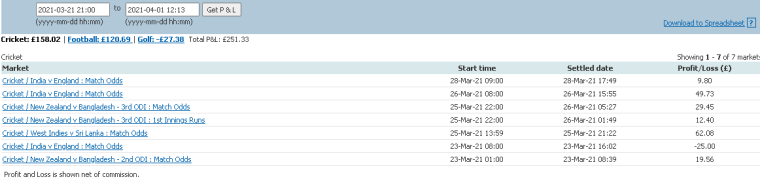

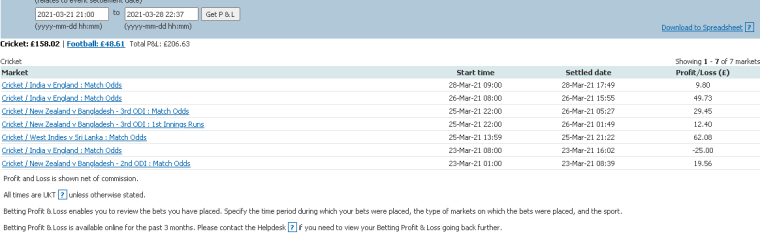

Cricket: +15.8 points

Really pleased with this. Not just how much profit but the efficiency of each trade. While inplay trading these games i only ever got 2 calls of play wrong the rest all went as planned. That wasnt what i expected going into the other formats. T20 for me is more predictable because of how short the match, you can understand why prices moves to each run/dot ball etc, really happy with that effort in the longer games. Only a couple odis left before ipl but not sure how strongly ill trade them might even just paper trade and focus on the test.Football: +4.86 points

Stuttering along this week cant say how many six yard tap ins have been missed. 2 of those go in on the losing trades and this week of football is fantastic, but happy to be seeing progress while actually in a slow period of football. Hopefully can cash in some nice gains before we start to limit games based on league motivation. Happy with the situation and looking forward to april which should be a significant month for these trades given the data now piling up on teams. Markets will be competitive.Conclusion: +20.66 points/20% bank growth

Really happy to see cricket and football working in tandem and complimenting each other. My new approach is allowing me to focus my attention on my main late goals and cricket. However the main test for my trading approach will be this coming month. IPL and plenty of football. Will be interesting to see if all this works in such a busy period.Starting Bank: £1,000

Current Bank: £1,206 -

Cricket Update:

Ind vs Eng: +0.98 points

Really good game to end the series. Unfortunately for me tho the game chopped and changed far too much for me to have a strong opinion. Getting in at anytime before i did would have just been a punt/gamble. What i did want to do was given england didnt get off to a strong start was to see how the middle order would cope given they had zero base to build off like usual. Malan and livingstone looked good and while i wanted to oppose they were making it comfortable. For me right now i think england are one of the hardest teams to lay. Someone always steps up. But livingstone got out and with ali and curran not exactly in unreal form i did take a small position. Mainly because indias main threats still had plenty of overs in the tank and hardik was bowling this time round. Made me sweat for it but a nice top up to the profits gained this past week and with only a few odis before the ipl starts i cannot wait for it.

Bank update later tonight after the football

-

Cricket Update: What a couple of days!

NZ vs Bang: +4.18 points

With NZ massive favourites again just like last time it would need an above average start to cripple their price. This opportunity came when they went to 120/4. I waited until mitchell had settled in and started to build a stake into NZ keeping a small portion back just incase of another wicket. That didnt happen and NZ battled smartly for the next 10 overs. At this stage i used my spare stake and added it to the runs market. Feeling that if they could be in a position come the 40th over to be within 60 runs of achieving 270 i backed as thats around an average odi score. Made it easily and more importantly they reached 300 which more or less killed the game for bangladesh. Their bowlers had so much zip and swing early doors and in my mind, while all that was happening, i was thinking well if thats what they can do wait for boult and henry to do even better with conditions. Tamim out very early and a few quick wickets i easily cashed out my trade and went to sleep looking forward to the england game in the morning.

Ind vs Eng: +4.97 points

Having only caught the end of the india innings looked like it would be a big effort to chase that total down. The markets reflected that. With roy and bairstow they can either fly or die, and for me would have been too much of a gamble to back. Instead i waited for a good point in the match to jump in. That came when i felt the market massively over reacted to the wicket of roy. So as ever i waited for stokes to get settled and entered a back of eng 1.81 with half stake and then further once they had pushed on further. What a display of power hitting. Total disregard for taking singles and just pure hitting was great to watch. Not only that but the markets loved it too and made this the easiest trade of the 2 days.

With these 2 days of cricket trading its yet another reminder that im getting super efficient with these games now and my reading of price-situation has continued to be improving each game outside of t20. Getting in the mindset of predicting situations to come in the game rather than just whats happening at the time is really helping my positional style of trading too. Filling me with confidence that im not a one trick pony. Cricket yet again producing a lovely profit and excited for the next round of matches. Pretty sure the 2 odis were some of the easiest money iv made this last few weeks feels good when everything clicks. Between this and football this could be a tasty run in to the summer and really build the bank (+15.35 points in 2 days). IPL around the corner too

-

Cricket Update:

West indies vs Sri lanka: +6.2 points

Only ever get involved in test cricket after day 3 onwards. For me thats when i get the best chance to assess things. This was a cracking test match with all markets going odds on in the final 3 days.

I backed the draw when was priced at 9.6, and when sri lanka had managed to get in front of the west indies lead. The reason for this was in most test matches now teams are fearful and far more defensive when declaring. I just didnt see them getting to a big enough score fast. They wouldnt be content with anything less than +400 runs lead and with nissanka and dickwella both chasing milestones they wouldnt declare anytime soon. The debutant would need to bat out cautiously to get to his century so had that in my mind. In between that time i expected the draw would crash in as the markets began to react to it. My biggest risk here was west indies skittling them out but for me the bowlers and pitch were not saying this was likely.

My next trade in this test was to lay sri lanka, having assumed a healthy lead and with west indies facing a dodgy evening session i wanted to see how they played against the new ball and if they would give any push towards tracking the score down. They didnt and so i jumped on a strong lay of sri lanka. This is were most of my profit was gained. Added to that i entered a portion of the already gained profit onto west indies at 36.0 i saw that the closer they got with each boundary the markets threatened and made massive swings here. Jumping in and out of this market was a nice top up to the profits. Having cashed out the west indies trade once they hit 8.0 and with the lay on sri lanka still going i waited until the evening sessions to cash out. This is round about the time the football came on.

Neither side threatened me with their bowling lineups and neither did the conditions, they ended up favouring the batsmen even more

. Had west indies had a go at some stage id have traded out far sooner. But always felt safe. Nicely timed trades helped bag me a handsome return using too safe staking. As i build into the other formats outside of t20 i will start to ramp them up. Really enjoyed using my positional trading approach here and managing each trade. Could have made more from some trades ie leaving it in longer but was content with the profits made at the time and given the match situations.

. Had west indies had a go at some stage id have traded out far sooner. But always felt safe. Nicely timed trades helped bag me a handsome return using too safe staking. As i build into the other formats outside of t20 i will start to ramp them up. Really enjoyed using my positional trading approach here and managing each trade. Could have made more from some trades ie leaving it in longer but was content with the profits made at the time and given the match situations.Very handsome 6.2 points profit made and pleased to see cricket back delivering the profits like this.

-

@darri This is one of my favourite books and one I return to often. It's great how he explains Buddhism and ancient philosophy using burritos and the Disappointment Panda.

-

@darri said in The road to full time:

So im not exactly a book lover in fact im quite ignorant with reading, probably why i work in video production as thats how i prefer info to be given to me. I need to see someone do something or experience it myself for me to understand it better. But when a book has a title, "The subtle art of not giving a f*ck", i was intrigued, thankfully for my simple mind there is an audiobook for most books these days. Please give it a read/listen there is also a youtube video of mark manson explaining the book in a short summarized way which is fantastic. Iv been in a mental blockage for a while now especially with lockdown over thinking things and caring too much about smaller things. Then i read this book. Not only did it help with my general mindset but its funny how relatable it is to trading.

The backwards law:

The pursuit of positive experience is itself a negative experience

The acceptance of a negative experience is itself a positive experience

NEGATIVITY is the path to POSITIVITYThink of this in trading terms in all aspects.

The pursuit of building a bank fast will be a negative experience

The acceptance that its a slow process will be a long term positive one.

The pursuit to always having a green day will be a negative

The acceptance of losing days will be a positive.Basically i could have listed almost every single factor in trading into this equation. By having this mindset we build our knowledge and skills on negative experiences so that we can build a solid platform to the positive ones.

What do we give a f*ck about is the whole point of the book. For me when i think of trading its worrying less about profits and what you could potentially make each trade. Instead worry about the process of making that trade. Why am i entering this trade? Is the price right? I often think back and see myself stressing over how my overall trading wasnt doing well and it sweeping into my chain of thought in my next trades. Block the money aspect out forget about making money. Work on producing very high quality trading decisions. Work on the process. Your only as good as your last trade. If i wasnt updating the blog on here or posting live trades id not even look at the results until the end of the week. If you cant do that then its probably a result of you over staking/emotionally attached.

I get it we are on a forum we post trades and we have people of vastly different trading levels. One of the first things i managed to get right is to not compare yourself or your trades to anyone else. How often do you have a red day to log in and see someone has romped home with a massive green day? Then you think oh wait he/she also had a good day here and start to copy only for it to then be a few losing days on the trot? Stop this. We learn nothing from doing that. Its our process and our way of thinking that separates us as traders (how the markets work). Post your trades even if you see me or keith post the same game. Dont care about how someone might rinse you for a dodgy trade because no one will. In fact quite the opposite people will help/advise if anything is noticed. Sometimes when i speak to people they act like the forum is just like social media and comparing their trades to the pros. Well the pros have good and bad days too they have just learnt to accept their losing days will come. Also surprise it took the pros a long time to get that good. If it were easy all the city traders would be lapping up the tax free cash

I have had chats with many people over lockdown and its really upped this notion of getting to that trading full time dream people have. If your gonna try rush it bad things will happen. You have to learn to deal with the bad times. Its with the bad times you learn how to trade. Its why people setup spreadsheets to make sure they can spot the bad trends/patterns. Instead of dreaming or constantly measuring against your long term plans, try to think what can i alter right now with my trading. Is that stopping everything and just working on one sport/one strategy/paper trading etc. Remember having goals is good but coming in going i want to be full time trading in a year was also my goal. It didnt work out. In fact it made me do all the wrong things. What i should have done was build in stages.

- Learn how markets react for the strategy you want

- Track your trades to spot for patterns

- Paper trade until its consistently profitable not just after 30-40 games

- Small stake at first feel how it feels to actually put money in

- See how you cope with losers-then work on a way to build the right discipline to counter the red mist (everyone gets that)

- Learn how to say NO to a potential trade and write down why you said no for future. I always work on the principle of if i can find just one reason not to trade it i wont, if nothing comes up absolutely trade it

- Then change nothing from before and keep improving the mental aspects

Now i ask you can you do all that within a year? Then i also ask you and its a common theme, can you do all that with 2/3/4 strategies at a time? The answer to both could quite possibly be yes but its certainly going to be tougher. Your putting constraints on your growth potential. People always think the more your doing the more you make. Not if each strategy isnt fully optimised and efficient. You dont get given 3 tasks in 3 different departments at work to master at one time, why would you do that to yourself in trading? These questions are the sole topic iv been talking about for so long and this book really emphasised this to me.

The premise of the book is fantastic its not sugar coating things saying we should all be acting like steve jobs or elon musk. Its telling everyday people that that notion is false. Worry about your way and soak up the info you need for your process. Just because say me or keith get a few trades right one day doesnt mean your way wont work better in the long term. Short term results mean nothing. Learn and work on becoming good long term, there isnt a get rich quick scheme going on here that the pros are keeping quiet about, in fact all the pros on here are humble enough to admit that its taken them a while and have had to learn from the rough times to get there. Its also why when people ask for help i dont just explain my own way to trade, ill look to encourage them to learn the process in the areas that i know are needed and help them in those areas. People who really want this will put in the grind to learn. Care about the process and how you plan to get there. Heres the thing not everyone says, trading wont work for everyone. Not everyone will be able to commit to the discipline side. It can seem unfair but is it also unfair that the nevilles managed to play for united who put in hours of practice to get there and you who only played for your sunday team and turned up hungover didnt? But unlike football there isnt a primed window or age bracket to learn these principles/skills. You can develop them. I was a troubled gambler with zero discipline now im a trader who consistently profits every month and that includes losing days/weeks in between.

Very hippie post but a very important message. Quite honestly it doesnt bother if people dont want to read all this. It doesnt bother me if no one likes my posts or my trades. What does matter to me is the people that DO, those are the people i want to talk to and work with. The 2nd half of the book helps to focus on what to actually care about. Massive lightbulb moment for me reading a book which quite honestly is only possible because of lockdown.

Well put Darri

-

So im not exactly a book lover in fact im quite ignorant with reading, probably why i work in video production as thats how i prefer info to be given to me. I need to see someone do something or experience it myself for me to understand it better. But when a book has a title, "The subtle art of not giving a f*ck", i was intrigued, thankfully for my simple mind there is an audiobook for most books these days. Please give it a read/listen there is also a youtube video of mark manson explaining the book in a short summarized way which is fantastic. Iv been in a mental blockage for a while now especially with lockdown over thinking things and caring too much about smaller things. Then i read this book. Not only did it help with my general mindset but its funny how relatable it is to trading.

The backwards law:

The pursuit of positive experience is itself a negative experience

The acceptance of a negative experience is itself a positive experience

NEGATIVITY is the path to POSITIVITYThink of this in trading terms in all aspects.

The pursuit of building a bank fast will be a negative experience

The acceptance that its a slow process will be a long term positive one.

The pursuit to always having a green day will be a negative

The acceptance of losing days will be a positive.Basically i could have listed almost every single factor in trading into this equation. By having this mindset we build our knowledge and skills on negative experiences so that we can build a solid platform to the positive ones.

What do we give a f*ck about is the whole point of the book. For me when i think of trading its worrying less about profits and what you could potentially make each trade. Instead worry about the process of making that trade. Why am i entering this trade? Is the price right? I often think back and see myself stressing over how my overall trading wasnt doing well and it sweeping into my chain of thought in my next trades. Block the money aspect out forget about making money. Work on producing very high quality trading decisions. Work on the process. Your only as good as your last trade. If i wasnt updating the blog on here or posting live trades id not even look at the results until the end of the week. If you cant do that then its probably a result of you over staking/emotionally attached.

I get it we are on a forum we post trades and we have people of vastly different trading levels. One of the first things i managed to get right is to not compare yourself or your trades to anyone else. How often do you have a red day to log in and see someone has romped home with a massive green day? Then you think oh wait he/she also had a good day here and start to copy only for it to then be a few losing days on the trot? Stop this. We learn nothing from doing that. Its our process and our way of thinking that separates us as traders (how the markets work). Post your trades even if you see me or keith post the same game. Dont care about how someone might rinse you for a dodgy trade because no one will. In fact quite the opposite people will help/advise if anything is noticed. Sometimes when i speak to people they act like the forum is just like social media and comparing their trades to the pros. Well the pros have good and bad days too they have just learnt to accept their losing days will come. Also surprise it took the pros a long time to get that good. If it were easy all the city traders would be lapping up the tax free cash

I have had chats with many people over lockdown and its really upped this notion of getting to that trading full time dream people have. If your gonna try rush it bad things will happen. You have to learn to deal with the bad times. Its with the bad times you learn how to trade. Its why people setup spreadsheets to make sure they can spot the bad trends/patterns. Instead of dreaming or constantly measuring against your long term plans, try to think what can i alter right now with my trading. Is that stopping everything and just working on one sport/one strategy/paper trading etc. Remember having goals is good but coming in going i want to be full time trading in a year was also my goal. It didnt work out. In fact it made me do all the wrong things. What i should have done was build in stages.

- Learn how markets react for the strategy you want

- Track your trades to spot for patterns

- Paper trade until its consistently profitable not just after 30-40 games

- Small stake at first feel how it feels to actually put money in

- See how you cope with losers-then work on a way to build the right discipline to counter the red mist (everyone gets that)

- Learn how to say NO to a potential trade and write down why you said no for future. I always work on the principle of if i can find just one reason not to trade it i wont, if nothing comes up absolutely trade it

- Then change nothing from before and keep improving the mental aspects

Now i ask you can you do all that within a year? Then i also ask you and its a common theme, can you do all that with 2/3/4 strategies at a time? The answer to both could quite possibly be yes but its certainly going to be tougher. Your putting constraints on your growth potential. People always think the more your doing the more you make. Not if each strategy isnt fully optimised and efficient. You dont get given 3 tasks in 3 different departments at work to master at one time, why would you do that to yourself in trading? These questions are the sole topic iv been talking about for so long and this book really emphasised this to me.

The premise of the book is fantastic its not sugar coating things saying we should all be acting like steve jobs or elon musk. Its telling everyday people that that notion is false. Worry about your way and soak up the info you need for your process. Just because say me or keith get a few trades right one day doesnt mean your way wont work better in the long term. Short term results mean nothing. Learn and work on becoming good long term, there isnt a get rich quick scheme going on here that the pros are keeping quiet about, in fact all the pros on here are humble enough to admit that its taken them a while and have had to learn from the rough times to get there. Its also why when people ask for help i dont just explain my own way to trade, ill look to encourage them to learn the process in the areas that i know are needed and help them in those areas. People who really want this will put in the grind to learn. Care about the process and how you plan to get there. Heres the thing not everyone says, trading wont work for everyone. Not everyone will be able to commit to the discipline side. It can seem unfair but is it also unfair that the nevilles managed to play for united who put in hours of practice to get there and you who only played for your sunday team and turned up hungover didnt? But unlike football there isnt a primed window or age bracket to learn these principles/skills. You can develop them. I was a troubled gambler with zero discipline now im a trader who consistently profits every month and that includes losing days/weeks in between.

Very hippie post but a very important message. Quite honestly it doesnt bother if people dont want to read all this. It doesnt bother me if no one likes my posts or my trades. What does matter to me is the people that DO, those are the people i want to talk to and work with. The 2nd half of the book helps to focus on what to actually care about. Massive lightbulb moment for me reading a book which quite honestly is only possible because of lockdown.

-

@darri missed the NZ v Bang match which was a little disappointing. Focusing mainly on the test match. Did however back India at 2.32 with Billings and Buttler at the crease as I sensed the momentum shift. Buttler fell instantly and India suddenly were 1.52 closed out for a 2 point green and was watching to see if other opportunities presented if England took back control. Constantly lost wickets Betfair went down didn’t bother to re enter. Happily just building slowly and like you can’t wait for IPL.

-

Cricket:

NZ vs Bang ODI: +1.95 points

With those starting odds was going to take a big score to scare anyone away from NZ. Tamim iqbal is one of the most destructive players if allowed to get in. He did just that and unlike other games were bangla over rely on him he was supported handsomely by the others too. Now 271 on this pitch was just merely par, but it was enough for people to get slightly scared. I had half my full stake in here and would trade around it if needed. NZ had a small wobble but i waited until neesham and latham got settled and entered rest of stake. NZ saw it out comfortably in the end.

Ind vs Eng ODI: -2.5 points

Only caught the eng innings for this. Would have loved to be getting in early before that india power hitting late on. India with a massively competitive score, england would need to bat in their new found style to catch it. Really fast start followed by a wobble. I waited for a partnership to form. Billings and Ali did just that. Both got settled. I entered at 2.22 with my full stake and waited for a swing. It came after a run of boundaries. Price swung right into 1.69 and i reduced my liability by half. Billings got out with a nothing type shot and i should have exited here for a small profit. The curran brothers can bat but against india in india was always gonna be some ask. I naively stayed in, slightly too aggressively traded here. Price was stable for a while and then queue Betfair suspending everything. I had already entered my exit price and was logging in to double check it had matched ok, to find the site down. These mistakes happen and nibbled at the nice profit gained earlier in the day. By the time i looked was too late to use another site to lay my position.

Conclusion: -0.55 points

Plenty of cricket to come and this for me is just a warmup to trading the ipl. Make sure that next game i dont carry any ill feeling into my trading as i see this as profit lost rather than bad trading. Actually really happy with the trades and how my thinking was throughout each game. Played them all correct apart from should have been more defensive in the eng match.

-

@karl-mccarthy best advice is to soak up all the info the guys give on the cricket page especially richard futter, martins dad, pretty sure he has helped most of us on here learn a bit more about how to turn average profits into bigger ones. LTD is probably one of the only type of test trades i personally do. For me im more of a one day and t20 trader think iv found good edges in there to profit. The tests to me are bonuses every month not my main trades

-

@darri Prob a bit more than 2 weeks but yes an increase of 60% on my initial bankroll of £500. A big chunk I'd say 20 - 30% of that is on the cricket and the ZIM v AFG games. I came across the test match on its 2nd day and couldn't believe the Draw price with AFG 600+ declared. As Martin's staregy goes, you won't go poor laying the draw in Test cricket and the pitch and weather conditions were perfect.

-

@karl-mccarthy when you say 60 points progress in 2 weeks do you mean your bank has grown 60% or are you counting points differently? If it is 60% thats unreal progress bud for someone just starting out

what was the cricket trades, i think if i had to choose one sport and only one sport to trade it would be cricket, value everywhere because its you against the markets, whereas football your more strike rate focussed as your edge

what was the cricket trades, i think if i had to choose one sport and only one sport to trade it would be cricket, value everywhere because its you against the markets, whereas football your more strike rate focussed as your edge -

@darri Great post. I’m still in the early learning stages but have increased my bank by 60 points these past few weeks. 3 big trades that have helped boost that figure have been in cricket so hoping to get some good advice with IPL starting soon. Before joining BTC I had never traded or bet on cricket and two weeks ago my eyes were opened. The liquidity in the cricket markets is insane and make Premier League football look like conference.