Jon from Oslo

-

Hello traders!

I’m Jon from Oslo (Norway). I have an education in Finance and work experience from banking/finance/accounting. I’ve been playing around in the stock market for many years with ups and downs. In a long term perspective, I recon you could make 8-10% ROI just by sitting in the stock market, but the variation from year to year is huge. Now, with the Covid situation, and the marked close to a peek (I beleve that a crash is imminent), I am keen on allocation some funds to other positions and sports trading seems very interesting. From the BTC I will surely benefit from the current trading strategies that are available for the members, and hopefully also develop some strategies on my own. I reckon that in half a year I will have enough trades done to evaluate and determine the path forward. -

Is it not the case that a lot of the mining companies in Africa are Chinese owed, obviously or indirectly. I have read a fair few articles and reports about how China and its "companies" are striping Africa of resources in exchange for building a road or two hear and there.

This would make sense to me if those companies go bankrupt after a relatively short time.

-

@jon-li Thank you, a very detailed response as well.

The mining operations have always worried me as I've been burnt before - announcement coming then the stock soars then it's a nothing announcement!

-

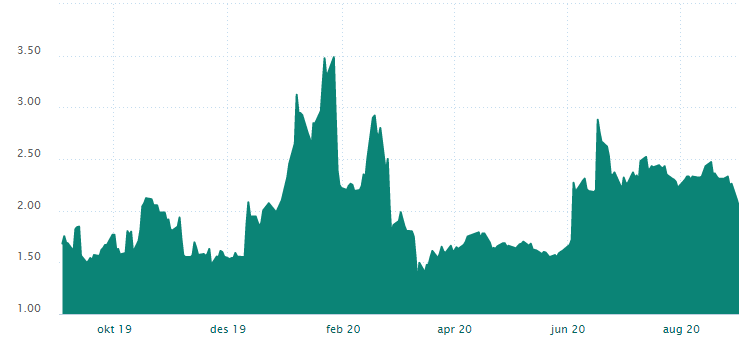

@ryan-carruthers I’ve only been following the gold price, so my knowledge of mining stocks and commodities are limited. However, the volatility tends to be high in the mining stocks (exposure to both commodity prices and how the company is preforming), so it might be good for trading if you could find an angle to approach. At the stock exchange in Oslo we have a company called Nordic Mining which is a good example of the volatility. Here is the stock chart for the last 12 months:

I’ve also seen a few listings on the stock exchange running mines in Africa. They seem to go bankrupt after a couple of years.Regarding the consumption of raw materials it seems to me that the prices have recovered from the drop earlier this year. If you believe that a vaccine is coming up shortly you probably could argue that the commodity prices should rice, and the other way around if things gets worse, the prices might be too high. I am a bit pessimistic and think it will get worse before it gets better. To risky to make a bet on this for my taste.

-

@jon-li Yep I agree, what's you view on mining stock funds or precious metals? I think there will be a lot of demand for copper, platinum etc... due to the countries using infrastructure to get the world moving again. Be great to hear your view on it?

-

@martin-futter Yes, at least for the European stock markets i find very little value to the upwards side. In the US you have the Faang stock doing quite well, driving up the indexes, and it might go further. There is from my point of view value in going short in for example the dax index, but you do not want to sit short for a long period, so it's all about timing. It might be better to sit tight and wait for a crash like we saw in February/March this year. And hope for a bigger crash. I think the Covid-19 situation will get worse in Europe in the coming months, and that a market crash of 20%+ is likely. I have a small short position now.

-

@jon-li Welcome!

We have a fair few guys who are also interested in the stock market, myself included.

Great to have you here.